Poison Pill: Meaning

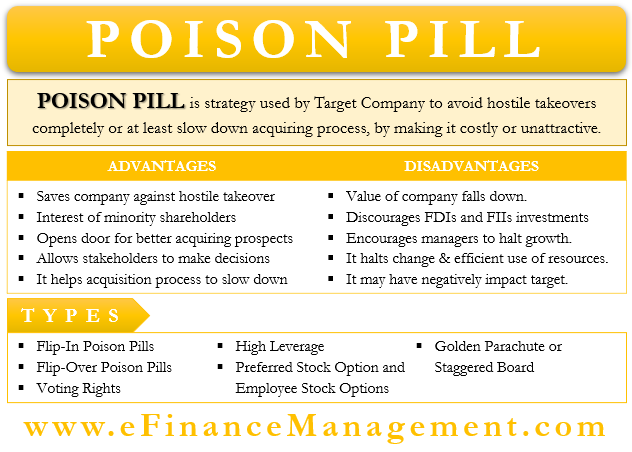

Poison Pill is a pre-offer defensive mechanism technique prevalent in the corporate world to thwart a hostile takeover. It is a strategy used by the Target Company to avoid the hostile takeovers completely or at least slow down the acquiring process. The main purpose of the target company by deploying this technique is to make sure the acquisition becomes costly enough and unattractive for the acquiring company or raider.

Under this strategy, the ‘Rights Issue’ mechanism is successfully used to defend against the hostile takeover. The target company allows the existing shareholders to buy extra shares of the company at a substantially discounted rate. As a result, the overall percentage stake to be acquired or already acquired by the raider decreases significantly.

The formal name of the Poison Pill is the ‘Shareholder Rights Plan.’ The shareholders have voting rights on approval and disapproval of acquisition. This right acts as a poison pill against hostile takeovers by making the target company less attractive. However, the Board of Directors has complete authority to pull back or modify these rights at any time. This clause helps the top-level management of the company to directly negotiate with the acquiring company.

When the implementation of a Poison Pill strategy takes place at a high pitch or in an extreme manner, then it is known as a Suicidal Pill.

Understanding the term: Poison Pill

The literal meaning of the term goes back to the time of wars and spying. At that time, spies would stay with the enemies to get all information. If they are expected to get caught, they would swallow a poisonous pill and die rather than bow down.

The same scenario is applicable to the business world. Under this strategy, in order to discourage the hostile takeover, the target company makes itself unattractive and costly enough for the raider. It puts a lot of obstacles in between and makes sure it becomes very difficult to acquire. The term Poison Pill is used in this context, where the target company swallows the pill of obstacles and defense and avoids getting caught in the hostile takeover. It is a Poison Pill because it works as a poison against the raider, making it difficult to continue the acquisition process. Thus they are pills that are difficult to swallow by the acquiring company. The company continues to defend itself by putting guns on the shoulder of shareholders of the company.

The term was first used in the business world in 1980, and since then, it has been a very popular defense mechanism against hostile takeovers.

Advantages of the Poison Pill

- It saves the company against hostile takeovers and keeps the control and management the same.

- The interest of Minority Shareholders remains safe.

- It opens doors for better acquiring prospects in the future. As it is not always the case that the target company does not want to get acquired ever. It can prefer a harmonious takeover over a hostile takeover with a better value for existing stakeholders.

- Poison Pills allow the shareholders (actual owners of the company) to make decisions with regard to the timing, value, and strength of acquisition.

- This strategy, even if not successful in avoiding hostile takeovers fully, at least helps the acquisition process to slow down and forces the acquirer to negotiate the terms. Thus, it brings him to the negotiation table.

These advantages are non-exhaustive in nature.

Disadvantages of the Poison Pill

- As the purchasing of additional shares takes place at a discount rate, the value of the company falls down by impacting the shareholder’s value adversely.

- This aggressive strategy discourages Intuitional investors like Foreign Direct Investors (FDIs) and Foreign Portfolio Investors (FPIs) from further investing in the company.

- Sometimes, this strategy encourages non-productive managers to continue to work and halt the growth and expansion of the company.

- If the target company is not efficiently using the resources, this strategy halts the change and efficient usage of resources by the acquiring company.

- If the Acquiring Company is very tough, this strategy might not influence its decision and would rather negatively impact the target company only.

These disadvantages are non-exhaustive in nature.

