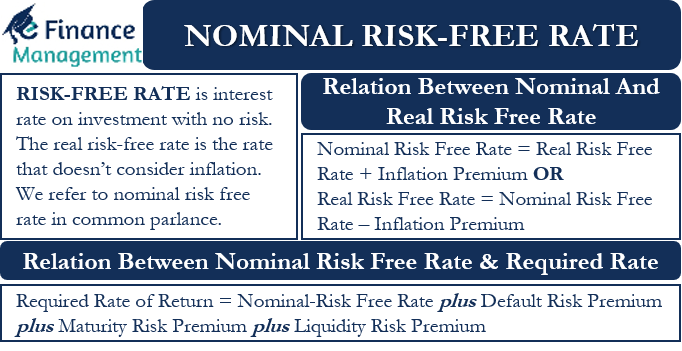

Risk-Free Rate or its other name is the Risk-Free Interest Rate. And it is the interest rate available on an investment or debt security with no risk. The risks could be on two counts. The first one is the interest rate risk; that is, there could be interest rate fluctuations over the period. And another one is the default risk, which means payment of interest and principal may not happen timely. Usually, when we talk about the risk-free rate, there could again be two different rates. The first One is the nominal risk-free rate, and the other is the real risk-free rate.

When we normally talk about the risk-free rate, we generally refer to the Nominal Risk-Free rate in common parlance. And the Nominal Risk-Free Rate is a general risk-free rate indicated or available on investment. Moreover, it does not take into account any influence of inflation. In other words, it is the usual interest rate indicated on the security, and it has no relation with the rate of inflation.

On the other hand, the Real Risk-Free rate refers to the rate that makes adjustments for inflation. That means the Real Risk-Free Rate is arrived at after deducting the inflation rate from the Nominal Risk-Free Rate.

One of the most used nominal risk-free rates is the three-month government Treasury bill, as it is considered to be the safest investment possible.

Relation Between Nominal-Risk Free Rate and Real-Risk Free Rate

In this article, we will discuss and focus mainly on the nominal risk-free rate. However, it is preferable and important to know the difference between these two types of risk-free rates (i.e., real risk-free rate and nominal risk-free rate) and the relationship between them.

In simple words, we can say that the nominal risk-free rate is the real-risk free rate plus the inflation premium.

The above concept and the exact relation can be better explained if we try to put this into a formula:

Nominal Risk-Free Rate = Real Risk-Free Rate + Inflation Premium OR

Real Risk-Free Rate = Nominal Risk-Free Rate – Inflation Premium

The nominal rates are the rate that we encounter every day, such as interest rates from banks and other financial organizations. For instance, if a Treasury bill is giving a return of 4%, it is the nominal risk-free interest rate. Or, we can say that this interest rate already accounts for the expected inflation. On the other hand, the real risk-free rate needs to be derived by referring to the inflation rate. The Real Risk-Free Rate tries to create or understand the purchasing power parity vis-a-vis the interest rate. Hence, this represents the actual change or impact on the purchasing power.

Relation Between Nominal Risk-Free Rate And Required Rate of Return

The above discussions of risk-free rates mean the least return that one expects from investing in risk-free security is the nominal risk-free rate. On the other hand, for risky investments or taking on additional risks, an investor will expect more risk premiums. These risks could be default risk, maturity risk, and liquidity risk.

So, if we add the premium of each of the above risks to the nominal risk-free rate, we get the expected rate of return. Or, it gives the return that an investor expects from investing in a specific security or asset.

Thus, the equation or formula for the required rate of return will be:

= Nominal-Risk Free Rate plus Default Risk Premium plus Maturity Risk Premium plus Liquidity Risk Premium

Final Words

The nominal risk-free rate is very important in the financial world, both for individual investors and institutional investors. It is vital for all investors to know about the nominal risk-free rate. This is because it helps them in determining their required rate of return. Additionally, this risk-free rate has other practical applications as well. It serves as a crucial ingredient in the calculation of several financial concepts, such as the Sharpe ratio, the Black-Scholes formula, cost of capital, and more.

Also Read: Real Risk-Free Rate of Interest

Frequently Asked Questions (FAQs)

Formula for calculating nominal risk free rate = (1 + Real Risk Free Rate) / (1 + Inflation Rate)

The nominal risk-free rate is the real-risk free rate plus the inflation premium. And the Real Risk-Free Rate tries to create or understand the purchasing power parity vis-a-vis the interest rate. Hence, this represents the actual change or impact on the purchasing power.

The exact relation can be better explained if we put this into a formula:

Nominal Risk-Free Rate = Real Risk-Free Rate + Inflation Premium OR

Real Risk-Free Rate = Nominal Risk-Free Rate – Inflation Premium

The required rate of return is Nominal-Risk Free Rate plus Default Risk Premium plus Maturity Risk Premium plus Liquidity Risk Premium.