As the word suggests, additional Funds Needed, or AFN means the additional amount of funds that a company needs to carry out its business plans effectively. These plans could relate to capacity expansion, diversification, geographical spread, innovation and research, retail outlet expansion, etc. This is basically to create more assets to increase the sales volume and sales revenue and thereby growing the net profits. The funds in question are to be raised from external sources. Another name for AFN is external financing needed. As long as internal funds and reserves are available, that remains an internal managerial action within the company, how to utilize and divert the available resources for the purpose.

Basically, AFN is a method that helps a firm to determine the additional funds that it would need in the future. A company that plans to expand its present operations, either by offering more products, or entering new locations, will use this method to determine the funds it would need to finance these plans while carrying its core business smoothly. Or the funds needed to capture new opportunities without disturbing the current operations.

Generally, when there is an increase in sales, a company would need assets to maintain (or further increase) the sales. Thus, it may need more machinery, property, inventories, and other assets.

Some part of this additional requirement is borne by a sudden rise in liabilities, and some by an increase in retained earnings. The remaining requirement of funds is what constitutes additional funds needed. AFN assumes that a company’s financial ratios do not change.

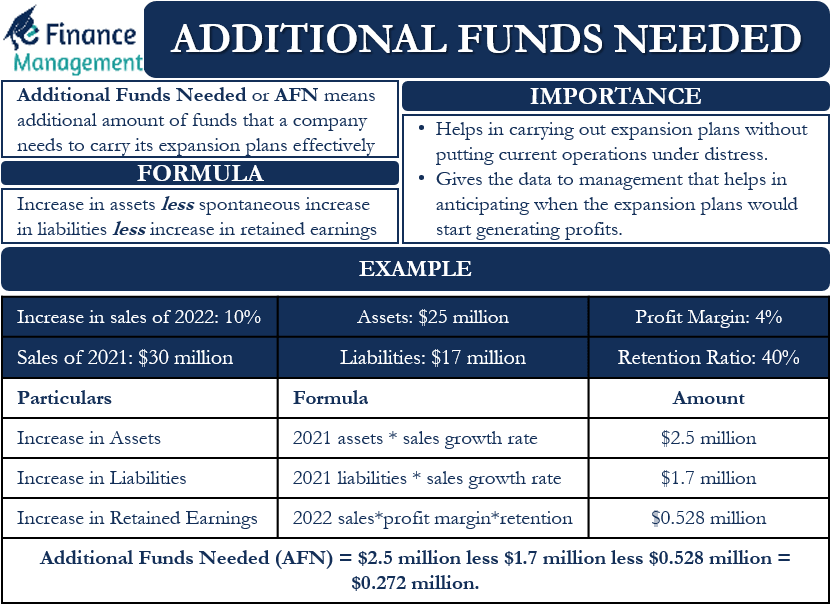

Formula of Additional Funds Needed

A simplified formula to assess the quantum of additional funds is:

Increase in Assets less Spontaneous increase in Liabilities less Increase in Retained Earnings

We can also represent the above formula in the form of an equation:

| (A0 / S0) * ΔS | – | (L0 / S0) * ΔS | – | S1 * PM * b |

In this equation, A0 means the current level of assets, and Lo means the current level of liabilities. ΔS/S0 refers to the percentage increase in sales (change in sales divided by current sales), S1 refers to new sales, PM is the profit margin, and b is the retention rate (1 – payout rate).

All the inputs to calculate the AFN are easily available in the financial statements. If we get a negative answer, it would mean a surplus of capital or the funds is already available within the system. And only the proper utilization or direction is needed for the purpose rather than raising additional funds from external sources.

To accurately calculate the AFN, it is important that we correctly identify the increase in assets, liabilities, and retained earnings. For this, it is crucial to understand that factors affecting the AFN may vary from company to company or from project to project.

For example, some companies may not feel it important to raise their sales force when it launches a new product. This results in big savings. Similarly, some companies would feel it important to raise their marketing budget to support the new level of sales.

Also Read: Financial Planning

Example of Additional Funds Needed

Let’s understand the calculation of AFN with the help of a simple example.

Company X expects a 10% jump in sales in 2022. At the end of 2021, its assets were $25 million, while its liabilities were $17 million. The sales for the year 2021 were $30 million, while its profit margin was 4%. The current retention ratio of Company X is about 40%.

First, we need to calculate the increase in assets.

Increase in Assets = 2021 assets * sales growth rate = $25 million × 10% or $2.5 million.

Next, we need to calculate the increase in liabilities.

Increase in Liabilities = 2021 liabilities * sales growth rate = $17 million × 10% or $1.7 million.

Now, we need to calculate the increase in the Retained Earnings.

Increase in Retained Earnings = 2022 sales * profit margin * retention rate

= $33 million * 4% * 40% = $0.528 million

Now, putting the values in the formula:

Additional Funds Needed (AFN) = $2.5 million less $1.7 million less $0.528 million = $0.272 million.

Importance of Additional Funds Needed

The following points will help to bring out the importance of additional funds needed:

- Accurately determining the AFN helps a company carry out its expansion plans without putting the current operations under distress.

- Also, knowing AFN gives management the data that helps it to anticipate when the expansion plans will start generating profits. And when the profits from expansion plans would be able to offset the investment made to carry those plans.

- Moreover, all this data eventually helps a company to come up with a timeline for when it would be able to pay off outside debt.

- AFN also assists management in realistically planning whether or not it would be able to raise the additional funds to achieve higher sales.

Final Words

Additional funds needed are a crucial financial concept that helps to determine the future funding needs of a company. Moreover, management can also use AFN to make better decisions regarding its expansion plans. However, to accurately calculate AFN, it is important to understand and appreciate the impact of the factors affecting it.