Maturity Risk Premium

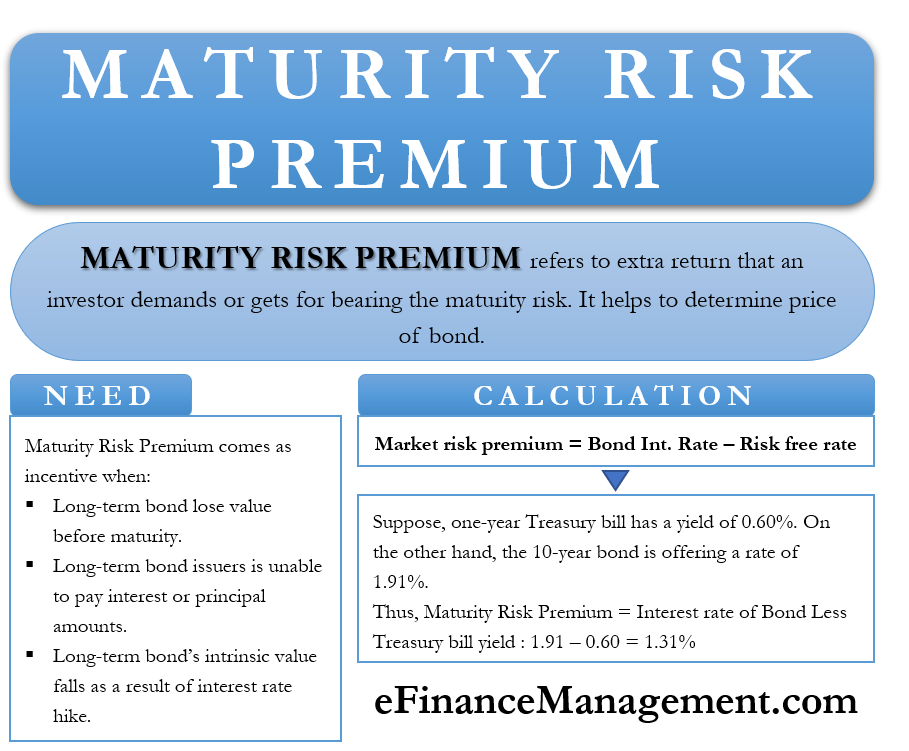

Maturity Risk Premium is basically the extra return that an investor demands or gets for bearing the maturity risk. Usually, the concept of maturity risk applies in the case of a bond. A long-term bond offers a premium in the form of a higher interest rate to compensate for the higher risk investor takes due to higher maturity.

We can say longer the maturity of a financial instrument, the more the maturity risk premium it offers. This is a major reason why the interest rates on longer-term securities are generally more than the short-term securities.

This risk premium plays a significant role in determining the price of a bond.

Formula

The following formula can be used to calculate the maturity risk premium.

Maturity risk premium can be obtained by deducting the Treasury bill yield from the interest rate of the bond. To put it mathematically,

Maturity Risk Premium = Interest Rate of Bond – Treasury Bill Yield

How to Calculate?

We can easily calculate this premium if we know the maturity date of the bond and the interest it offers. For simplicity, we assume that the investor wants to invest in a 10-year bond.

Risk-Free Rate

Next, one will have to get the yield for risk-free securities, which have the same maturity as the bond. One best way to get a risk-free yield is to look at the interest rate of the Treasury securities. These securities are risk-free as the U.S. government backs them.

Also Read: Maturity Risk Premium Calculator

Once you get the risk-free rate, subtract it from the interest that the 10-year bond offers. The result you get is the minimum risk premium for investing in a 10-year bond.

Need for Maturity Risk Premium

One big risk of investing in a long-term bond is that it could lose value before maturity. When you purchase a bond, you are basically investing money or lending money to the issuer. The issuer, in return, is obligated to make regular interest payments at a pre-defined frequency and principal payments at maturity.

For instance, if you invest in a two-year bond, you get the money back at the end of two years. But, in a 30-year bond, you need to wait for thirty years to get the money back. Not much could change in two years, but in 30 years, many things could change. The changes could severely impact the payment status of the interest and principal of the bonds.

Default Risk (Issuer)

The change could be the issuer running into financial hardships. If such is the case, then the bond issuer may not be able to make payment of interest at regular intervals or principal amount on maturity, or both.

Also Read: Bond Valuation

Interest Rate Risk

Moreover, there is also a risk that the market interest rate goes up (interest rate risk), leading to a fall in the bond’s intrinsic value.

Reinvestment Risk

Security with longer maturity has reinvestment risk as well. This is the risk of cash flows, which the investor gets over the life of the bond, which can’t be reinvested at a higher interest rate.

These are the reasons why investors in long-term bonds need an extra incentive. And this extra incentive comes in the form of a maturity risk premium.

Maturity Risk Premium and Interest Rate Risk

There is a very close connection between the concept of maturity risk premium and interest rate risk.

If you invest in a bond, the issuer undertakes to pay a set rate of interest and the principal at maturity. There are chances that before maturity, the market rates will rise. In such a case, the bond you invested in gives you interest at a lower rate than the market rate. This risk of the interest rate rising more than the set rate is the interest rate risk.

The maturity risk premium helps offset this risk by raising the interest rates on the securities with longer maturity.

Example

Assume the yield of a year Treasury bill is 0.71%, and the interest rate on a 10-year Treasury bill is 2.41%.

Maturity Risk Premium = 2.41% – 0.71% = 1.71%

Now, to make a decision on whether to buy a bond or not, you have to calculate the required rate of return. Suppose we need to calculate the required rate of return of 13-year bonds. The formula for getting a required rate of return is adding default risk premium, liquidity risk premium (along with maturity risk premium), and the risk-free rate.

Here, risk-free rate = 1.2%

Liquidity risk premium = 0.7%

Default risk premium = 0.5%

For calculating maturing risk premium of a 13-year bond, the yield of 13 years is to be subtracted from that of 10 years as we are already considering the risk-free rate of a 10-year bond. Let’s assume the maturity risk premium of the 13-year bond to be 1.21%.

Hence, required rate of return of 10-year bond = 1.2% + 0.7% + 0.5% + 1.21% = 3.61%

Therefore, if an investor wishes to make an investment in 13-year bonds, they should undertake such investment only if the interest rate on the bond is equal to or more than 3.61%.

You can also use the Market Risk Premium Calculator.

Evaluate Bond

Now suppose you need to calculate whether or not the return offered by a bond you want to invest in is appropriate or not. For this, you will have to calculate the required rate of return. To calculate this return, you must know the risk-free rate. Also, you should know the default and the liquidity risk premium.

To get the required return, we need to add all these premiums, as well as the maturity premium, to the risk-free rate.

Assume you want to compute the required rate of return for a 15-year bond. The risk-free rate is 2.3% (10-year Treasury bond), the liquidity risk premium is 0.3%, and the default risk premium is 2.5%.

We first need to get the maturity premium. To calculate this premium, we need to subtract the yield of the 15-year Treasury bond from the 10-year Treasury bond. From this, we will get the maturity premium for five years because we are taking the risk-free rate of a 10-year Treasury bond. For the sake of simplicity, let’s say the maturity premium is 1.5%.

Now, the required rate of return will be:

Risk-free rate plus liquidity risk premium plus default risk premium plus maturity premium

= 2.3% + 0.3% + 2.5% + 1.5% or 6.6%

Interpretation

So, if the 15-year bond that the investor plans to invest in offers less than 6.6%, then the investor must not invest in it.