An Arbitrageur is essentially a person who conducts arbitrage. And arbitrage is the simultaneous purchase and sale of securities from different markets/segments in order to make a profit from the difference in price. Thus, an arbitrageur is an investor who seeks to profit from the difference in the price of the security by buying and selling them quickly in different markets.

The security could be a share, a bond, a commodity, a currency, or any other instrument that one can easily buy and sell.

Theoretically, the price of a security should be the same worldwide. But due to market inefficiency, the price can sometimes be inconsistent. To conduct arbitrage, a person must buy security from one location and sell it in another region simultaneously.

Suppose Investor A finds that shares of Company X are traded on the NYSE (New York Stock Exchange) for $10. But on the LSE (London Stock Exchange), the same shares are traded for $11. Here, Investor A would buy shares of Company X on NYSE and sell the same shares on LSE to gain $1 per share.

Arbitrageurs can also try to profit by using private information about a company. If, for example, a person has inside information about an impending takeover, they would buy the shares now to benefit from the price increase later.

Also Read: Arbitrage

Who are Arbitrageurs?

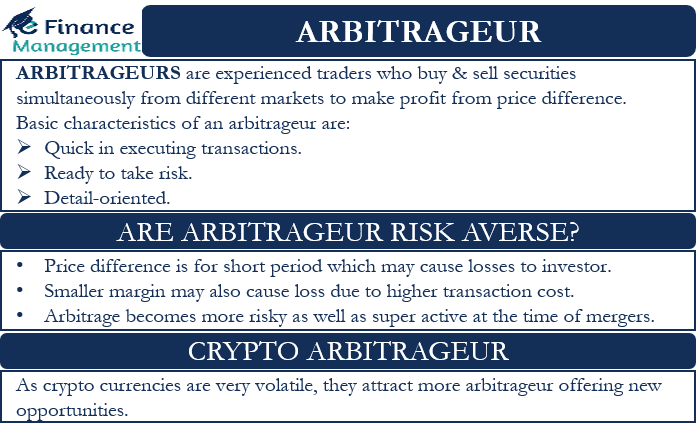

Arbitrageurs are usually experienced investors or traders, as it is very difficult to find arbitrage opportunities so easily and frequently. Moreover, an investor must be very quick to execute such a transaction, which is one reason why most retail investors who use smartphones to trade are not arbitrageurs.

An arbitrager must also be very detail-oriented and must not hesitate to take a risk. Although arbitrage is considered risk-free, it carries enormous risk because these transactions sometimes involve betting on future price movements. In addition, the time difference can be devastating and turn a profitable opportunity into a loss-making trade.

Furthermore, arbitrageurs play a crucial role in improving capital markets. They help identify price inefficiencies and thus make price determination more precise. If an arbitrageur finds an arbitrage opportunity, the demand for that security in that market increases. And the usual demand-supply rules tend to increase the price of security in the market/segment, leading to equilibrium prices in the markets.

On the other hand, the supply of security will increase in another market, which will cause the price to fall. Thus, prices in both markets will receive the same cancellation of any arbitrage opportunity or lead to an arbitrage equilibrium.

Are Arbitrageur Risk Averse?

In theory, arbitrage is a risk-free trade, as it involves simultaneous purchases and sales. However, these transactions are not without risk. This is because the price difference remains for very little time, sometimes less than a second. The price difference is for a short time because the market automatically corrects itself due to supply and demand. So, if an investor is unable to execute the trade in a quick time, he may have to take losses.

Another risk in arbitrage is the margin or spread. Usually, the difference in the price of securities between markets is very small, sometimes as little as a few cents. It is, therefore, possible that even after the transaction has been carried out, a trader will suffer a net loss in a short period of time due to transaction costs.

Therefore, it is important that arbitrageurs consider transaction costs when entering an arbitrage trade. Hence, the biggest arbitrageurs are generally institutions that invest a lot of money, trading large amounts to make big money out of small arbitrage differences. Therefore, since the margin is in cents or pennies, so unless you invest millions, you will not make a big profit.

Arbitrage also becomes risky at the time of the merger, which is also the time when they are super-active because mergers usually result in a price difference in the share price. At the time of the merger, arbitrageurs buy the target company’s shares in the hope of profiting from the difference in the trading price and the cash payment after the merger.

However, in a merger, there is always a chance that the merger will not be completed. And in this case, the target company’s share price may fall dramatically, leading to large losses for arbitrageurs.

Crypto Arbitrageur

Technology has made arbitration opportunities in the capital market very rare. As a result, many arbitrageurs are now turning to the cryptocurrency market, which is a relatively new financial market. As cryptocurrencies are highly volatile, they are attractive to arbitrageurs as they offer arbitration opportunities.

The cryptocurrency exchanges are also new and are still in the learning phase. So they offer arbitrage opportunities. Even Bitcoin was arbitrageurs’ favorite for a long time. Several times, it has been noted that the price of Bitcoin in South Korea was higher than on the US cryptocurrency exchanges.

Final Words

The lack of connectivity between the various financial markets is the main reason for the price difference. As technology has emerged, the number of arbitrage opportunities has dropped dramatically, but they still exist, but not for long. So, to capitalize on these rare opportunities, arbitrageurs deploy state-of-art technologies to quickly identify and execute an arbitrage opportunity.

Continue reading – Types of Derivatives Traders to learn about other traders.