What is Throughput Accounting?

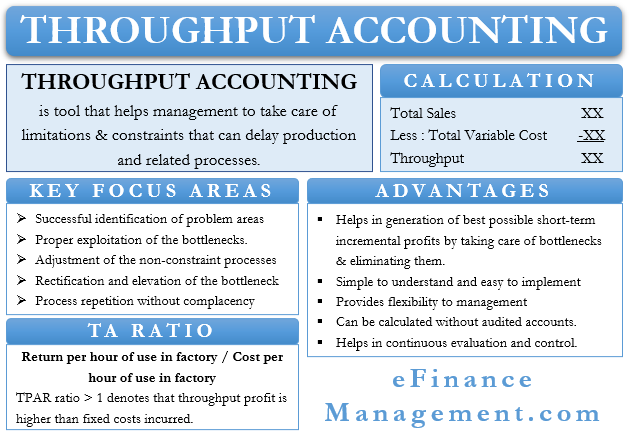

“Throughput” is the rate at which a corporation converts its goods, services, and other offerings into sales and makes money out of it. “Throughput Accounting” is a modern technique of management accounting and presents an alternative to conventional forms of accounting. Eliyahu M.Goldratt is the father of throughput accounting. Its main goal is to identify the limitations and constraints that can delay the production and related processes that can eventually lead to a delay in sales. The delayed sale will mean a delay in money realization.

Throughput accounting is a tool in the hands of the management to take care of such limitations and constraints. Thereby it aims to increase sales, revenue, and eventually profits for any organization. Also, it considers the time factor and helps to minimize any time loss that can cause a delay in revenue generation. And hence, it is sometimes also termed bottleneck throughput accounting.

How does Throughput Accounting Work?

Throughput accounting takes into account two factors: Sales or revenue and total (truly) variable cost of production. Total (truly) variable costs of production are those costs that vary with the production or output level exactly in the ratio of 1:1 per unit. This may include the cost of raw materials consumed, freight, commission on sales, etc.

Throughput accounting does not include direct labor costs under variable costs of production. It assumes that the workers are paid on a fixed rate basis or salary basis and not as per piece-rate basis. In the real world, it is not possible to employ workers as per the production schedule or on a need-basis, nor usually the payment is made on a piece-rate basis. An organization has to incur a fixed cost on its workers in order to retain and maintain them. Hence, labor charges are not variable in the true sense.

The formula for calculation of throughput in monetary terms is as below:

Throughput (in $) = Sales revenue figures less TVC or Total Variable Costs

How to Deal with Bottlenecks using Throughput Accounting?

The basis of throughput accounting is the theory of constraints, as developed by Goldratt. Every production facility regularly faces several constraints or bottlenecks, and the management actively works to remove these bottlenecks. The key steps efficient management should take to tackle these bottlenecks are:

Identification

The first and foremost step in the removal of bottlenecks is the successful identification of the problem areas in the production chain. Every production facility involves the use of various processes. Not all of them are the problem in any given crisis scenario. Hence, the management must first identify the process that is creating the problem out of the several processes.

Proper Exploitation of the Bottlenecks

The next step is to make sure that the problem area or process is being put to use to the maximum possible level. The utilization of the process or resource should be done in the most efficient manner in order to give the highest possible productivity or output. Wastages, if any, or constraints such as idle time or spare capacity should be taken care of.

Adjustment of the Non-Constraint Processes

The third step for the management is to adjust all other processes and resources in accordance with the problem or bottleneck at hand. The other non-constraint resources should start working in accordance with the constraint at hand in order to avoid further wastages and bottlenecks. It should be adjusted in such a way that if a piece of machinery breaks down and other processes continue at the same pace, it should not lead to a situation of increased unfinished produce, over-burden on the chain, and further jamming of the entire sequence of events.

Hence, the correct way to go for the management should be to slow down other processes and production for a while and rectify the error first. This will ensure that no new bottlenecks arise out of the already existing bottleneck situation.

