What is the Accounting Equation?

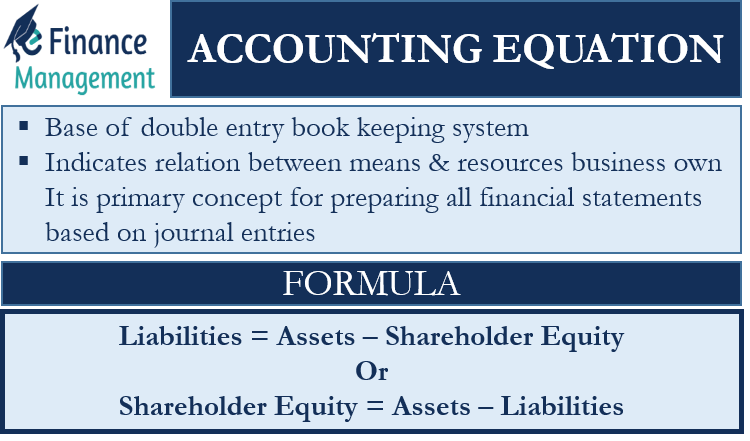

In the realm of finance and accounting, there exists a fundamental equation that serves as the cornerstone of all financial statements and analysis: the accounting equation. Also known as the balance sheet equation, this equation provides a clear framework for understanding the relationship between a company’s assets, liabilities, and owner’s equity. It forms the basis for accurate financial reporting.

The accounting equation is the base of the “Double Entry Book Keeping System.” The definition of accounting equation with the principle of “equality” duly finds its effect on the balance sheet with the “Asset Side” being a sum total of “Liabilities and Shareholder’s Equity. Mathematically represented as:

Assets = Liabilities + Owners Equity

Here, we have used plus sign for the indication addition and a minus sign for showing the reduction, however, in the double-entry system of bookkeeping, the reduction and increase are shown by recording debits and credits.

The underlying rationale behind the fundamental accounting equation is that of equilibrium. This means that every plus should have a corresponding minus, and every debit should have a corresponding credit.

Elements of the Accounting Equation

Let’s delve deeper into each component:

Assets

Assets refer to all the economic resources owned or controlled by a company, which have the potential to generate future economic benefits. This includes tangible assets such as cash, inventory, property, and equipment, as well as intangible assets like patents, trademarks, and goodwill. Assets represent the total value of what a company owns.

Liabilities

Liabilities encompass all the financial obligations and debts a company owes to external parties. This includes loans, accounts payable, accrued expenses, and other forms of liabilities. Liabilities represent the total value of what a company owes.

Owner’s Equity

Owner’s equity, also known as shareholders’ equity or stockholders’ equity, represents the residual interest in the assets of a company after deducting liabilities. It reflects the ownership stake held by the shareholders in the company. Owner’s equity can increase through investments by owners and retained earnings from profitable operations, or decrease through losses and dividend payouts.

Accounting Equation Example

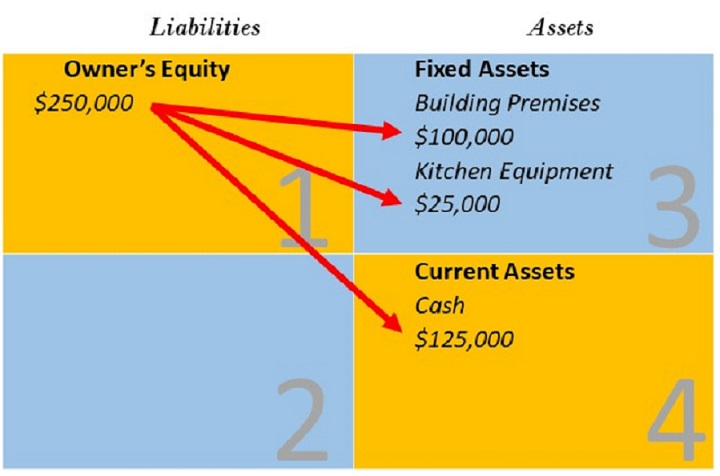

Transaction 1

John has just started a restaurant business. He had some money ($250,000) he had saved throughout the years. He utilized a part of this savings to purchase small premises ($100,000) that would serve as his restaurant and kitchen equipment ($25,000) such as ovens and freezers. The balance savings ($125,000) was also introduced to the business as his capital. He continued to hold this amount in his bank.

Also Read: Assets vs Liabilities – All You Need To Know

Let us now test the fundamental accounting equation.

