What is the Full Disclosure Principle?

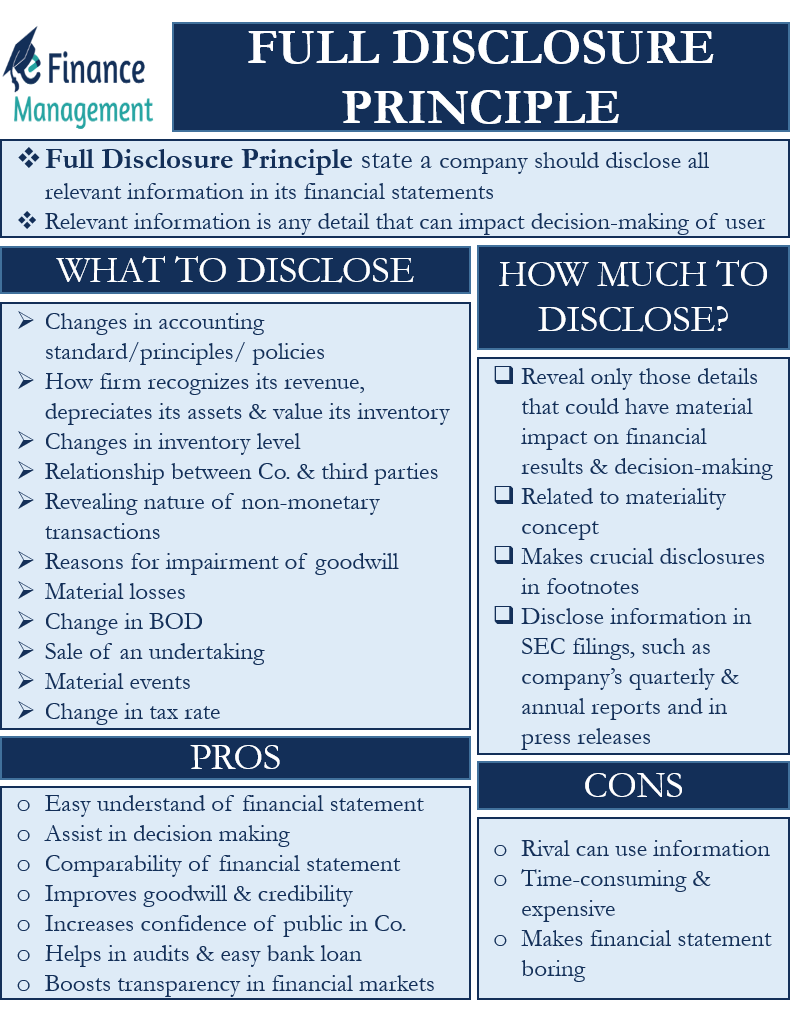

The Full Disclosure Principle, as the word suggests, means that a company should disclose all relevant information in its financial statements. Relevant information is any information or detail that can influence or impact the decision-making of a user. The primary objective of this concept is to ensure that stakeholders transparently get all the information they need to make better decisions.

This principle asks the companies to reveal all relevant material information in the financial statements. Or, if not in the financial statement itself, then at least in the form of notes to the financial statements. Since external users do not have much access to the information on the company, the full disclosure concept ensures that financial statements reveal all the information these users need.

Disclosure could be of transactions that are not yet quantified—for example, undecided lawsuits, any tax dispute with the government, and more. In the case of a loan, the full disclosure concept requires the firm to reveal all its loans, as well as its maturity dates, collateral, etc.

How Much to Disclose?

The amount of information that a business can reveal is potentially enormous, making the interpretation of this concept judgmental. Also, sharing or telling every piece of information would mean dumping a large amount of information on analysts and investors. This will sometimes may even confuse all of them to accept and interpret this bunch of information properly. Thus, this principle recommends that firms should reveal only those details that could have a material impact on the financial results and related decision-making. In other words, we can say that the full disclosure concept is related to the materiality concept.

Also Read: Presentation of Financial Statements

So, according to this concept, this relevant information can be revealed by the firm either directly in the financial statements itself along with every line item. Or this can be revealed in the footnotes to the statements. Usually, a company makes crucial disclosures in the footnotes. A firm needs to disclose the information in the SEC filings, such as the company’s quarterly and annual reports, as well as in the press releases.

A company does not follow this concept for preparing financial statements that are of use internally. This is because the management is assumed to know the information that a firm generally discloses to outsiders.

For example, Company A makes clothes, and Company B is its main customer. However, Company B finds supplier C, who is selling the same quality clothes. Still, at a price less than Company A. Thus, Company B cancels all future orders with Company A. Though this information will not impact the current year numbers of Company A. Yet, the company must reveal it in its financial statements. This is because this information would affect the investors’ decision-making.

Full Disclosure Principle: What to Disclose?

Following are some of the details, apart from the financial numbers, that a firm must disclose in the financial statements:

- Any changes in the accounting standards or principles.

- How a firm recognizes its revenue, how it depreciates its assets, how it values its inventory, etc.

- Detail or changes in the accounting policies that a company follows.

- Information on the changes in the inventory level.

- Details (or any changes) in the relationship between the company and third parties.

- Revealing the nature of non-monetary transactions.

- Reasons responsible for the impairment of goodwill.

- Material losses (if any) and any asset retirement obligations.

- Change in the board of directors. Though it is non-monetary, revealing this information could impact investors’ decision-making.

- Sale of an undertaking.

- Material events occur after the reporting period but before preparing the financial statements.

- Any expected change in the tax rate.

A point to note is that some of the material information could be difficult to quantify. Despite this, the company must reveal those details if they could have a material impact on the firm’s financials and investors’ decision-making. Additionally, the management must provide forward-looking statements on such items, revealing how these items can impact the firm’s financial performance. Companies can use conference calls to give more clarity on the disclosure.

Also Read: Types of Financial Statements

Advantages of the Full Disclosure Principle

Below are the advantages of the full disclosure concept:

- It makes it easier to understand the financial statements and, in turn, assists in decision-making.

- It makes it easy to compare the financial statements across periods and across companies.

- Making full disclosure improves the goodwill and credibility of the firm.

- It increases the confidence of the general public in the company.

- Full disclosure also helps in audits as well as makes it easy for companies to apply for a bank loan.

- It boosts transparency in the financial markets, as well as limits deceptive activities.

Disadvantages of the Full Disclosure Principle

Below are the disadvantages of the full disclosure concept:

- Since rivals can also access the full information, they can use it to gain an advantage over the company.

- Revealing more information could be time-consuming and expensive. A company may need to hire an expert (or a team) that will be responsible for disclosing the information as per the full disclosure concept.

- Giving more information could make the financial statements boring to some investors. So they may not read all the information.

Final Words

The Full Disclosure Principle is very important in the corporate world. Moreover, its importance has grown in recent years owing to several high-profile scandals involving the manipulation of accounting results, such as the Enron scandal in 2001 and Madoff’s Ponzi scheme (2008).

In addition to the financial statements, the full disclosure principle is also of use in contractual agreements. Using this principle in agreements ensures that parties reveal all material information related to the transaction to each other.