What is a Cash Budget?

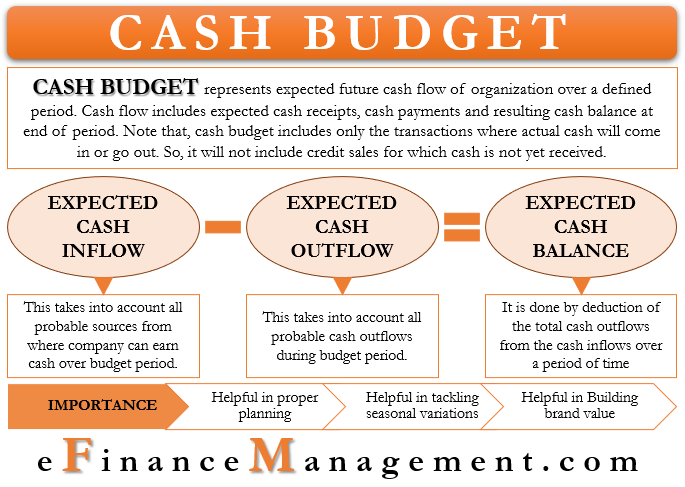

A Cash budget represents the expected future cash flow of an organization over a defined period of time. It is an estimate of the cash receipts expected in the future over the budget period, the expenditure to be incurred in cash, and finally, the cash balance with the company at the end of the period. However, the cash position can be ascertained more frequently, say every month, to keep a check on the company’s performance with regards to the budget. It is a type of operating budget.

In case of businesses facing seasonal variations in demand, the cash budget can be made for small durations, say weekly or monthly. This will help to achieve realistic budget goals. A company can go for a longer period budget, say even a year, if its cash flows are relatively stable with little fluctuations. The cash budget gives a broad view of the company’s cash requirements in the near future. If the receipts seem to be falling short of the future expenditure, the company can plan to raise or arrange for more cash from other sources in time. This will help it to avoid the unpleasant situation of being short in cash and hindrance of business activities.

One important thing to be taken into account is that a cash budget includes only the transactions where actual cash will come in or go out. For example, it will not include a credit sale for which cash or payment has not yet been received. Also, it does not include expenses like depreciation or amortization since no exchange of cash takes place while recording any of the two.

How is the Cash Budget Prepared?

A cash budget takes shape after the preparation of other budgets like sales, purchases, etc. These budgets give a clear picture of the cash drivers in the company and by how much. This budget mainly comprises of three parts-

Also Read: Financial Budget

Cash Inflow Forecast

This budget takes into account all the probable sources from where the company can earn cash over the budget period. These sources include cash sales, cash to be received against accounts receivables, cash to be generated from the sale of a fixed asset over the period, cash to be earned from the sale of stocks and bonds, or any other similar source. The cash balance at the beginning of the budget period will add up to the total cash inflow to give the total cash with the company over the period.

Cash Outflow Forecast

Preparing the budget will take into consideration all the probable cash outflows during the budget period. These outflows will include all the cash payments made for purchases of raw materials, inputs or semi-finished products, consumables, any cash to be paid for the purchase of a fixed asset during the period, provisions for repairs and maintenance, labor payments, selling and administrative expenses, printing, and stationery requirements, dividend distribution, etc.

Cash Balance Forecast

The cash balance forecast is done by deduction of the total cash outflows from the cash inflows over a period of time, maybe a week or a month, as the management feels appropriate. If the budget foresees a high surplus of cash balance, the management may use it appropriately by preparing a financing budget. It becomes the basis for deciding suitable investments for the company. The management may decide to invest in land, plant, and machinery, invest in some other fixed asset, or may allocate the surplus funds to other functions within the organization as per need.

In case the cash balance thus calculated seems to be marginal or deficient of the actual cash requirement of the company, the management may take actions accordingly. They will have to look for other sources of raising capital. Or they may have to increase the borrowings from the bank, or cut down on unnecessary expenditure or delay it.

Also Read: Types of Budget

Example of Cash Budget

Let us look at an example of a cash budget for a period of one month for ABC manufacturing Pvt.Ltd. Its cash balance at the beginning of the budget period is US$ 20000. The cash inflows forecasted over the month are Sales amounting to US$10000, Accounts receivables collections to the tune of US$75000, and a fixed asset sale of US$45000. Hence, the total cash with it over the period will be US$ 150000.

Its cash outflows forecast consists of payments for materials amounting to US$ 25000, labor payments amounting to US$20000, selling expenses of US$10000, printing expenses of US$5000, repairs and maintenance activities of US$10000, and asset purchase of US$30000. Hence, the total outflow forecast amounts to US$ 100000.

Therefore, the cash balance at the end of the budgeted period will be US$ 50000 (US$ 150000 – US$100000). We see that the closing balance of cash with the company is more than the opening balance. The management may decide to use the surplus cash for its proposed activities from the financing budget. It may decide to pay dividends in near future to its shareholders. Or it may just sit over it to use it in the future.

Importance of Cash Budget

Helpful in Proper Planning

The cash budget helps the management in proper planning. It will know in advance the possible cash surplus or deficit scenario in near future. In both cases, it can stay prepared in advance to avoid sudden crisis or loss of investment opportunity. A consistent surplus budget may signal the management to look for other investment opportunities. It can also decide to raise the scale of its own operations.

On the other hand, a cash deficit situation can alert it to take care of its expenditures. Also, it can timely arrange funds by way of equity or debt. Banks are unwilling to extend loans on very short notice or may charge extra interest on the same. Management may avoid such a situation by taking action in time. Thus, it will lead to the efficient utilization of its scarce resources.

Helpful in Tackling Seasonal Variations

A cash budget may be overall positive. But it may still show cash deficits in certain months or periods due to the seasonal nature of businesses. The management can carefully draft plans to tackle these seasonal variations in advance. Proposed cash outflows can be timely curtailed or avoided for periods of stress or low sales. It will help the company to prevent cash shortage.

Moreover, managers can know in advance the periods with a cash surplus. Sitting over idle cash can lead to a waste of an investment opportunity. It can result in missing out on handsome profits for the company. Also, the management may plan to repay part of its debt and reduce its interest burden during periods with a cash surplus.

Building Brand Value

A cash budget acts as a tool to correctly time expenditures of the company as per its cash resources. Also, as said earlier, it gives the management time to be prepared for utilizing surplus cash when available. It helps in timely payment for materials to suppliers, early repayment of the debt, timely disbursement of salaries, proper streamlining of production activities to ensure timely deliveries to customers, etc. This results in building goodwill and brand value of the business. This in turn helps the company to grow and increase its profitability.

Quiz on Cash Budget

This quiz will help you to take a quick test of what you have read here.

Excellent website