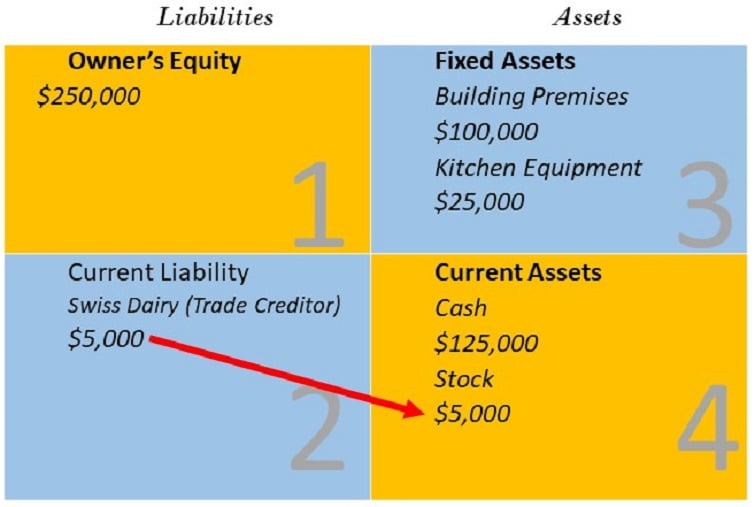

Transaction 2

The operations of the restaurant commenced, and John started entertaining a healthy customer base. To boost his working capital, John decided to now purchase goods on credit. He, therefore, opened a credit account with his vendor, Swiss Dairy, from whom he regularly purchased cheese, bread, eggs, and other items used every day in his produce. He placed a credit order of $5000 with his vendor.

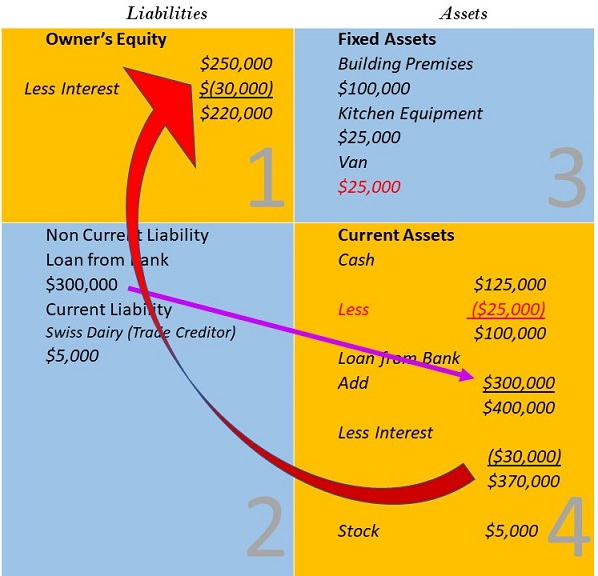

We can now see a movement from quadrants 2 to 4.

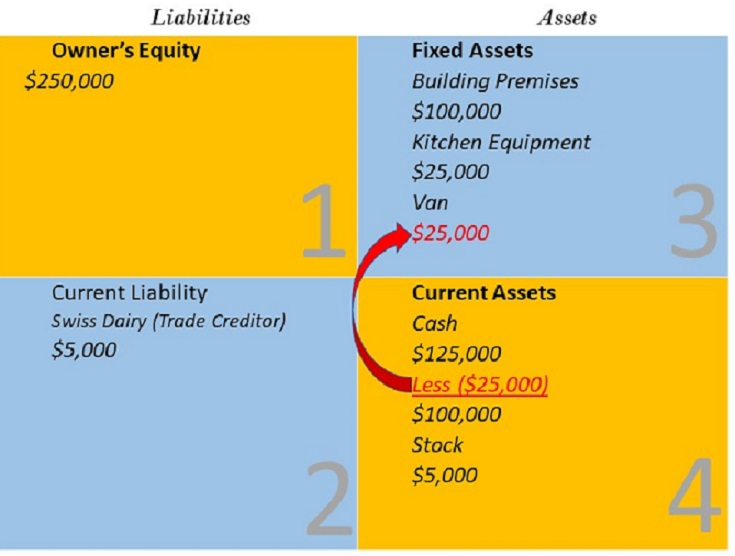

Transaction 3

John’s restaurant has now become a favorite with his customers. However, his customer base is spread far and wide. Therefore, to be able to serve them better, John decides to commence free home delivery. For this purpose, he decides to purchase a van with the bank balance he has on hand.

As is seen above, the flow of the transaction is not across but within the same side. Such transactions also you can easily account for.