Types of Poison Pills

Following are the types of Poison Pills strategies useful as a defense:-

Flip-in Poison Pills

The flip-in poison pill is a basic and common type of poison pill and is in the company’s charter and official documents as a provision. Under this strategy, the target company allows existing shareholders (except the acquiring company) to purchase additional shares at a discounted price. As a result of this, the value of the already purchased shares by the acquiring company falls to a record low. The price which the company is paying for a stake becomes much higher than the current value of the same; as a result, it becomes very expensive for the acquiring company. Activation of the Flip-in provision occurs after the acquiring company has purchased enough hostile stake (above a particular threshold limit) and before completing the final acquisition process. Moreover, the issue of additional shares also reduces/ dilutes the overall percentage stake of the acquirer in the total capital.

Once the activation of the provision takes place, it does not allow the raider to buy additional shares. And as a result, the more buying and selling of additional shares takes place, the more it dilutes the stake.

Example

For example, the threshold limit of XYZ Company is 20% stake. Let’s say ABC Company is successful in acquiring in 20%, and so in this situation, activation of Flip-in Provision takes place. After the activation, it does not allow ABC Company to further purchase any shares. XYZ Company gives additional shares to existing shareholders at a discount. This dilutes the 20% ownership stake of ABC Company and makes it an expensive acquisition deal. Here the ABC Company has two choices; it can back out and drop the acquisition deal or can pursue the acquisition by negotiating the terms. And the last step, which may be quite costly, is to acquire further stakes to make up to the 20% threshold at exorbitant prices from existing shareholders.

Flip-Over Poison Pills

Under the flip-over poison pill strategy, the shareholders get the right to purchase shares of the acquiring company at a discount rate post-acquisition. As a result of these provisions, the acquiring company losses its stakes and value after the merger deal is over. Ultimately the purpose of Flip-In and Flip-Over is the same, but they work in the opposite direction. They both work by issuing discounted shares, diluting the ownership stake of the acquiring company, and makes the takeover expensive.

Flip-In and Flip-Over are the most popular Poison Pill strategies. Other strategies are as follows:-

Preferred Stock Option and Employee Stock Options (ESOPs)

This is the third strategy, where the equity shareholders of the company get a Preference Shares stock option. The equity shareholders can exercise such an option only when an outsider is trying to acquire. As a result, this stock option suddenly makes the target company unattractive.

Similarly, Employee Stock Options (ESOPs) are also issued, which can only be exercised in hostile takeovers. At this stage, it might be possible that the talented employees of the organization might leave the organization. This will reduce the talented workforce in the organization.

Voting Rights

This strategy goes hand-in-hand with Preference Stock Options and Flip-in Provisions. It gives special voting rights to Preference Shareholders after the acquirer has crossed the threshold limit of ownership stake. Again this makes Target Company unattractive.

Golden Parachute or Staggered Board

Golden Parachute is a compensation given to the top executives because of their termination due to the Mergers and Acquisition. As a result, this increases the acquisition cost and acts as a poison pill.

Similarly, the Staggered Board is where the directors are divided into various divisions and serve for different time lengths. This is a time-consuming affair and takes years for the acquirer to get full control. And so, this strategy also acts like a Poison Pill.

These three elements are useful against hostile takeovers and act as poison pills.

High Leverage

In order to avoid hostile takeovers, the target company starts acquiring a lot of debt in the company. A lot of loans and advances create a negative impact on the acquiring company.

Real-life Examples of Poison Pills

History is full of real-life examples of Poison Pills; some of them are as follows:-

- PapaJohn’s Pizza, in 2018, adopted the Poison Pill’s strategy against an investor who had a 30% stake in the company.

- In 2012, Netflix had also adopted the Poison Pill strategy after an investor had acquired a 10% stake in the company.

- In 2016, Pier 1 Imports has adopted a Poison Pill as a defense against Alden Global Capital LLC, which had a 9.5% stake in the company.

There are many other real-life examples as well.

Poison Put Vs. Poison Pill

Under Poison Put, the target company issues bonds that it can fully redeem with the full investment value before the maturity date. The top executives of the company issue bonds with poison put element as a defense against a hostile takeover. The main purpose of this strategy is to make the acquisition costlier for the acquiring company by asking them to pay to bondholders of the company.

Poison Put and Pill is both defense techniques. The only difference is that Pill impacts shareholders of the company, share price, and share value, while Put does not impact equity at all.

Conclusion

Irrespective of the limitations of Poison Pills, it is one of the most sought-after and practiced defense mechanisms. It allows the target company to deal in a better way with the acquiring company. It gives a chance to the target company to negotiate terms and come up with a fruitful deal for both the entities, the acquirer and the target.