What is the Cross Currency Rate?

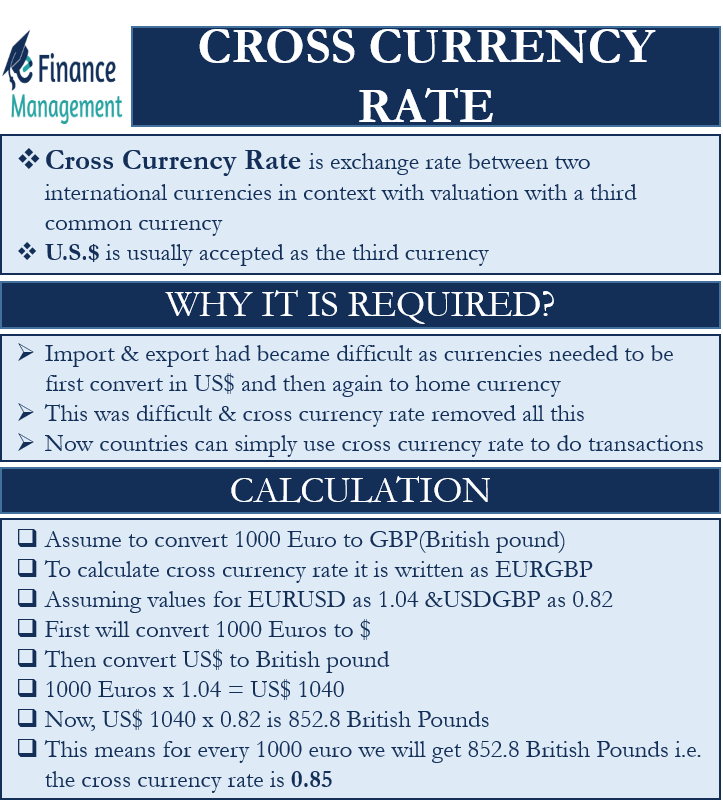

Cross currency rate is the exchange rate between two international currencies in context with valuation with a third common currency. The U.S. Dollar is usually accepted as the third currency worldwide. Thus, a currency pair without taking into account the USD is known as a cross-currency pair. Because the US economy is the largest in the world, we consider the USD the strongest currency. The majority of forex transactions involve the US Dollar across the globe.

We always denote the value of the US Dollar as 1 when we use it as the base currency. We call the first currency the base currency in a pair of currencies. It is written on the left side. For example, in the pair USDGBP, USD is the base currency. It denotes the number or amount of British pounds for every US Dollar. The second currency in the pair is the quote currency. And this quote GBP is the quote currency. (Read our article on How to Read a Currency Pair for more)

There are only a few important cross-currency pairs that are quoted regularly in the international markets. They are the Euro- British Pound (EURGBP), Euro- Japanese yen (EUPJPY), Euro- Swiss Franc (EURCHF), Australian Dollar- New Zealand Dollar (AUDNZD), and Euro- Swedish Krona (EURSEK).

Why is a Cross Currency Rate Required?

Countries globally tend to specialize in only a few products and manufacture them. They import the other products which they can get at a cheaper price from some other nation rather than making them themselves. A few years ago, a buying nation had to convert its currency into US Dollars to pay for its import. The exporting nation would again convert those US Dollars back to its home currency.

However, trade volumes started swelling between countries with the advent of globalization. Subsequently, the need to convert your currency into US Dollars was done away with. Now we can directly trade in cross-currency pairs without involving the US Dollar. This has made international trade much easier and faster between countries not involving the US.

Cross-Currency Rate Calculation

Let us assume that we have to convert 1000 Euros to GBP or British Pounds. We will need to calculate the Cross-currency rate for Euro and British Pounds, written as EURGBP. We do not have this value. However, we have the values for EURUSD as 1.04 and USDGBP as 0.82. Hence, to determine the EuroGBP rate, we have to make two-stage calculations.

First, we have to convert 1000 Euros to US Dollars. Second, we have to convert it into British Pounds to arrive at our answer. Hence, 1000 Euros x 1.04 = US$ 1040. Now, we have to calculate how much British Pounds we will get with US$ 1040. We multiply US$ 1040 by 0.82 to arrive at 852.8 British Pounds. Therefore, for every 1000 Euros, we will get 852.8 British Pounds. The EURGBP rate is 0.85.

We have done the above calculation for the sake of simplification. In actual usage, we just have to multiply the values for EURUSD and USDGBP to arrive at our answer. In the above instance, when we multiply 1.04 by 0.82, we get the answer as 0.85 only, which is the value of EURGBP.

Also Read: How to Read Currency Pair?

We need to understand one more point. Whenever we need to calculate the cross-currency rate from quote to base, we will use division in place of multiplication. Suppose we do not have the value for USDGBP but have the value for GBPUSD (1 / 0.82)= 1.22. Now we have EURUSD as 1.04 and GBPUSD as 1.22. To find the value of EURGBP, we will divide 1.04 by 1.22. Again, we will get our answer as 0.85, which is the same as above.

Calculation when have the Bid and Ask Rates

Let us now look at the real-world examples when we have the bid and ask rates for any two currencies. Suppose we have the bid and ask rates for EURUSD as 1.0426 and 1.0486 and GBPUSD as 1.2210 and 1.2250.

Now let us calculate the EURGBP bid rate. This is the rate at which we will buy Euros and sell British Pounds. The calculation will be 1.0426/ 1.2250= 0.8511

Similarly, we will calculate the EURGBP ask rate as 1.0486/1.2210= 0.8588.

Therefore, the cross-currency rate for EURGBP will be 0.8511 – 0.8588.

Summary

Cross-currency rates are an extensive and dynamic area of study. The currency rates keep fluctuating on a daily, even hourly, basis. Traders can take positions on currency pairs that are not frequently traded. This can provide them with an opportunity to earn handsome profits. Also, these rates help to make trade much simpler between different nations of the world, not involving the US.