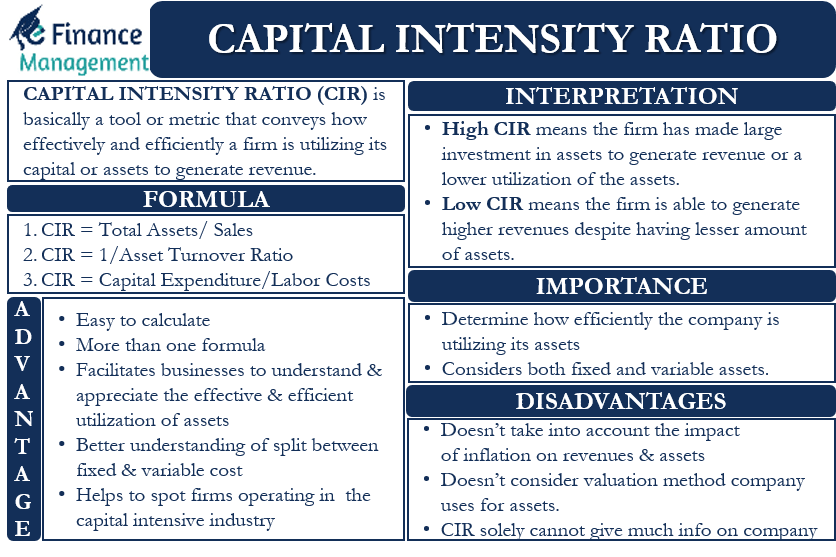

Capital Intensity Ratio is a financial ratio (or specifically an efficiency ratio) that tells a lot about a company’s financial health. It is basically a tool or metric that conveys how effectively and efficiently a firm utilizes its capital or assets to generate revenue. Specifically, this ratio tells us the amount of capital or assets a firm needs to generate a single dollar of revenue.

In simple words, we can say that this ratio tells us the efficacy with which the capital and assets of the firm are put to use for production. This ratio is the reciprocal of the asset turnover ratio, which means if you have an asset turnover ratio, one can easily find the capital intensity ratio.

We need to have a good/higher capital intensity ratio for all capital-intensive businesses. A capital-intensive business is one that invests a massive amount of capital in its production process. For example, power generation plants. Such companies need to produce in high volumes to earn a return on their investment.

Interpreting Capital Intensity Ratio

A high capital intensity ratio (CIR) means a firm has made large investments in assets to generate revenue. Or a company is witnessing lower utilization of the assets. A high ratio could also suggest that a firm is more capital intensive and less labor-intensive.

In contrast, a low CIR means that a firm is able to generate higher revenues despite having a lesser amount of assets. Thus, companies can use this ratio to make adjustments to their capital spending and planning.

But, if we compare two companies very similar to each other in terms of business model and production processes, then the firm with lower CIR is better. This is simply because the firm is able to generate a similar level of revenue with a comparatively lesser quantum of assets.

Formula of Capital Intensity Ratio

A simple formula to get CIR is to divide the total assets by sales.

Thus, CIR = Total Assets / Sales

Another formula to calculate CIR is using the asset turnover ratio. CIR = 1 / Asset Turnover Ratio.

One more formula to calculate CIR is Capital Expenditure / Labor Costs.

Let us consider an example to understand the calculation of CIR:

Suppose Company A has revenue of $46,542 while its total assets are $79,974. Company B, which is the rival of Company A, has an asset turnover ratio of 0.94. Now, we need to compare the CIR of the two companies to find which of the two is more efficient.

Capital intensity ratio for Company A will be Total Assets / Sales, or

= $79,974 / $46,542 or 1.72

The CIR for Company B will be = 1 / Asset Turnover

= 1 ÷ 0.94 = 1.06

On comparing the CIR of both, we found that Company B is using its assets more efficiently. Company B uses $1.06 worth of assets to generate revenue of $1, while Company A uses $1.72 of assets to generate $1 of revenue.

Also Read: Efficiency Ratios

In the above case, Company B appears to be better than Company A. But, it could also be the case where the CIR of both the companies is good. The only way to know this is by comparing the CIRs of two companies with the industry average. If, suppose in the above case, the industry CIR is 2, then the CIR of both A and B is lesser than the industry average and thus, is good. Of course, the preferred one will be company B between the two firms.

Importance of CIR

As you know now, the CIR helps to determine how efficiently a company is utilizing its assets. Generally, using fewer assets to earn revenue suggests a business is more efficient with its resources. Thus, it is crucial for managers to use this ratio to make intelligent production decisions related to assets.

Usually, capital-intensive firms are the victims of high operating leverage. Thus, it becomes important for such companies to carry out large-scale production to maximize the use of assets. This is where the capital intensity ratio gains more importance because it considers both fixed and variable assets.

What Is A Good Capital Intensity Ratio?

Whether or not a CIR is good or bad depends upon the industry a company is operating. Generally, a CIR of 1 or less than 1 is ideal, but again one must weigh the CIR in terms of the industry in which a company operates. For instance, a company operating in a service industry generally has a CIR of close to or below 1. In contrast, a manufacturing company would usually have a CIR of more than 1. Further, in capital-intensive industries like power plants, bridges, ports, hospitals, and hotels, the capital intensity ratio will always be more and maybe anywhere upwards of 2.

Thus, to get meaningful information from a company’s CIR, it is important that one considers the industry in which it operates and compares it with other companies operating in the same industry. Also, when comparing, it is very important to compare the CIRs of two similar levels of companies. Otherwise, we will not get any meaningful information; rather, the decision could be wrong.

Advantages of Capital Intensity Ratio

Following are the advantages of Capital Intensity Ratio:

- This ratio is easy to calculate because all the numbers that one needs for this ratio are easily available in the financial statements.

- There are more than one formulas to calculate this ratio. This thing also makes this ratio easier to calculate.

- It facilitates/helps businesses to understand and appreciate whether the assets are being utilized effectively and efficiently. Moreover, it helps management to identify the assets that are inefficient.

- Companies can also use this ratio to understand better the split between and impact of fixed and variable costs. This, in turn, allows businesses to reap more benefits from the economies of scale.

- CIR helps investors in determining risks associated with a company. In general, investors prefer to put their money in companies with lower CIR.

- It also helps to spot firms operating in a capital-intensive industry.

Disadvantages of CIR

- This ratio does not consider the impact of inflation on revenues and assets.

- This ratio also does not consider the valuation method that a company uses for assets. For instance, one company may use a historical method to value assets, while another company may use a fair value method. In such a case, it becomes difficult to compare the CIR ratio of the two companies.

- The use of modern technologies by a company may change the result of this ratio. So, if one company uses state-of-art technologies and another does not, this ratio may fail to give accurate results.

- CIR solely can not give much information on a company. To get meaningful information, one always needs to compare it with the industry average or of a CIR of any other company (or companies). Moreover, one needs to compare it with the CIR of a similar company; else, it may not be of any use.

Final Words

The capital intensity ratio tells how efficiently a firm utilizes its resources and is closely related to the total asset turnover ratio. Investors would prefer a company with a lower ratio. Hence lower the ratio is better for investors/creditors and other stakeholders. But, one needs to compare the CIR of one company to another to better understand this ratio. However, whether or not a CIR of a firm is good depends on the industry in which the company operates.