What do we Mean by a Futures Contract?

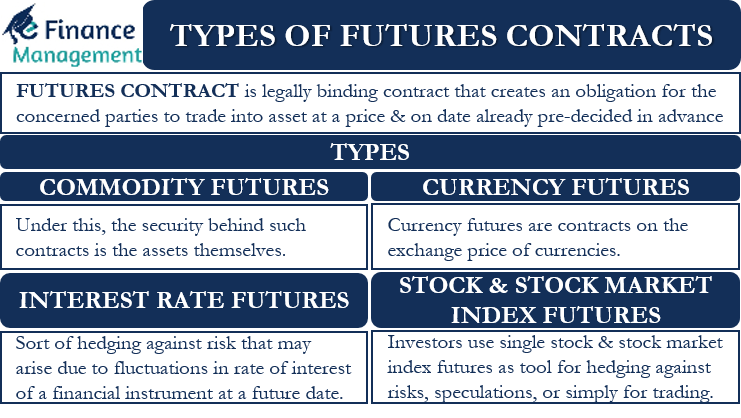

A futures contract is a legally binding contract that creates an obligation for the concerned parties to trade into an asset at a price and on a pre-decided date. The market price of the asset at the time of expiry of the contract is not of concern in such contracts. The parties to the contract have to settle the trade compulsorily at the price set while entering into the contract. Futures contracts are standardized in nature, mentioning the price, quality, and quantity in advance so that traders can trade in them seamlessly on a futures exchange. We categorize many types of futures contracts depending upon their underlying asset. The most common types of futures contracts are commodities futures, stocks and bonds futures, currency futures, and interest rates futures.

Types of Investors under Futures Contract

There are primarily two categories of people who enter into any of the above contracts.

Hedgers

The first category is of those people who use it as a tool for hedging their risk of unfavorable price movement of an asset in the future. They enter into the futures contract to fix a price for their trade. This minimizes any uncertainty as well as the risk of prices going up or down in the future.

Speculators

The second category is those of speculators. They have no intention of taking the physical delivery of the asset. They look to make quick profits at the expiry of the contract by differences in the price of the asset at that date.

Futures contracts may seem similar to options as both can be settled in the near future. But there is a major difference between the two. Options just give a right to trade in the asset at the time of expiry of the contract or even before. They do not create an obligation to do the same. But futures contracts generate an obligation to settle the contract at the expiry of the time period.

What are the Main Types of Futures Contracts?

Let us now look at the main types of Futures contracts.

Commodities Futures

Commodities are tangible assets that investors can physically buy and sell. The most common commodities in which investors buy futures contracts are oil, metals, natural gas, food grains, etc. The security behind such contracts is the assets themselves.

Commodities futures are very important for managing price risk, especially to people like farmers. The primary producer of crops or the farmer can enter into a futures contract to sell his produce at a particular price at a particular date in the future. This way, he gets an assurance of the price he will get for his efforts. He can be free from the tension of losses because of the price going down in the future. Similarly, the purchaser of food grains from the farmer will also know in advance the price which he has to pay for the food grains. He can accordingly plan his production if the product is a raw material for his further production. Or he may sell the produce at a higher rate and ensure that he makes a profit from the trade. Oil and gold are other important commodities in which futures contracts play a major role globally.

Currency Futures

Currency futures are contracts on the exchange price of currencies. The parties to the contract fix an exchange rate for the exchange of two currencies on a specific date in the future. Such contracts help nullify the exchange rate risk that may arise in the case of international trade over a period of time. Usually, the parties close these contracts before the date of expiry as per their need.

For example, suppose Mr.X has an investment in India that is due to mature in November this year. One USD is equal to 75 INR at the current exchange rate. He can buy currency futures and lock the current exchange rate of USD to INR. Thus, he will be sure of what investment amount he will receive at this currency exchange rate, no matter what the currency exchange rate is at that time.

Interest Rate Futures

Interest rate futures are a sort of hedging against the risk that may arise due to fluctuations in the rate of interest of a financial instrument at a future date. Uncertain interest rates may create an extra interest burden on companies and result in heavy losses. We usually use interest rates futures with a money market or bond market instruments such as government bonds, bills, etc. They are the underlying assets for such futures contracts.

Whenever there is a rise in the rate of interest, the prices of the bonds fall. Similarly, bond prices rise with a fall in the rate of interest. An investor can sell interest rates futures contract when the interest rates rise and the price of his bonds falls. They can then repurchase the bonds at a lower rate from the market. This will help them to offset some of the losses they will suffer from a fall in the price of the bonds.

Stock and Stock Market Index Futures

Investors use single stock and stock market index futures as a tool for hedging against risks, speculations, or simply for trading. They are also an indicator of the confidence and sentiments of investors in the market. Single stock futures are a hedge against the future price of the stock. While stock market index futures track the movements of an index.

Stock futures are derivative financial contracts that create an obligation to buy or sell a stock at a specific price and date in the future. They are useful for investors who have a considerable investment in one or few stocks. They want to cover their risk position in case of an adverse stock price movement in the future.

Similarly, stock market index futures create an obligation to trade on the basis of an underlying index and its movements. They are not deliverable at the expiry of their term. Investors just settle their position on such futures in cash. They also help investors take positions on specified indexes and hedge their risks. People use these contracts for speculative purposes as well as to make quick profits as there is no physical delivery and only cash settlement.

Frequently Asked Questions (FAQs)

A futures contract is a legally binding contract that creates an obligation for the concerned parties to trade into an asset at a price and on a pre-decided date.

Various types of futures contracts include:

1. Commodities futures

2. Currency futures

3. Interest-rate futures

4. Stock and stock market index futures

Commodities futures are very important for managing price risk, especially to people like farmers. The primary producer of crops or the farmer can enter into a futures contract to sell his produce at a particular price at a particular date in the future. This way, he gets an assurance of the price he will get for his efforts. He can be free from the tension of losses because of the price going down in the future.