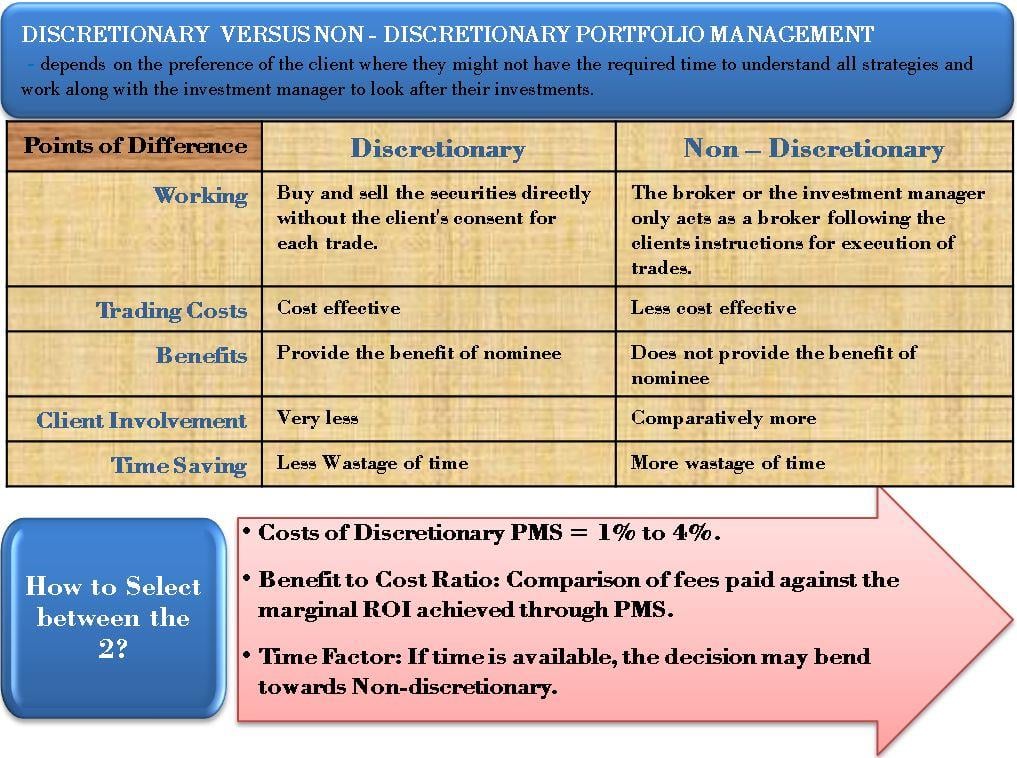

Discretionary and Non-discretionary portfolio management are two portfolio management styles. Discretionary portfolio management does not involve the client actively, and the investment manager takes all the decisions on his behalf. In contrast, a non-discretionary investment account involves the client at every step of portfolio management.

Discretionary versus non-discretionary portfolio management depends on the preference of the client. They might have the required time to understand all strategies and work with the investment manager to manage the investments. There can be various reasons for the client’s involvement vs. no involvement in the portfolio management under the discretionary account.

Discretionary Vs. Non-Discretionary Portfolio Management

Client Involvement

Discretionary PMS is like an outsourced service whereas, under non-discretionary PMS, the client remains involved in every trade decision making.

Working

Under a Discretionary portfolio, the trader can actually buy and sell the securities directly without the client’s consent for each trade. The consent is taken in the beginning in the form of a Power of Attorney. However, the trader would still be making decisions in accordance with the agreed mandate of the client and its investment goals.

Under Non-discretionary portfolio management, the broker or the investment manager only acts as a broker following the client’s instructions to execute trades. They are also advisors, but the final call is of the client.

Also Read: Portfolio Management

Type of Clients

Usually, the services under the discretionary investment type relate to high net-worth individuals (HNWI) and institutional investors. These can be funds of companies or pension funds that have a minimum requirement of capital starting at $250,000.

Process & Investments

Like in any other investment process, the clients’ risk profile analysis is done along with financial goals. However, the length and breadth of the kind of assets invested under a discretionary portfolio can be very diverse. The assets can vary from ETFs, bonds, stocks, financial derivatives, crypto-currency, and even art and artwork.

Complexity

Discretionary portfolio services demonstrate different kinds of strategies and expert analysis depending on the client’s requirements. Different clients might want to follow different strategies. A discretionary portfolio service would group the clients’ money together for a specific strategy and trade their assets altogether. The trading would be strategy-wise but not client-wise. How does this work? A pool of money is created for different clients, and the client accounts are segregated for record-keeping purposes. Weightage is assigned to the pool as per each client’s investment. For example, a client investing US$1 million would be assigned 10% of the weight in a US$10 million pool of money that has been segregated for trading in a particular type of strategy.

In a non-discretionary portfolio account, the client owns the portfolio, and there is no need for pooling.

Trading Costs

The discretionary manner of trading is also cost-effective, and a win-win situation as the transaction cost reduces across clients. Clients indirectly get a good price for purchases of securities and higher profits in terms of the market-making capacity of the broker.

Also Read: Portfolio Management Services

In a non-discretionary trade, since there is no bundling of trades, one client’s trades create a new transaction cost each time he buys or sells from the portfolio.

Commissions

Investments in the regular investment model have a major flaw of the portfolio managers churning the portfolio to create greater commissions. This is avoided in a discretionary investment model as a business investment manager can bundle all the client’s money together and calculate a management fee on these entire assets under administration. This gives a good incentive to the portfolio managers as well when compared to non-discretionary portfolio management. The client utilizes different strategies by shifting the segregated money from one-month strategy to another.

Time-Saving

In a non-discretionary portfolio, the broker might recommend the available purchase and selling ideas to the client, but they will never do any transaction without the client’s consent. This will waste a lot of time and consequently lose the opportunity.

Benefits of Discretionary Portfolio Management

The client abstains from making day-to-day decisions and his involvement in understanding the strategy or trade on a regular basis. He can rely completely on the traders and the companies’ expertise and experience. It also allows the grouping of the trade from an investment manager’s point of view, giving the trading company greater bargaining power in terms of brokerage.

The basis of most of the discretionary PMSs is trust, experience, understanding and due diligence carried out by the client.

Discretionary services also provide the benefit of nominee administration, where the portfolio management company can carry out the transaction without sending clients transfer forms for any signature right when the trade needs to happen. The portfolio manager sends the contract notes and the valuation report to the client on a quarterly or half-yearly basis, along with the economic and market profitability and commentary of the transaction.

Benefits of Non – Discretionary Portfolio Management

The client has greater control over his own portfolio and the chance to question the decision of the investment manager along with the paid expertise. One can also understand that one can see different market cycles. There is a monthly or real-time confirmation of trades and portfolio position.

Deciding between a Discretionary and Non-Discretionary Portfolio Management Services

This can be an important decision for a high net-worth individual willing to invest more than $1 million in managing his assets. Many factors swing in favor of both the services. It is important that you consider your risk profile, appetite, and willingness to invest the required time in managing your own portfolio. The expense of management fees under discretionary PMS can vary from 2 to 2.5% at the minimum and can go up to 3 to 4% with very well-known services. Thus, ensuring that your investment manager gives you a high profit to compensate for such an expensive management fee is important.

An alternative to discretionary PMS is a direct investment into a mutual fund which is the most basic investment vehicle.