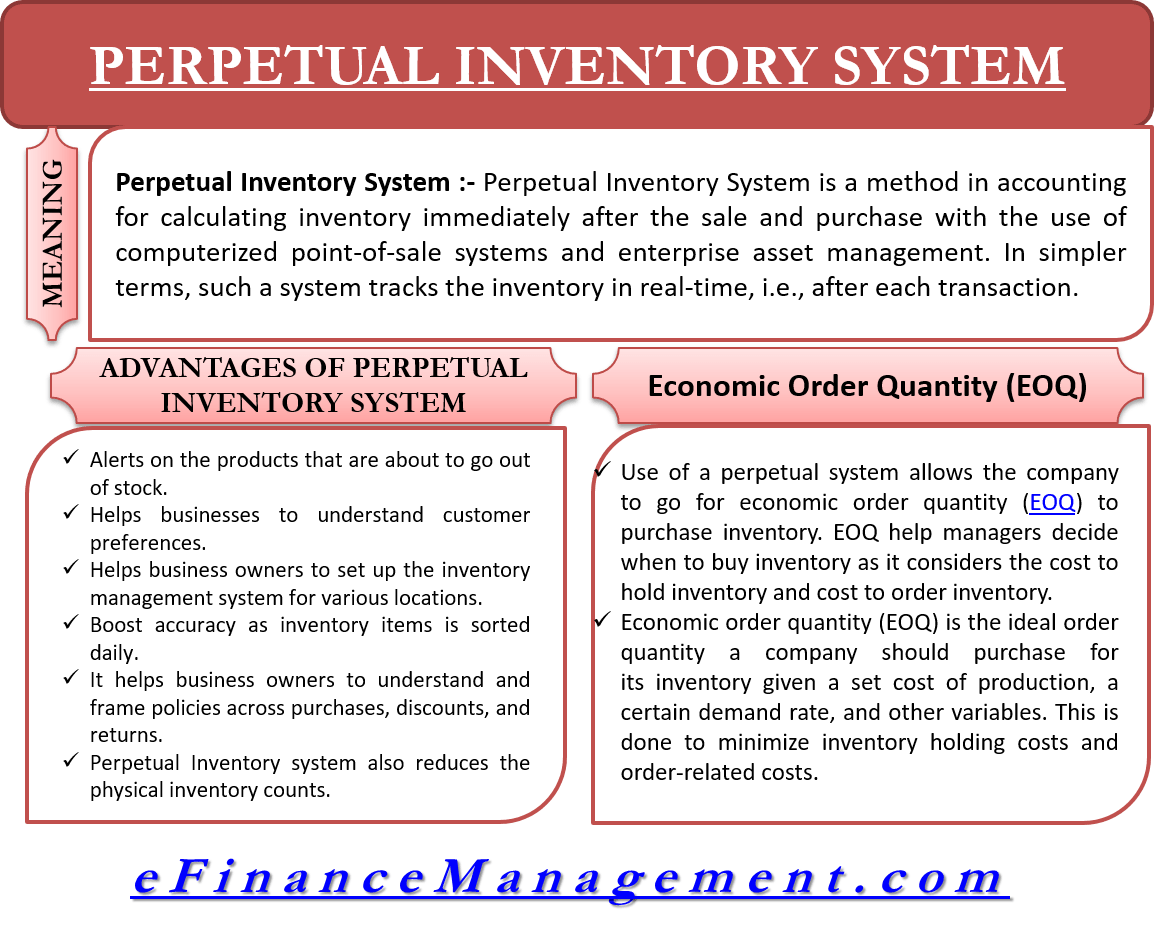

Perpetual Inventory System is a method in accounting for calculating inventory immediately after the sale and purchase with the use of computerized point-of-sale systems and enterprise asset management. In simpler terms, such a system tracks the inventory in real-time, i.e., after each transaction.

The accounting manager updates the cost of goods sold (COGS) in accounting records regularly. This is done to ensure complete sync of numbers in a store and the numbers in the accounting books. The perpetual system of inventory tracks the following activities – purchase of goods, sale of goods, goods moved from one location to another, use of items from inventory for production, and items that the company scraps.

Advantages of Perpetual Inventory System

Inventory tracking could get difficult due to breakage, loss, scanning errors, etc. However, using a perpetual system for inventory could help a business minimize such errors. Apart from this, there are many more advantages for deploying this system;

- Alerts on the products that are about to go out of stock.

- It helps businesses to understand customer preferences.

- Helps business owners to set up the inventory management system for various locations.

- Boost accuracy as inventory items is sorted daily.

- It helps business owners to understand and frame policies across purchases, discounts, and returns.

- The Perpetual Inventory system also reduces the physical inventory counts.

