Master Limited Partnership: Meaning

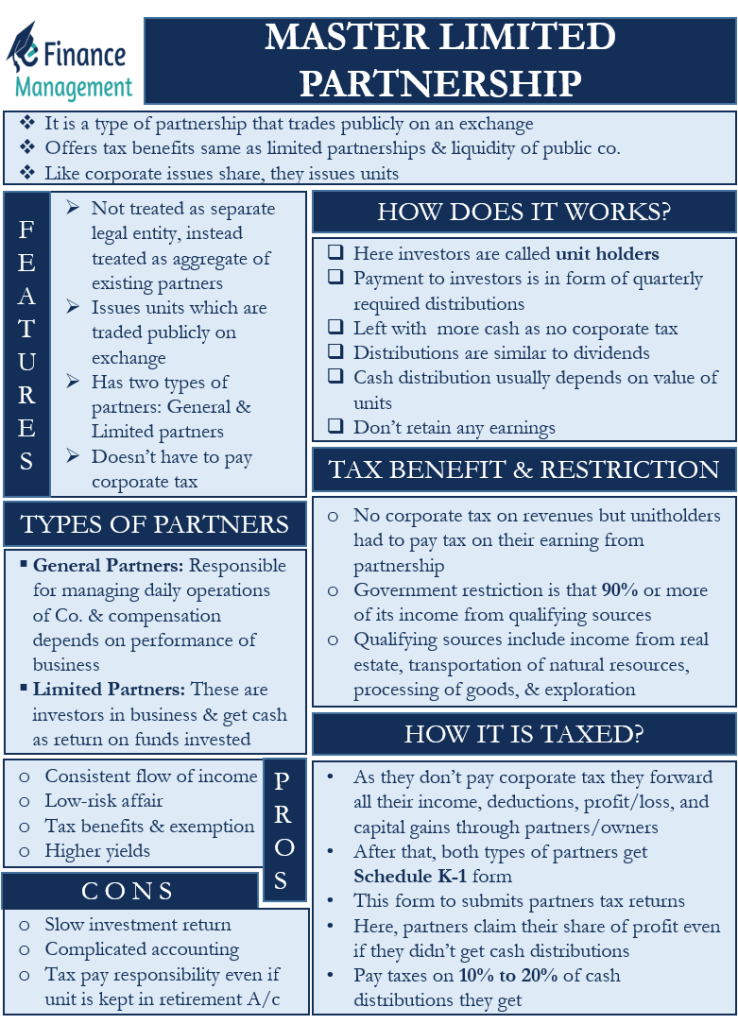

Master Limited Partnership, or MLP, is a venture in the form of a publicly listed limited partnership. And it trades on national exchanges like any other stock or security. Such a type of partnership has twin benefits. It offers the tax benefits that limited partnerships enjoy and the liquidity of a public company that is listed and tradeable. Such a partnership venture consists of two types of partners and those are general partners and limited partners.

Features of Master Limited Partnership

Listed below are the features that will help in better understanding the MLP:

- In the eyes of law as well as for the tax purposes an MLP is not a distinct legal entity like any other corporation/company. Instead, it is treated as an aggregate of existing partners.

- Though an MLP does not issue shares like a corporation, it issues units. These units trade publicly in an exchange.

- As discussed above, such a partnership consists of two types of partners and those are general partners and limited partners.

- It does not have to pay corporate tax on the revenues as it is not treated as a separate entity.

How does Master Limited Partnership work?

MLPs issues units to the investors. And the Investors in MLPs are called unitholders once they buy units of the MLP. General partners usually own a small general partnership stake in an MLP. They may also own the units of the limited partner to raise their ownership stake. So in an MLP, a general partner can have a general as well as limited partnership stakes. However, only units of a limited partner are traded publicly but not that of a general partner.

The payment to investors from MPL is in the form of quarterly income distributions. Such distributions are similar to dividends, and MLPs usually pay them on a quarterly basis. A point to note is that there is no guarantee of a cash distribution. Even if an MLP does not make cash distribution, it is the responsibility of the unitholders to pay taxes on their share of income.

