What do we mean by Contribution Margin and Operating Margin?

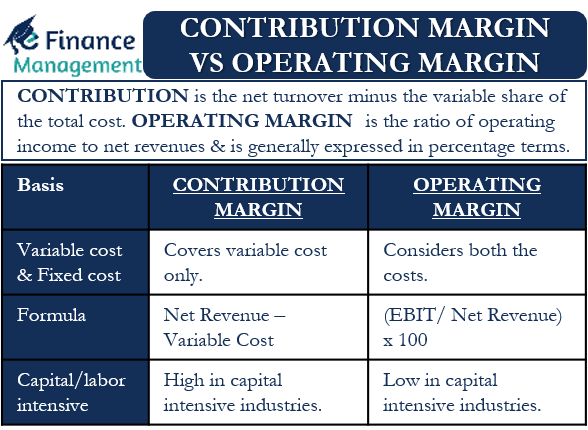

The contribution margin is the net turnover minus the variable share of the total cost of an organization. It covers the fixed costs of the organization as well as a profit share. Therefore, the contribution margins in the case of heavy industry are high due to their capital-intensive nature. Similarly, the margin is low in the case of sectors that are heavily dependent on labor. The operating margin is the relationship between the net revenues and the operating income of the entity. It is also called as operating ratio and is generally expressed in percentage terms. Operating income is the difference between the net revenues of an organization and its expenses over a given period. However, it excludes interest costs and taxes. EBIT or Earnings before Interest and Taxes and Return on Sales (ROS), the Margin on Sales are the other terms for referring to operating income.

Contribution Margin

The formula for calculating the contribution margin is:

Contribution Margin = Net Revenue – Variable Costs

The above metric is useful for companies to evaluate internally. It is a financial measure of how comfortably the company meets its fixed costs such as rents, salaries, insurance premiums, etc. Moreover, a low contribution margin often acts as an alarm signal in an organization. It gives management a warning to either increase the prices of its goods or services or make efforts to reduce its variable expenses. Both solutions will contribute to an increase in the contribution margin, an increase in profitability, and leave more money to cover the fixed costs.

Operating Margin

The formula for calculating the operating margin is:

Operating Margin = Operating Income over a particular period / Net Revenue x 100

This financial parameter is a company’s income from its core or base activities. It provides an understanding of how much revenue is left after covering its costs for goods sold and operating expenses, excluding interest and taxes. Net revenues are the total sales or revenues a company earns from its products and services, minus all sales returns, exchanges, and discounts. Operating margin is a measure of a company’s efficiency and profitability. It also says how comfortably a company can meet its interest obligations on its total debt and corporate tax liability.

What is the difference between Contribution Margin and Operating Margin?

The main differences between the two financial indicators are:

Meaning

As discussed above, the contribution margin is the remaining portion of net revenue after deducting all variable expenses of an organization. However, the operating margin is the profit margin that remains after deducting an organization’s operating expenses, excluding only interest and taxes, from its net revenue. Therefore, its scope is much broader. Moreover, we usually express the operating margin in percentage or a ratio form.

Also Read: Contribution Margin vs Gross Margin

Inclusion of fixed costs and variable costs

The contribution margin only includes variable costs from a company’s total costs by definition. It is a measure of how well-positioned the company is to meet its fixed share of total costs.

We calculate the operating margin by subtracting both variable and fixed costs from the company’s net revenue. The major fixed costs that we include in the calculation but do not include in the contribution margin are salaries for personnel, rents and leases, depreciation and amortization charges, insurance premiums, and utility bills that are not variable in nature. Operating expenses also include some forms of taxes that are not part of the variable expenses that we use to calculate the contribution margin. These taxes are property taxes, sales taxes, city and state taxes, etc.

Capital intensive and labor-intensive industries

The contribution margin as a percentage hardly differs between capital-intensive and labor-intensive industries.

However, it is not so with operating margins, as Capital-intensive industries have a significantly lower operating margin in percentage terms than labor-intensive industries. This is due to the fact that capital-intensive industries, in contrast to labor-intensive industries, have a high proportion of fixed costs. In addition, depreciation and amortization expenses will be substantial, resulting in low operating margins.

Contribution margin and Operating margin: Which is more important?

Both the contribution margin and the operating margin have their own merits and importance. Contribution margin is an excellent comparative tool that helps the company analyze its portfolio product by product. It helps to minutely examine the variable cost distribution for each product individually across a large number of products. Therefore, it is an important metric to identify low-profit making products or even those products that can cause losses to the organization. Management can make corrective decisions in good time and even remove the product from the product portfolio if necessary. To sum up, it is an important indicator and tool for production volume planning, acceptance or non-acceptance of a particular order, analyzing product performance with reference to their contribution to the company’s overall profitability, and so on.

Also Read: How to Calculate Contribution Margin?

The operating margin is a broader profitability ratio with a broader scope. Unlike the contribution margin, the operating margin considers several important operating expenses that need to be taken into account. It gives a much clearer picture of an organization’s financial health and stability. A company can present a very rosy picture through an attractive contribution margin. But it can have high expenses in the name of rent, salaries, utility bills, etc. They can show the true picture when calculating the operating margin. In addition, depreciation and amortization in capital-intensive industries are high. This can significantly affect EBIT.

Therefore, operating margin is a much broader and more reliable parameter. It throws light on the profitability and sustainability of an organization’s core business. Through this, there can be a comparison between the operating performance of companies and the industry segment. This indicator is important for all the stakeholders – management, investors, creditors, and others.

Frequently Asked Questions (FAQs)

The operating margin can be obtained by subtracting all fixed costs except interest expenses from the contribution margin.

In capital-intensive industries, depreciation forms a major part of the costs, which are fixed in nature and therefore not taken into account to arrive at a contribution margin. Whereas in labor-intensive industries, labor costs are high and are variable in nature. We deduct these costs from net revenues, which ultimately reduces the contribution margin.