Keep reading Advantages and Disadvantages of Perpetual Inventory System

Perpetual vs. Periodic Inventory System

Under the perpetual system, the accounts manager updates the account after each purchase or sale. Similarly, inventory subsidiary ledger and inventory quantities are also updated continuously.

Under the periodic inventory system, an accounts manager records inventory to purchase or sell in the ‘Purchases’ account. Though the ‘Purchases’ account gets a continuous update, the accounts manager updates the “Inventory” periodically, usually at the end of the accounting period (monthly or quarterly). Thus, inventory subsidiary ledger and inventory quantities also don’t get updated continuously.

Let’s understand the difference between the two with the help of an example where a company buys 1,000 units of fabric at $40 per unit. Under the perpetual system, a company would debit the merchandise inventory, and $40,000 would go into the accounts payable. Under the periodic inventory system, the company would debit the purchases and credit the accounts payable.

Now, if, on a certain date, a company sells 200 units at $50, then the entry under the perpetual inventory system would be $10,000 debit to ‘Account Receivables’ and credit to ‘Sales.’ Then, a debit of $6000 for ‘Cost of Goods Sold’ and $6000 credit to ‘Merchandise inventory.’

Under the periodic inventory system, $10,000 debit to ‘Account Receivables’ and $10,000 credit to ‘Sales.’ Then, at the end of the accounting period, an adjusting entry comes in the ‘Merchandise inventory,’ ‘Purchase’ and ‘Cost of Goods Sold.’

Difference Between the Perpetual vs. Periodic Inventory System

Technology

To maintain a perpetual system of inventory, the account managers need to be on their toes. Manually recording might lead to mistakes and errors or omissions. To speed up and reduce the chances of error, the companies must deploy computers and other technology system. In the periodic system of inventory, however, the role of technology is much less.

Cost of Goods Sold

Organizations that adopt a perpetual inventory system continuously adjust the cost of goods sold. On the other hand, companies following the periodic inventory system calculate the total amount at the end of the accounting period. This is done by adding the total purchases to the beginning Inventory and subtracting the ending inventory. Therefore, under the periodic inventory system, it might be a little difficult to get the correct cost of goods sold amount before the end of the accounting period. Also, the perpetual inventory system is done in real-time, but the periodic inventory system shows the COGS at a specific point in time.

Cycle Counting

Under the periodic inventory update system, it isn’t easy to use the cycle counting method. It is because there is no way the manager can get accurate inventory counts in real-time.

Types of Companies Using These Systems

Since the task of continuously updating the inventory system is not easy, not many organizations adopt it. It is usually the large business that deploys the perpetual inventory system. Also, businesses with expensive products such as jewelry, electronics, and so on use such a system for inventory. Other organizations make use of the periodic inventory system.

Investigating a Transaction

Under the periodic inventory system, the task of investigating an error is almost impossible. However, finding even the smallest recording error becomes easier in the perpetual inventory recording system.

Table of Differences

| Basis | Perpetual Inventory | Periodic Inventory |

| Technology | Requires use of technology | Less role of technology |

| COGS | Continuous adjustment of COGS | Adjusted at the end of period |

| Cycle Counting | Use the cycle counting method | Difficult to use this method |

| Types of companies | Large organizations with | Small organizations |

| Investigating a transaction | Easy to find errors | Investigation of error is impossible |

Read more about other Techniques of Inventory Management.

Template for Perpetual Inventory System

Purchase goods from Supplier

| Account | Debit | Credit |

| Inventory | — | |

| Accounts payable | — |

Record supplier purchase discount

| Account | Debit | Credit |

| Inventory | — | |

| Accounts payable | — |

To record freight costs

| Account | Debit | Credit |

| Inventory | — | |

| Accounts payable | — |

Purchase return to a supplier

| Account | Debit | Credit |

| Accounts payable | — | |

| Inventory | — |

Sale of goods to a consumer

| Account | Debit | Credit |

| Cost of goods sold | — | |

| Inventory | — | |

| Sales | — | |

| Accounts receivable | — |

Physical inventory count shortage entry

| Account | Debit | Credit |

| Loss on inventory write down | — | |

| Inventory | — |

Economic Order Quantity (EOQ)

The use of a perpetual system allows the company to go for economic order quantity (EOQ) to purchase inventory. EOQ helps managers decide when to buy inventory as it considers the cost to hold inventory and the cost to order inventory.

Final Words

Since the perpetual system is time-consuming and expensive, not many companies adopt it. However, with the advent of computers, such a system has got popular. Additionally, the use of radiofrequency identification scanners (RFID), Barcodes, and point of sale systems (POS) has made the system more accurate and informational. So, it is clear that the perpetual system is much superior to the periodic inventory system. However, a periodic system would make sense if a business has a small inventory or it is easy to review the inventory without going into details. Also, the periodic system will work better where the staff does not have the proper training to use the perpetual system of inventory tracking.