While managing an investment portfolio, an investor has the option of being hands-on with the funds and securities constituting it or buy and hold on to them. The former is active management, while the latter is passive management. Let’s look at these two in detail before drawing comparisons.

Active vs Passive Portfolio Management is a distinction between two investment philosophies as it relates to portfolio management.

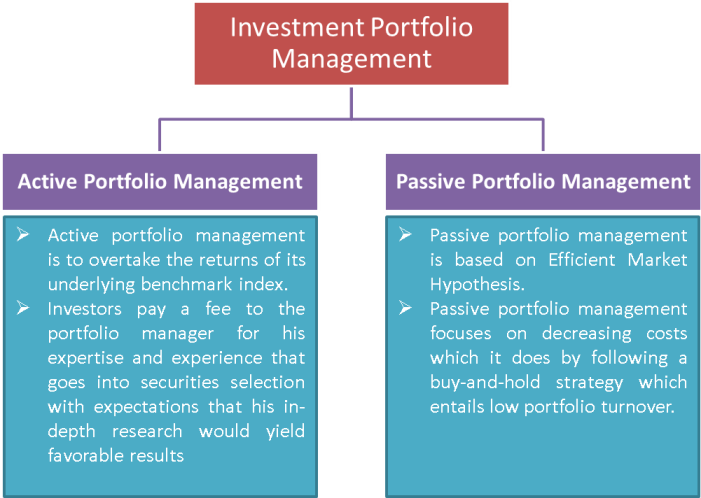

Active Portfolio Management

The foremost aim of active portfolio management is to overtake the returns of its underlying benchmark index. The premise behind active management is that a skilled portfolio manager, backed by a specialist investment team, can select such securities for a portfolio that would surpass returns posted by its benchmark index or some other relevant measure of portfolio performance.

Investors pay a fee to the portfolio manager for his expertise and experience that goes into securities selection with expectations that his in-depth research would yield favorable results, which will compensate for the fee, which is typically higher than a passive strategy.

Passive Portfolio Management

The investment philosophy behind passive portfolio management is based on Efficient Market Hypothesis. This theory postulates that financial markets are efficient pricing-wise. All investors have all information available to them at all times with no inside information which could benefit a certain segment of the market. If this is the case, then there is little room, if any, for an investor to beat the market, thus making active management less effective.

Also Read: Portfolio Management Services

Due to this, passive portfolio management focuses on decreasing costs which it does by following a buy-and-hold strategy that entails low portfolio turnover.

Active vs Passive Portfolio Management

The aforementioned definitions of the two approaches to portfolio management outline the basic difference in investment philosophies: while active management believes that market returns can be exceeded, passive management believes it is futile to try to do so.

To elucidate their differences further, we can look at their strengths and weaknesses as, for the most part, the strength of one strategy is a weakness for the other and vice-versa.

Beat Market Returns

One strength of active portfolio management is that it provides an opportunity to beat market returns, and the fact that some actively managed mutual funds do better than their passively managed peers which have the same benchmark shows that there are inefficiencies in the market which skilled portfolio managers can use to their advantage. On the other hand, the best passive portfolio management can do is match market returns.

Undertake Various Strategies

Active management also allows portfolio managers to undertake various strategies which can mitigate risks associated with particular market segments during difficult times. For instance, if the banking sector is struggling due to poor performance or facing headwinds due to some new regulation, active managers can reduce or eliminate exposure to the sector to reduce the overall risk to the portfolio. Passive management, on the other hand, does now allow this benefit. In order to save costs, a passive portfolio has to mostly stay the course it has chosen and, in the aforementioned case, will have to take losses.

Also Read: Actively Managed ETFs

Low Cost

Among the benefits provided by passive management, low cost is the foremost. If one buys into an exchange-traded fund (ETF) that replicates an index like the S&P 500 or Russell 3000 or others, one can get by paying a very low fee compared to nearly all actively managed products. Further, there are passive ETFs for almost all market segments, market-cap-wise, industry-wise, and geography-wise, which investors can use to diversify investments across the spectrum while still paying a low fee.

Transparency

Transparency can also be attributed to passive portfolios, specifically when it comes to ETFs. These funds disclose their holdings each day after the close of trading, thus keeping investors in the know at all times. On the other hand, since active management strategies are designed to beat the market, portfolio managers remain guarded about their positions. Even among mutual funds, portfolio holdings are usually disclosed only once a quarter.

Tax Efficient

Also, given that portfolio turnover in passive portfolio management is low, this strategy is more tax-efficient than active management, where portfolios are rebalanced quite frequently in an attempt to deliver higher than market returns, which, in turn, results in higher costs.

Since cost is such a significant factor, let’s see how it can impact investments.

Impact of costs on investments

For this example, let’s ignore returns for a while as we lay out the premise.

Let’s assume a portfolio worth $100,000. In the first case, the portfolio is completely invested in active management strategies, which cost 1.75% annually. This amounts to $1,750 in a year. This means that whatever the strategy yields as returns at the end of the year, the aforementioned cost will reduce those returns to that extent.

Let the portfolio be completely invested via passive portfolio management techniques in the second case. Since these techniques are generally much cheaper than active management strategies, let’s assume the expense to be 0.5%. This amounts to $500 a year.

Thus, even before we talk about returns, the actively managed portfolio will need to earn $1,250 more than the passively managed one to yield the same absolute returns.

Now let’s bring back returns to the comparison.

Let’s assume that active portfolio management yields 10% returns for the year while passive portfolio management yields 9%. In absolute terms, the active strategy would result in a total portfolio value of $110,000, while the passive strategy would result in $109,000. But when we adjust these values for the expenses associated with the respective strategies, the active strategy results in a total portfolio value of $108,250. In contrast, the passive strategy results in a total portfolio value of $108,500.

Thus, the passive portfolio management strategy results in higher gains even after returning less than active portfolio management techniques.

Conclusion

The aforementioned example is just to highlight the importance of costs in investments. It is not to say that passive portfolio management is necessarily or always better than active management.

Given an investor’s risk profile and time horizon, a mix of both strategies could yield optimal results rather than choosing one over the other.

Sir, what is the difference between equitable and register mortgage?