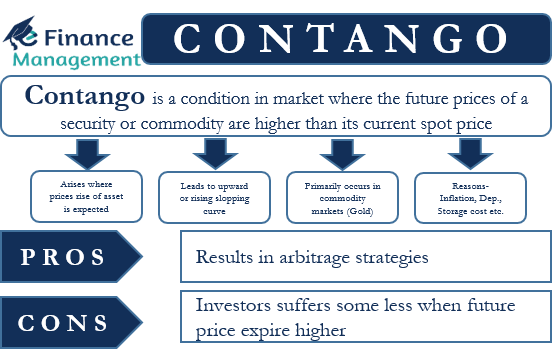

Contango is a term used in the Futures Market and contracts for commodities, currencies, stocks, and indices. Contango is a condition in the market where the future and father maturity contract prices of a security or commodity are higher than its current spot price or lower maturity futures price. As would happen with all such futures contracts, ultimately, the futures prices and spot prices converge near the expiry.

Or, we can say that such a situation arises when there are expectations of a rise in asset prices. We can also say that such a situation leads to an upward or rising sloping curve as the future prices are more than their spot prices.

Such a situation primarily occurs in the commodity markets, especially in the gold industry. And there are several factors responsible for such a situation in the commodity market. These factors could be storage cost, commodity insurance, inflation, depreciation, the expectation of higher real prices, and more.

A recent example of such a situation was the oil prices due to the impact of the coronavirus pandemic. The spot oil prices were lower than the future prices.

Also Read: Contango vs Backwardation

More About Contango

Similar to other markets, supply and demand impact future prices as well. Under contango, investors are ready to pay a higher amount in the futures market than in the spot. The extra that traders are willing to give in the future is usually due to the carrying cost. These costs relate to the charges that an investor would pay to hold that asset for some time. And these could be storage and maintenance costs, insurance and financial cost of carrying, etc.

Eventually, the spot and futures prices will come in line or converge at the time of expiration. This happens because of the presence of a large number of buyers and sellers in the market. And, their presence makes the market efficient by eliminating arbitrage opportunities.

Advantages and Disadvantages

The biggest advantage of contango is that it results in arbitrage strategies. So, a trader can buy a commodity at a spot and sell it for a profit in the future. The arbitrage opportunities decrease as the contract nears expiration.

Traders can benefit from this situation in another way. A contango situation suggests the prices would be more in the future. So, to benefit, a trader may buy more of that commodity at the spot price to profit from higher prices in the future.

Also, traders can benefit from buying futures contracts. But, this would work only if the actual future prices are more than futures contract prices.

Talking of disadvantages, automatically rolling forward contracts results in a significant disadvantage under contango. This is because investors suffer some loss when a futures contract expires at a higher price than the spot.

A point to note is that this disadvantage is only for commodity ETFs that use futures contracts. So, it is primarily for oil ETFs because other ETFs (such as gold) use actual commodities, and thus, investors don’t suffer losses.

Backwardation

Backwardation is the opposite of Contango, which we can also call forwardation. In this, future prices are less than the spot price. Therefore, the graphical curve always shows a downward slope or trend in backwardation. Backwardation could be due to several reasons, including short-term events. For example, a drought in a region may push the spot prices higher than the future prices.

Backwardation could also be due to a rise in the demand for a commodity. So, such a situation could indicate a supply shortage of a commodity.