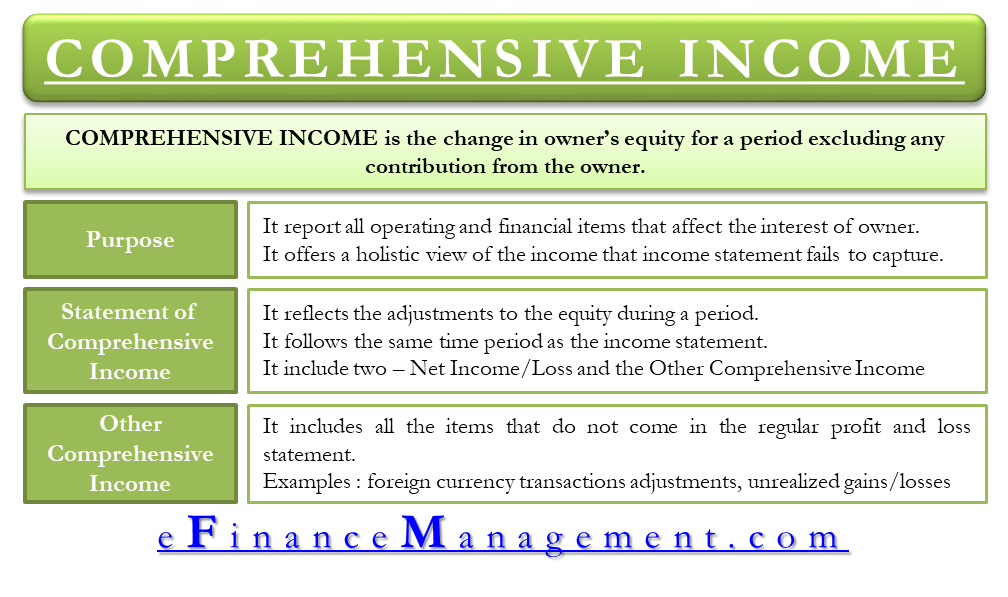

Comprehensive Income is the change in owner’s equity for a period excluding any contribution from the owner. In simple terms, it is the total of all revenues, gains, expenses, and losses and the unrealized gains and losses resulting in a change in the equity or the net assets. Unrealized gains and losses can be those from foreign currency transactions or hedge/derivative financial instruments.

A company’s income statement reports just the profits and losses but may omit the change in the net assets due to the change of ownership, transfer of equity holdings, and other factors. However, a comprehensive income includes all such changes to the net assets and the net income.

It usually appears within the stockholders’ equity section of the balance sheet or a financial report. A business can report such an income monthly, quarterly, or yearly.

Purpose

The purpose of such an income is to report all operating and financial items that affect the interest of the owner. It offers a holistic view of the income that the income statement fails to capture. We can say that the comprehensive income gives a clear view of an external user of the items affecting equity in a period.

It is an expansion of the net income, which shows only the revenues and expenses occurring during a period. On the other hand, the unrealized gains or losses that are yet to occur are nowhere found in regular statements. Such items do not appear on the income statement because there is a consensus that reporting unrealized numbers may inflate earnings.

However, any outsider won’t get a complete picture of the company if these numbers are missing. Hence, companies report comprehensive numbers to give a complete view of their activities.

Note that no rules force a company to show comprehensive numbers on the balance sheet. However, the Financial Accounting Standards Board (FASB) encourages companies to include such a section for the benefit of external users.

Statement of Comprehensive Income

It reflects the adjustments to equity during a period. Or we can say it offers a clear view of the company’s comprehensive income. Such a statement follows the same time period as the income statement and includes two main things.

First the net income or loss appearing in the income statement, and second, the other comprehensive income (OCI). The sum total of both sections gives a comprehensive income. Note that if a company does not have an item to show under OCI, then there is no need for such a statement.

Companies with such items must present the comprehensive statement immediately after the income statement. They may also combine it with the income statement.

Read our article on the difference between income statement and statement of comprehensive income to gain more insight about the differences between the two.

Other Comprehensive Income (OCI)

Also known as comprehensive earnings, it includes all the items that do not come in the regular profit and loss statement. A company does not use these items for typical profit and loss calculations as these are not the result of the company’s regular business operations.

We can say that such an income represents the change in a company’s net assets due to non-owner sources, including revenues and expenses that the company is yet to realize—for example, a capital gain or loss from an investment not yet sold. After a company sells the investment, the loss or gain from it comes into the income statement.

Other examples of such type of income include foreign currency transaction adjustments, unrealized gains/losses on hedging derivatives, unrealized gains/losses on post-retirement benefit plans, available-for-sale securities unrealized gains and losses, and Unrealized gains and losses from debt securities, and more.

One adds the net income for a period to the retained earnings. At the same time, an accountant must add the amount of OCI to the accumulated other comprehensive income. Both retained earnings and accumulated other comprehensive income appear on separate lines within stockholders’ equity on the balance sheet.

A primary difference between the comprehensive and other comprehensive income is that the former includes the latter. This means that if we add the net income to the other comprehensive income, we will get the comprehensive income.

Comprehensive Income = Net Income + OCI

Such other type of income is very infrequent for a small business. Thus, it is more important to value large businesses and shows how hedging and overseas operations may impact financial performance.