Transaction 4

John sees that his liquid cash balances have started to reduce because of ongoing business. Therefore, as a precautionary measure, he decides to borrow a loan from a financial institution to maintain a buffer of funds. He borrows an amount equal to $300,000. The interest is payable at the rate of 10%. Let us see how the following transaction will play out.

The borrowing of $300,000 is not utilized towards the purchase of any asset or spend. Therefore, it will lead to a corresponding increase in the cash balance. Secondly, the interest payable reduces the cash balance. Conversely, the corresponding entry will be passed into the owner’s equity account. The interest payable would be routed through the P&L account, where it is recorded as an expense. In the absence of any other transactions, the interest would reduce the profits and, consequently, the owner’s equity.

Significance & Implications of Accounting Equation

The accounting equation provides a snapshot of a company’s financial position at a given point in time. Maintaining a balance between assets, liabilities, and owner’s equity, it ensures that every financial transaction is accurately recorded and reported. Understanding the equation’s implications helps businesses make informed decisions and evaluate their financial health.

Maintaining Balance

The equation serves as a double-entry bookkeeping system, ensuring that every transaction affects at least two accounts and that the equation remains in balance. For example, if a company acquires an asset by purchasing it with cash, the asset value increases (left side of the equation), and the cash value decreases (right side of the equation), maintaining equilibrium.

Financial Analysis

The accounting equation is crucial for financial analysis and ratio calculations. Ratios such as debt-to-equity ratio, current ratio, and return on equity rely on the accurate determination of assets, liabilities, and owner’s equity. These ratios enable stakeholders to assess a company’s liquidity, solvency, profitability, and overall performance.

Decision-Making

The accounting equation aids in decision-making processes. For instance, by analyzing the equation, management can determine whether to finance investment through debt (liabilities) or equity (owner’s equity). It helps evaluate the impact of financial decisions on the company’s financial structure and long-term sustainability.

The accounting equation serves as the bedrock of financial accounting and reporting, providing a framework for understanding a company’s financial position. It ensures that transactions are accurately recorded and enables stakeholders to assess the company’s financial health. By comprehending the relationship between assets, liabilities, and owner’s equity, businesses can make informed decisions and strategize for the future. The accounting equation stands as an essential tool for accountants, financial analysts, and business owners, facilitating transparency and reliability in financial reporting and analysis.

Relationship of Accounting Equation

The accounting equation represents the relationship between a company’s assets, liabilities, and owner’s equity. It is a fundamental concept in accounting that helps maintain the balance and accuracy of financial records.

Let’s explore the relationship between these three components:

Assets and Liabilities

These have an inverse relationship within the accounting equation. Assets represent what a company owns or controls, including cash, inventory, property, and equipment. Liabilities, on the other hand, are the financial obligations and debts owed by the company to external parties. When a company acquires assets, it typically does so by utilizing a combination of its own resources (owner’s equity) and external sources (liabilities). For example, if a company takes out a loan to purchase equipment, the asset value (equipment) increases while the liability value (loan) also increases. This maintains the balance within the equation.

Assets and Owner’s Equity

The relationship between assets and owner’s equity demonstrates the ownership stake of the company’s shareholders. Owner’s equity represents the residual interest in the assets after deducting liabilities. It reflects the net worth of the company attributable to the owners. When a company generates profit from its operations, it increases owner’s equity through retained earnings. Retained earnings are accumulated profits that are reinvested in the business. This increases the company’s net assets (assets minus liabilities) and, consequently, its owner’s equity.

Liabilities and Owner’s Equity

Liabilities and owner’s equity are distinct but interconnected elements within the accounting equation. These represent the claims of external parties on the company’s assets. In contrast, owner’s equity represents the claims of the company’s owners on the same assets. An increase in liabilities, such as taking on additional debt or accounts payable, can potentially decrease the owner’s equity if it is not offset by an increase in assets or retained earnings. Conversely, if a company repays its debts or generates profit, it reduces liabilities and increases owner’s equity.

By adhering to the accounting equation, businesses ensure the accuracy and reliability of their financial records. It facilitates the preparation of financial statements, such as the balance sheet, which provides a snapshot of a company’s financial position at a given point in time.

Read Accounting Equation Example for further explanation.

Frequently Asked Questions (FAQs)

a) Current Assets + Fixed Assets = Total Assets

b) Current Assets – Current Liabilities = Working Capital

c) Assets = Liabilities + Owners Equity

c) Assets = Liabilities + Owners Equity

1. Assets

2. Liabilities

3. Owners equity

Capital and reserves and surplus form owners’ equity.

Quiz on Fundamental Accounting Equation.

Let’s take a quick test on the topic you have read here.