Rectification and Elevation of the Bottlenecks

After all the other processes have been aligned with the bottleneck, the management has to then decide on elevation and rectification of the process or resource that has gone faulty. They will have to decide if any capital expenditure is needed to rectify the constraint. They may find some other solution for the problem and implement it accordingly.

An important consideration before the management takes the elevation decision is to ensure that first the available resources have been fully exploited or not. The management should emphasize the second step first pertaining to the best possible utilization of the resources presenting the problem. They should take the new capital expenditure decision only after ensuring that it is absolutely essential and unavoidable.

Process Repetition Without Complacency

In both the events of new capital expenditure or rectification of an old problem or resource, the management should not get complacent. It should be ready to again start from step 1 in case of arising of a new constraint or bottleneck. It may happen that some other resource may start creating a new problem, or the rectified one may again go faulty. The management must ensure that no lag occurs in the treatment of the new problem again. It should be ready to constantly tackle and eliminate constraints and bottlenecks arising in the course of the production.

Usage and Calculation with the help of an Example

Let us assume the case of Company ABC Pvt. Ltd. with two products – product A and product B.

Product A:

Selling Price: USD 200

Cost of materials: USD 70

Fixed Costs: USD 20

Variable Costs: USD 60

Profit: USD 50

Machine hours – 1 hour per unit

Demand: 10000 units

Product B:

Selling Price: USD 250

Cost of materials: USD 85

Fixed Costs: USD 20

Variable Costs: USD 75

Profit: USD 70

Machine hours – 1.5 hours per unit

Demand: 8000 units

Total machine hours available with the Company are 18000 hours. In order to fulfill the entire demand, the Company requires 22000 hours (10000×1 + 8000×1.5). Thus, the management has to decide on an optimum mix of production to maximize profitability.

The next step is to calculate the “throughput value” per machine hour. The formula for the same is:

Selling price less direct costs or cost of materials ÷ machine-hours every unit of product will take

Throughput Value for Product A = $200 – 70/ 1= $130

Throughput Value for Product B = $250 – 85/ 1.5= $110

Therefore, it is more profitable for the company to focus more on the production of product A. The management shall make a production plan as follows:

Product A- 10000 units x 1 hour per unit= 10000 hours

Product B- 5333 units x 1.5 hours per unit= 8000 hours

Throughput Accounting Ratio or TPAR

TPAR is a ratio, and the formula for calculating the throughput accounting ratio is:

Return per hour of use in factory or throughput value ÷ Cost per hour of use in factory

Continuing the above example,

Total costs:

Product A – ($20 + $60) x 10000 units= $800000

Product B – ($20 + $75) x 8000 units= $760000

Total – $1560000

Cost per hour – $1560000 / 18000= $86.67

In the above example, the calculation of TPAR will be:

TPAR for product A:

Return per hour of use – $130

Cost per hour – $86.67

Hence, TPAR = $130/86.67 = 1.50

TPAR for product B:

Return per hour of use – $110

Cost per hour – $86.67

Hence, TPAR = $110/86.67 = 1.27

Interpretation of Throughput Accounting Ratio (TPAR)

A TPAR ratio greater than one denotes that the throughput profit is higher than the fixed costs an organization will incur on a product. In simple words, it will be profitable for the company to continue producing the product as it will cover its fixed costs and help the company make profits. The higher the TPAR ratio, the better it is for a product and the company as a whole.

Advantages of Throughput Accounting over Other Conventional Forms of Accounting

Throughput accounting has numerous advantages over other forms of accounting such as cost accounting, financial accounting, etc.

- It helps in the generation of the best possible short-term incremental profits by taking care of the bottlenecks and eliminating them.

- It is simple to understand and easy to implement for management with respect to other forms of accounting.

- Also, they can act on the information without having to wait for formalities such as an audit, as in the case of other forms of accounting. This means quicker decision-making and implementation.

- It is not completely bound by financial accounting reports generated under GAAP and hence, provides flexibility to the management.

- It facilitates daily, and weekly report generation and hence helps in continuous evaluation and control.

- Also, this method has a realistic approach to ascertaining the effectiveness of the control systems in place and achieving the company objectives of making maximum possible money in minimum time.