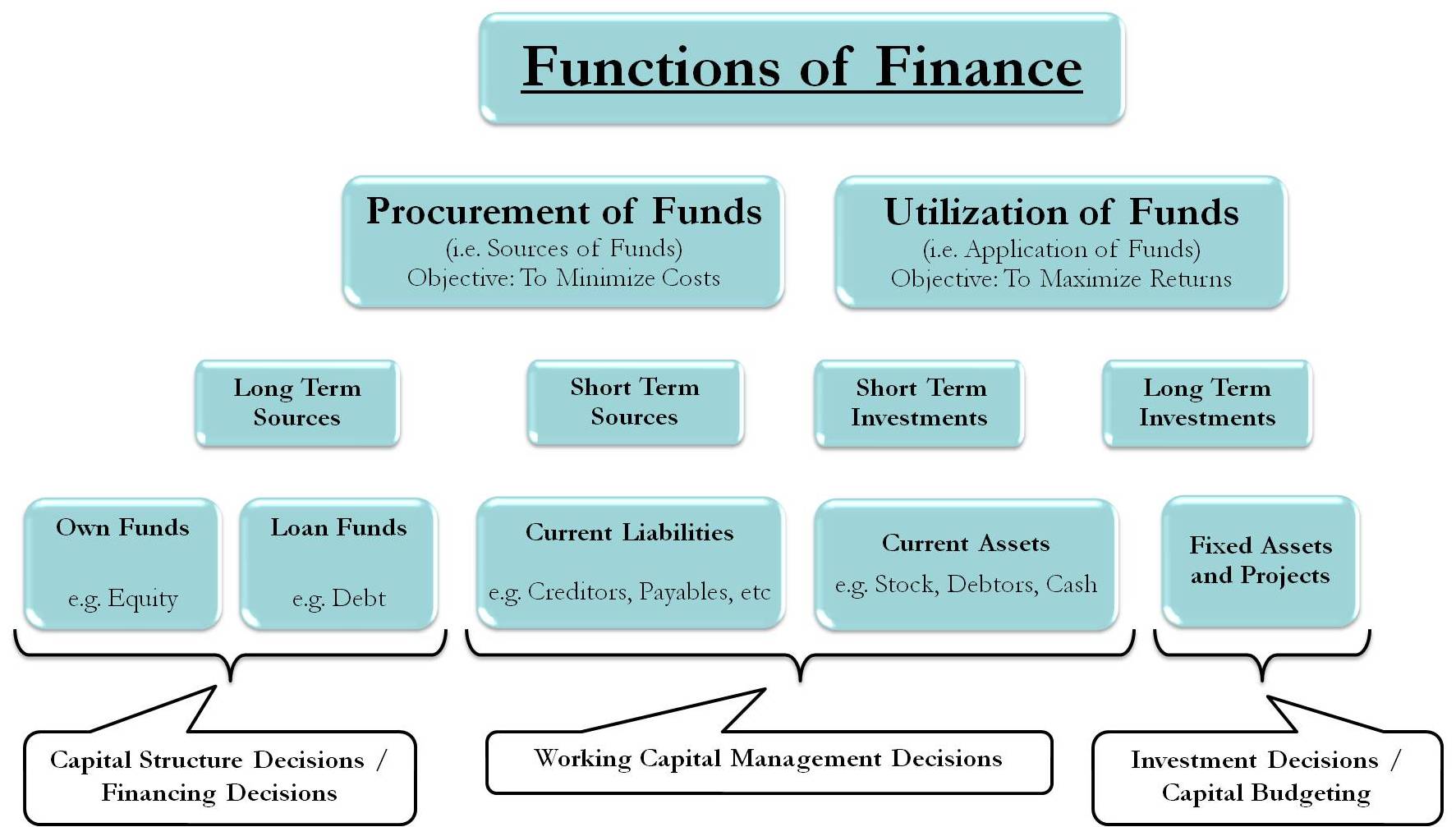

Functions of financial management are guided by the ultimate aim of any business, i.e., profit and wealth maximization. If we broadly classify the functions of a finance head of the business, it can be the procurement of funds and utilization of funds. The objective underlying the function of procurement of funds is to minimize the cost of funds, whereas the objective behind the utilization of funds is to maximize the returns. Let us see more about the functions of financial management.

Following is a diagrammatic representation of the Functions of Finance. Extracted from Prasath Saravana B, Padhuka’s Student’s Handbook on Cost Accounting And Financial Management.

Procurement/Sourcing of Funds

Assessing the Requirement of Funds

The function of procurement of funds starts from estimating the requirement of funds. It involves a lot of forecasting exercises to identify every future requirement of the project and find out the sum required for investment in fixed assets and working capital. He has to take a decision on what will be the sources of finance for procuring funds. Not only the quantum of a requirement is enough, but the finance manager also has to decide the timing of that requirement. The timing of funds is very important in financial management because it carries the time value of money, and we know ‘a dollar today is not the same as a dollar 1 year later.

Financing Decisions/Capital Structure Decisions

Once a reasonable estimate of funds is charted out, the capital structure decisions would finalize two things, viz. a) the mix of long-term finance and short-term finance 2) the mix of own funds and debt funds. Longs term funds are normally used to finance long-term requirements such as fixed assets, other long-term investments, and a part of the working capital that remains permanently invested at any point in time.

Utilization/Application of Funds

Working Capital Management Decisions

Working capital management is a very important day-to-day activity for a finance manager. It spreads over both the broader functions, i.e., procurement and utilization of funds. It mainly involves the management of current assets and current liabilities and keeps the gap between the two managed as per the available funds with the organization. Cash management is a big task in working capital management. The finance manager must ensure that all the branches, units, etc. have sufficient cash to address the necessary expenses. The smoother the management of cash, the smoother is the flow of operations of the business.

Dividend Decisions

Dividend decisions mainly involve making decisions in relation to the payment of dividends to the shareholders. The main concern to handle is to decide the dividend payout ratio, which is dependent on a lot of things like the requirement of funds for the company in their projects, the comparison of returns expected in the company’s projects, and the return available to the shareholder in the normal market, stability of the dividend payment, market expectations, the trend of earnings, tax considerations to the shareholders, etc.

Investment Decisions/Capital Budgeting

Investment decisions involve the utilization/application of funds in the right mix of projects and fixed assets to maximize the returns for the organization. There are various techniques used like Net Present Value, Internal Rate of Return, Payback Period, etc.

Financial Analysis/Performance Appraisal

The financial analysis is neither included in the functions of finance, but it is necessary to evaluate all the functions of finance performed. This evaluation results in the findings for improvements etc. Performance appraisal assesses the effectiveness of procurement of funds and their respective utilization.

There are other functions like dealing with day-to-day transactions and negotiating with creditors, debtors, bankers, etc.

Read our detailed article on Types of Financial Decisions.

Thanks Sanjay Bulaki I learn a lot from your blog regarding finance

Nice explanation