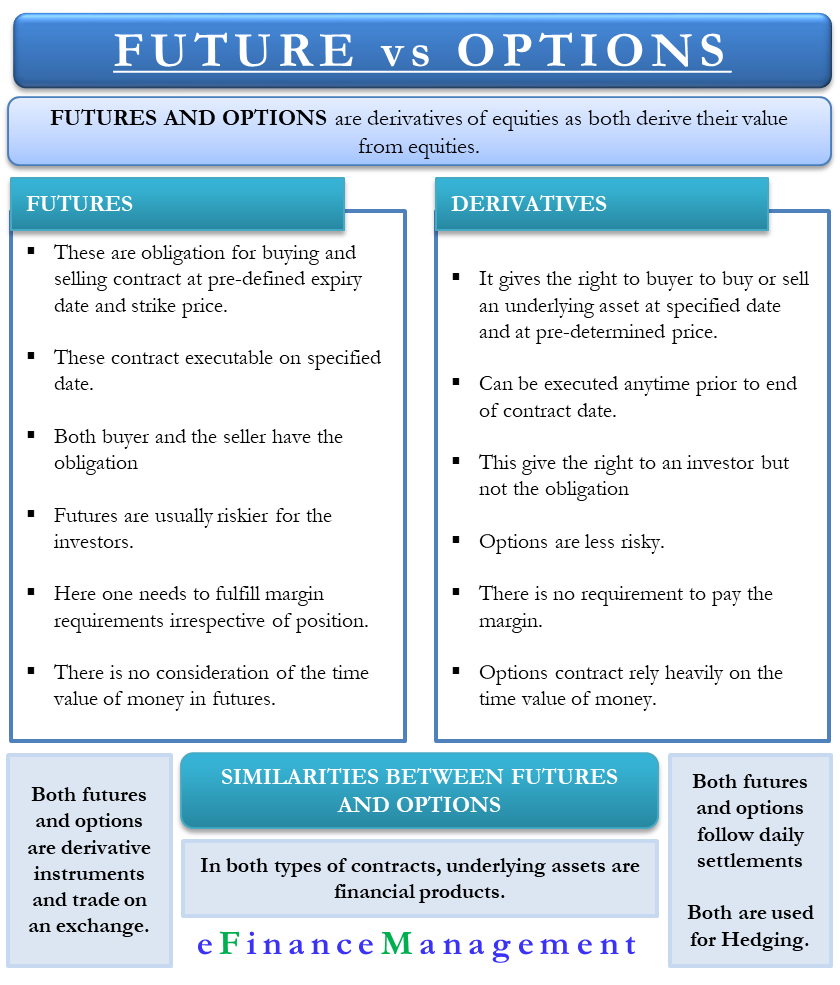

Futures and options, as rightly said, are the derivatives of equities as both derive their value from equities. These derivatives are popular due to multiple reasons, such as stable margin requirements, no time decay, more cost-efficient returns, and more. Though both futures and options allow investors to hedge their risk, both are very different from each other. Yet, you will find many using the two terms interchangeably. However, to better understand the importance, meaning, and usage of the two terms, we need to see the differences and similarities between futures vs options.

Futures vs Options – Differences

Following are the differences between futures vs options:

Meaning

Through a future contract, two parties enter into an agreement wherein they agree to transact at a price in the future. The date at which both the parties are obligated to sell (or buy) the asset is also predetermined. So, we can say that futures are an obligation for buying and selling a contract at a pre-defined expiry date and strike price.

On the other hand, Options are a contract between the buyer and seller. It gives the right to the buyer to buy or sell an underlying asset at a specified date and a pre-determined price. What makes it different from a future contract is that it is not a binding contract or is not an obligation for either party.

Date of Execution

One can execute a futures contract only on the date specified in the contract. Options can be executed anytime prior to the end of the contract date.

Obligation

Trading in futures comes with the obligation. Both buyer and seller have the obligation irrespective of their profit or loss in the position. On the other hand, options give the right to an investor but not the obligation to transact (buy or sell) the underlying asset. For the options seller, if the buyer chooses to execute the contract, then the seller will have to abide.

Risk

Though both are derivatives, the level of risk is different in both. Futures are usually riskier for the investors simply because they offer the chance to earn higher rewards as well. Thus, they are not recommended for those who are starting to trade. Such investors might end up losing a heap of money if the future contract starts moving in the opposite direction of the trader’s position.

Options are better for beginners as they are less risky. But, the returns from options are also less than what investors could earn in a future contract. In options, the maximum loss that a person can face is limited to what they paid when buying the call or put option.

Payoff

In a future contract, the loss or gain might be unlimited, and therefore, the payoff diagrams are symmetric. On the other hand, the payoff diagram of the options is always asymmetrical because the potential gain of option buyers is unlimited. However, the loss of the option buyer is limited to the premium that they have paid.

Also Read: Forwards vs Futures Differences

Margin requirements

For trading in futures, one needs to fulfill margin requirements irrespective of the position (long or short) taken by the trader. On the other hand, the buyer only needs to pay the premium for options. There is no requirement to pay the margin.

Time Value of Money

There is no consideration of the time value of money in the future. Options contracts rely heavily on the time value of money. Whether or not a trader would execute an option contract gets clearer as we move closer to the expiry date. Thus, the time value of money is important.

Futures vs Options – Similarities

Following are the similarities between Futures vs Options:

Nature

Both futures and options are derivative instruments and trade on an exchange. Both enable the trader to trade the underlying asset at a specific price and pre-determined time.

Underlying Assets

In both types of contracts, underlying assets are financial products. The underlying assets could be stocks, bonds, currencies, commodities, etc. Without an underlying asset, there could be no derivative instruments. In one way or another, an investor trades the underlying asset in case of both futures and options.

Leverage

Both are leverage instruments. Meaning, that in comparison to trading equities, both put the trader in a better position to control the price movement of the underlying assets. For instance, a future contract with an initial margin requirement of 10% will let the trader control ten times the underlying asset in comparison to the cash position.

Hedging

In order to hedge their position against cash, traders frequently use futures and options. If a trader has taken a buy position in the cash segment and the market seems to be turbulent with a negative stance, then the trader would want to hedge the position by taking a position in futures or options. There are various hedging strategies that traders apply in order to minimize their risk or have a market-neutral position.

Settlement

Both futures and options follow daily settlements

Final Words

Both futures and options are derivatives contracts, which an investor can customize as per their requirements. Investors can magnify their returns using both types of contracts while speculating the future price movement. And, talking of the confusion over the two terms, one easy way to remember is options contract comes with an option (to settle before the expiry date), while there is no such option in the futures contract.