Hedge Ratio

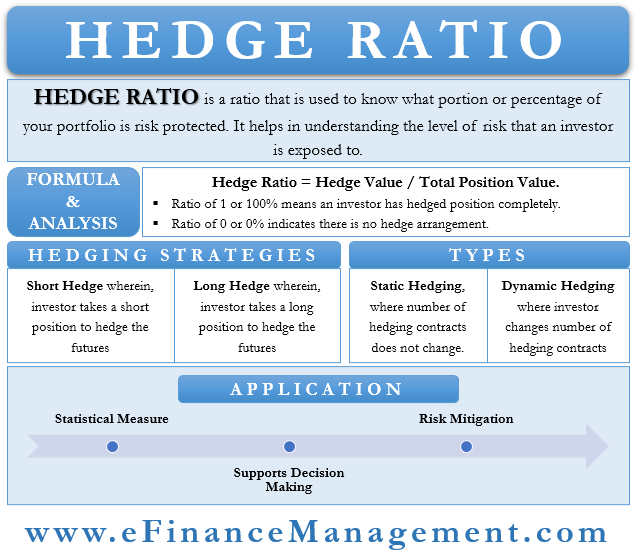

A hedge is a crucial component of the risk management process. Hedging one’s portfolio helps to mitigate risk and manage one’s exposure. Once you have hedged your portfolio, you might want to know what portion or percentage of your portfolio is risk protected. This is where we use the hedge ratio.

Basically, this ratio is the comparative value of an investor’s open position to their overall position. Or, we can say it compares the value of the investor’s position that is protected with the hedge to the total size of the population.

Along with this, such a ratio may also mean a comparison of futures contracts (buy or sell) to the value of hedged cash commodities.

Importance of Hedge Ratio

Understanding this ratio is crucial for managing risk. Primarily, it helps understand the level of risk that an investor is exposed to. Also, it gives information on how the change in asset or liability would offset the change in the hedging instrument.

Moreover, it also allows investors and analysts to make wiser investment decisions. It also assists in evaluating an asset’s performance.

Hedge Ratio Formula

The formula to calculate the Ratio is:

Hedge Value / Total Position Value.

A ratio of 1 or 100% means an investor has hedged their position completely. On the other extreme, if the hedge ratio is 0 or 0%, it indicates there is no hedge arrangement for those investments.

Also Read: Hedge Ratio Calculator

Example

Let us take an example for more clarity. Assume that the portfolio of Mr. X has a value of $25,000. And he hedges 60% of the value of the portfolio, that is, $15,000 (25,000 * 60%).

Here, the hedge ratio is 60%. But let us consider the following cases to make the concept more simple and easy to understand.

Case 1

If the total position value changes to $28,000

Hedge Ratio = 15,000 / 28,000 = 0.54

Interpretation

Due to an increase in total position value, the hedge ratio has decreased from 60% to 54%. This simply means that the risk exposure of investment has increased. Here, the investor is required to adjust his position to minimize this risk.

Case 2

If total position value changes to $21,500

Hedge Ratio = 15,000 / 21,500 = 0.69

Interpretation

Here, a decrease in the value of the total position has increased the hedge ratio. This simply means that the portion of the risk in the overall portfolio has reduced, and the portion hedged from risk has increased from 60% to 69%. This ultimately means that the position of the investor is more secured from risk than earlier.

Refer to Hedge Ratio Calculator for a quick calculation.

Optimal Hedge Ratio

Optimal, or the minimum-variance hedge ratio, is a very crucial input in the hedging of risk. It defines the relationship between the sports instrument price and that of the hedging instrument. Therefore, it helps determine the percentage of your portfolio that you should hedge. Or we can also say that the hedge ratio tells where an investor’s portfolio currently is, while the optimal ratio shows where an investor needs to reach hedge it.

Such a ratio is useful when there is a difference in the characteristics of the hedged and hedging instrument, i.e., there is a cross hedge.

The formula for optimal hedge ratio is ρ x (σs / σf)

In this, ρ is the correlation coefficient of the change in the future and spot price.

σs is the standard deviation of the change in the spot price.

σf is the standard deviation of the change in the future price.

Let us review this with an example. Suppose an airline firm, which purchases 10 million gallons of jet fuel annually, expects the fuel price to rise ahead. Thus, the company plans to hedge the purchase price. It wants to know the optimal hedge it should go for.

For the sake of simplicity, we assume that the correlation between oil futures and the spot price of fuel is 0.95. The standard deviation of crude oil futures is 6%, while the SD for spot jet fuel price is 3%.

Now, putting the values in the formula, we get the ratio (0.95 * (3% / 6%)) 0.475. So, the optimal quantity of hedge that the airline company should go for is 0.475 * 10 million, or 4.75 million gallons of jet fuel.

Hedging Strategies

There are primarily two types of hedging strategies:

Short Hedge

In this, an investor takes a short position to hedge the futures or a commodity. An investor goes for this strategy if they expect to sell the asset in the future or expect the futures price to drop.

Long Hedge

As opposed to a short hedge, in a long hedge strategy, an investor takes a long position to hedge the futures or a commodity. An investor takes such a strategy if they plan to sell an asset in the future or expect the price to rise in the future.

Types of Hedging

There are primarily two types of hedging:

Static hedge

In this, the number of hedging contracts doesn’t change over time despite any movement or change in the hedging instrument’s price.

Dynamic hedge

In this, an investor changes the number of buy/sell hedging contracts so as to bring the hedge ratio towards the target ratio.

Applications of Hedge Ratio

Following are the practical uses of the ratio:

Statistical Measure

This ratio is a statistical measure of the risk that an investor exposes themselves to by taking a set of positions in the financial markets.

Supports Decision Making

This ratio assists investors in making better investment decisions. Also, since this ratio tells the risk in a portfolio, it serves as an investment guideline as well.

Risk Mitigation

This ratio assists in measuring the risk exposure. Thus, the optimal hedge ratio works as a risk mitigation technique.

Advantages and Disadvantages of Hedge Ratio

The following are the advantages of the hedge ratio:

- Regular hedgers use this ratio to estimate and optimize asset performance.

- It is simple to calculate. The calculation involves the use of just two inputs – total exposure and hedge position.

- This ratio helps investors to get an idea of their exposure at the time of taking a position.

The following are the disadvantages of this ratio:

- There may be cases of currency mismatch. This happens when there are no futures of the currency in which the investor has exposure.

- Practically it isn’t easy to get a perfect hedge.

Final Words

The hedge ratio is very crucial from a risk management point of view. It gives investors a good idea of their risk position and also how much they need to hedge. However, investors must not solely depend on it. They must use other measures as well to gauge their risk level. This is like insurance which calls for a premium also.