The amount of cash distribution usually depends on the value of the MLP units. Thus, it is crucial that investors, before investing, carefully examine if an MLP will be able to meet its current as well as future commitments.

Also Read: Partnership

Since MLPs do not pay corporate taxes, they are left with more cash for distributing to the investors. For enjoying tax advantages, the MLPs are supposed to earn at least a minimum of 90% of their income from qualifying activities. These activities could be such as related to commodities, natural resources, etc.

So, we can say that MLPs usually operate in steady, slow-growing industries. This ensures a steady cash flow for MLPs over time. Unlike corporations, MLPs do not retain any earnings. Instead, they return it to the investors.

Types of Partners in MLP

The following are two types of partners in an MLP:

General Partners –We can call these being the founder or main partners having control over the operations of the MLP. These partners manage the daily operations of the company. And their compensation for their efforts depends upon the business performance and outcome.

Limited Partners – These are the investors in the business, and we can also call them unitholders. Such partners are not managing the operations of the MLP. Rather their main motto is to earn from investing/buying units of such MLPs.

Master Limited Partnership: Tax Benefit and Restriction

As we discussed above, an MLP is not required to pay corporate tax on its earnings. But all the unitholders have to pay taxes on their earnings from the MLPs.

Since these businesses do not pay taxes, they are not subject to double taxation like the corporations. It means a yield on MLP is higher than a usual stock as the business is left with more money for distributing to the unitholders.

Since an MLP does not pay taxes, the government puts a restriction on it to limit its (govt.) loss of corporate tax revenue. And this restriction is that an MLP must earn 90% or more of its income from qualifying sources to continue enjoying the tax benefits.

The qualifying sources include income from real estate, transportation of natural resources, processing of goods, and exploration. So, the restriction primarily limits the areas where an MLP can operate.

How is MLP Taxed?

Unlike other types of business structures, such as LLCs, partnerships, etc., there is no double taxation on MLPs. The double taxation here means businesses pay corporate tax on their revenue, and shareholders pay income tax on the income from their holdings.

Since MLPs do not pay taxes, they forward all their income, deductions, profit/loss, and capital gains to the partners or owners. After that, both types of partners get a Schedule K-1 form. The partners need to use this form to submit their tax returns. In the tax return, the partners need to claim their share of profit even if they did not get the cash distributions from the MLP.

It is also possible that investors had to file their return in the MLP’s home state, even if they do not live in that state. There may also be cases when the partners had to file taxes in every state where the MLP carries business.

Partners usually had to pay taxes on 10% to 20% of the cash distributions they get from the MLP. This is because MLPs generally charge a higher depreciation and amortization. It helps to offset the taxable income. Though it is beneficial to the investors initially, they eventually need to pay taxes on that amount when they offload their investment. But that may become long-term capital gains attracting a lower rate of tax.

Pros and Cons of Master Limited Partnership

These are the benefits of Master Limited Partnership:

- MLP offers investors a consistent flow of income. Because MLPs have certain restrictions about their earnings and due to no tax, they have large cash available for distribution. Moreover, investing in an MLP is a low-risk affair.

- The investors need to pay taxes only on the earnings received from MLPs. But not on the appreciation in the value of their investments till they sell their units. Also, investors get tax benefits because when they sell their holdings, they would have to pay taxes at the capital gains rate and not the personal income tax rate. Although, the personal income tax rate is generally higher than the corporate tax rate, provided the investors cross a particular threshold.

- Yield is higher for MLP investors in comparison to traditional stocks.

- MLP’s tax exemption feature encourages investors to put more money into the business.

These are the drawbacks of MLP:

- Restrictions force MLPs to operate in slow-growth industries, leading to a slow investment return.

- Though MLPs do not have to pay taxes, each unit holder is still responsible for paying their taxes. This could complicate the accounting.

- Even if the unitholders keep the units in a retirement account, they will be responsible for paying taxes on the partnership income.

Final Words

Though MLPs are a good investment, they may not suit all investors. Investors who want a simple investment structure (also in terms of tax) will be better off by investing in stocks or bonds. But those who prefer a steady flow of income and are okay with the tax treatment can invest in MLPs.