What are Accounting Policies?

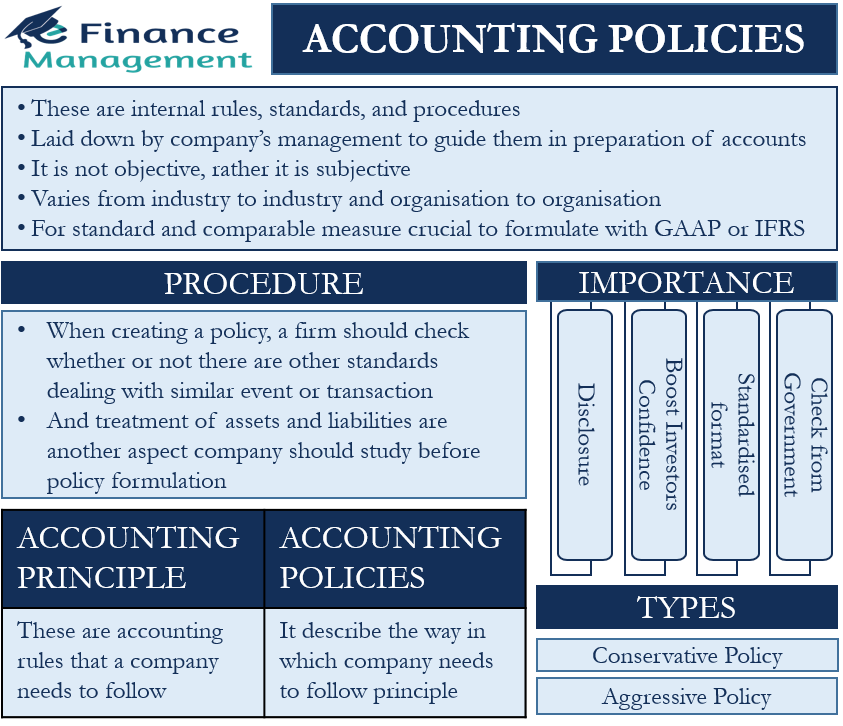

Accounting Policies are internal rules, standards, and procedures that a company’s management lays down to guide them in the preparation of accounts. Basically, these policies help with the accounting, setting up measuring systems, as well as in the presentation of accounts.

Such policies are very useful when recording complex accounting activities. These activities include which depreciation method to use, how to treat R&D expenses, goodwill recognition, valuing inventory, and more.

An accounting policy is not objective, rather it is subjective. This means there is not any list of such policies available that an entity can use for all types of transactions. Rather, entities come up with their own policies depending on their individual circumstances.

Therefore one needs to bear in mind that each organization’s policy can differ from others. In other words, the policies can and usually varies from industry to industry and organization to organization. But it is crucial that they are formulated in accordance with the GAAP and IFRS (whichever is applicable) to remain standard and comparable.

Accounting Principles vs. Accounting Policies

If we believe that accounting policies sound very similar to accounting principles, then we are only partly correct. Accounting principles are the accounting rules that a company needs to follow. But, the policies describe the way in which a company needs to follow those rules. Or, we can say, these policies guide the company on how to go about preparing the financial statements. These policies remain within the overall accounting principles.

Accounting principles serve as a guide as to how a company needs to operate, record and present its financial statements. These principles, however, are flexible, and this encourages companies to come up with policies to guide their accounting and reporting.

Accounting Policies Examples

Following are some of the key areas where accounting policies play a crucial role:

Inventory Valuation

Inventory is an important asset part of any manufacturing or trading organization and so is their valuation. There exist various methods for valuing the inventory, such as FIFO (First in First Out), LIFO (Last in First Out), average cost method, and more. The IFRS does not approve the use of the LIFO method. So, if a company follows IFRS, then its policies must ensure that it does not use IFRS for reporting purposes at least. Moreover, the policies may allow the company to use a method that increases their earnings or lower their tax liability.

Depreciation

There are several methods to calculate depreciation as well, including the straight-line method, declining method, unit of production method, and more. So, the policies must guide the company on the depreciation method to use, the rate of depreciation, disposal process, capitalization of expenses (if any), and more.

Revenue Recognition

The policies must guide the company on when to recognize the revenue, as well as expense. Moreover, it must be clear on what all conditions need to be fulfilled for the recognition of the revenue.

R&D Expenses

Whether or not to capitalize the R&D expenses and what expenses need to come under R&D expenses is a confusing question that many companies face. So, it is important that a company has proper policies on the recording and recognition of such expenses.

Apart from these, other important areas where policies play a crucial role are:

Treatment of goodwill, treatment of leases, foreign currency, contingent liabilities, valuing investments, and more.

Importance of Accounting Policy

These policies hold importance not just to the companies, but to the investor and governments as well. The following points will bring home the importance of these policies for all the stakeholders:

Check from Government

All firms need to have their policies in accordance with either GAAP or IFRS. This allows the government to keep a check on the financial performance of the companies, and in turn, protect the interest of the investors.

Proper Framework

These policies provide companies with a standardized format that they need to follow when preparing their financial statements. This ensures consistency in the financial statements.

Boost Investors Confidence

If an investor knows that a company has proper policies in place, it boosts their confidence, as well as trust. Moreover, it even allows investors to easily compare the financial statements.

Disclosure

It is important for companies to reveal the policies they follow. The disclosure will help the investors and outsiders to properly evaluate and interpret the financial strength or otherwise of the organization. Moreover, it also keeps a check whether or not a company is following its own policies consistently year after year or not.

Types of Accounting Policies

Generally, companies have policies that are between the two extremes – Conservative and Aggressive.

Conservative Policy

A conservative policy generally understates the performance in the early years but shows a better performance in the subsequent years. This type of policy is more sustainable as it allows a firm to show improvement in the following years. And, thus it gives confidence to investors as well.

Aggressive Policy

Such type of policy generally overstates the performance in the initial years. And, in the following years, it shows a drop in performance. Such policies may not be in the interest of investors as they may mean misrepresentation of figures. It also lowers the trust over the company’s financial status and raises doubt over the management too.

Whichever type of policy a company follows, it is important that it reflects in its accounting and financial figures. Also, it is crucial that a company sticks to the type of policy it uses. And, if it is changing its policy from aggressive to conservative, or vice versa, then it should clearly state why it is doing so.

Accounting Policies and Procedure

When creating a policy, a firm should check whether or not there are other standards dealing with a similar event or transaction. Treatment of assets and liabilities is another important area that decides the strength of the balance sheet and its impact on various ratios. So the company should study these aspects also carefully while deciding the policies. In their accounting policy, a company can also use prudent concepts, such as gains must not be estimated and recognized only when they are realized.

Moreover, when a company is selecting a policy, it must consider and always remember if any specific accounting standard is applicable to any event. If there is any, then the policy must be in accordance with that standard. And, in case, no specific standard applies to the event or transaction, then it can develop its own policy using past experience and judgment so as to present the same in the best possible manner.

Apart from these factors, when developing its policies, a company must ensure that its policies give an accurate and fair picture of its financial performance.

Final Words

Now we know that accounting policies play a vital role in developing a framework for companies that they need to follow in recording their day-to-day transactions. Additionally, these policies also help in preparing financial statements. It will not be wrong to say that these policies serve as a foundation upon which an entity carries its accounting work. Thus, it is very important for a company to take all time and precautions when developing its policies.