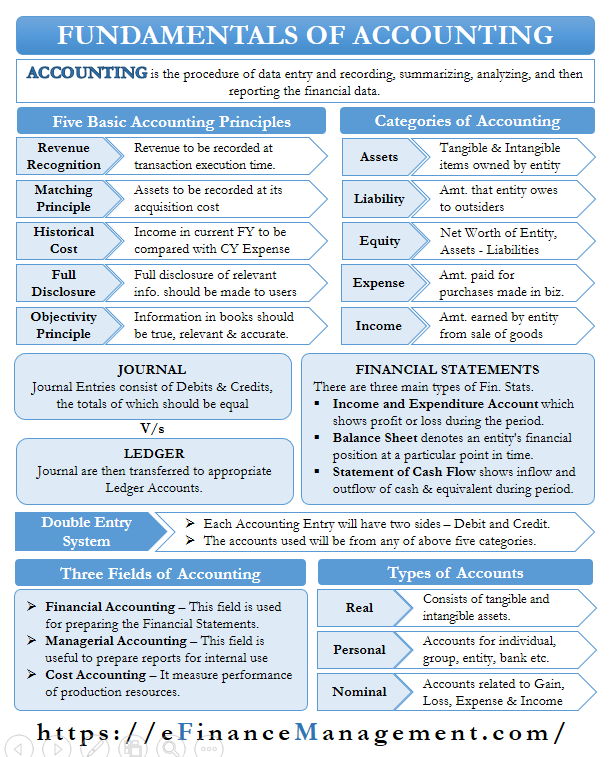

Fundamentals of Accounting

Accounting is the procedure of data entry, recording, summarizing, analyzing, and then reporting the data related to financial transactions of businesses and corporations. Fundamentals of accounting are guiding principles to perform such tasks. Operations of a business entity over an accounting period, generally a year, are keys to prepare financial statements. A company uses accounts to measure where it stands in the economic sense. They help in decision-making as well as cost planning and assessment. Above all, accounting reports are of utmost importance to outside entities as well, viz., the investors, creditors, and regulatory bodies. Professionals across the world use a set of standards- “GAAP– Generally Accepted Accounting Principles” for preparing these reports.

Fundamentals of Accounting Principles

There are five basic accounting principles:

Revenue Recognition Principle

According to this principle, revenue recognition happens at the time of execution of the transaction—irrespective of receipt of payment or cash. More importantly, the sale of goods or services should be complete, and payment should be due for it. Also, the associated costs are booked during the same period.

Historical Cost Principle

This principle directs that all assets will be reported at the actual cost of acquisition and not at their current market value. There is an exception to this rule for highly marketable securities. They are valued at their fair market value. Intangible assets with impairments are also shown at their appropriate market values. Thus, this principle ensures a reasonable value/cost of the assets reported.

Further, depreciation is provided for all the assets in every accounting period to take care of their wear and tear. Thus depreciation is deducted from the historical value of the asset. This results in reduced net asset value every year.

Also Read: Accounting Principles

Matching Principle

The matching principle directs that income earned during an accounting period is compared with corresponding expenditure. Similarly, all the costs related to the sale or revenue reported in a particular period be taken into account in that period only.

Full Disclosure Principle

The full disclosure principle states that an entity’s books of accounts should fully disclose all the relevant information to its users. Also, there should be no deliberate concealment of information. The idea and objective are that concerned people should be able to make proper and well-informed decisions based on the reports.

Objectivity Principle

This principle states that all the information in the books of accounts should be objective, reliable, and accurate. Also, they should be free from the personal bias of the reporting persons. Above all, every transaction should be backed with adequate evidence, such as vouchers, receipts, invoices, etc., as support.

Read Accounting Principles for a more detailed article.

Accounting Categories

There are five types of accounts category in this system:

Assets

Assets are tangible and intangible items that a business entity owns. Tangible or physical assets are those which can be touched or felt, like land, machinery, building, etc. Intangible assets are goodwill, patents, and trademarks, which are abstract ones.

Also Read: Accounting Information

Liabilities

Liabilities are whatever the entity owes to outsiders. So, it includes loans, the amount payable to creditors, etc.

Owner’s Equity

It denotes the net worth of the entity. Most important, it is a measure at any particular point in time and not over some time.

| Owner’s Equity = Assets – Liabilities |

Expenses

Anything the business entity purchases for its daily activities is an expense and can be in the form of salaries, rents, utility bills, etc. As per the accrual basis of accounting, costs are recorded in the books of accounts when they are incurred/due. However, actual payment can be made at a later date or sometimes in advance.

Income

Income is what the entity earns by selling its goods or services or by way of interest or dividends. Notably, it is also recorded in accounts when made and not when it is realized, as per the accrual basis of accounting.

Journal and Ledger in Accounting

A journal entry is the basis of all accounts for any business entity. It consists of a debit and a credit for each transaction. And the total of all debits should always equal the sum of all credits. If there is a difference between the two, that means journal entries will not balance. It will result in a discrepancy in the accounts.

Subsequently, all journal entries get their way to their respective ledger accounts. Every ledger will usually have an opening balance unless it is the first time created one. Previous year balances are taken here. At the end of the accounting period, each ledger account will have a closing balance, considering the transactions in the current accounting period. Making financial statements of an entity is the next step. Therefore, proper ledgers are very important to anybody.

Double Entry System

As per GAAP, accounting entries have to be done using the double-entry bookkeeping system. Thereby each transaction will have:

- two sides for every financial transaction;

- the entries will be under any of the five categories of accounts;

- every account “debited” shall have a corresponding “credit” entry in other reports.

That’s how the sum of all debits will always be equal to the amount of all credits.

Financial Statements

The three main types of financial statements in accounting are:

Statement of Profit and Loss

This statement shows the profit or loss made by the entity during a particular period. The total income of an entity minus total expenses gives us the “Net Profit” or “Net Loss” of the business entity.

| Net Profit or Loss = Income – Expenditure |

Balance Sheet

A balance sheet denotes an entity’s financial position at a particular point in time. Again, as per the principle of matching, both sides of the balance sheet should always match. On the one hand, we have assets, whereas the other side comprises liabilities and owner’s or stockholder’s equity.

| Assets = Liabilities + Owner’s/Stockholders’ Equity |

Statement of Cash Flows

This statement shows how and where cash has been earned. Subsequently, it shows how it has been spent or utilized during a specific period. Cash may have come from its operating activities or financial and investing activities.

Fields of Accounting

There are three main areas or fields of Accounting.

Financial Accounting

It comes into play for preparing the above three types of financial statements, namely income and expenditure statement, balance sheet, and statement of cash flows. These statements are useful for ascertaining and reporting the financial information and standing of the entity periodically, usually a year. This information is also of interest to stakeholders. Such as suppliers, creditors, investors, owners, board of directors, and regulatory bodies like the Securities and Exchange Commission (SEC), etc.

Furthermore, financial statements are of use to calculate financial ratios, which are vital indicators of a firm’s financial performance and standing.

Managerial Accounting

The financial ratios and analysis are essential to making important decisions by the management. Above all, managers decide on the future course of action of the organization regarding products, pricing, inventory, marketing, etc. Managerial accounting is useful for preparing reports for internal use and hence is critical for decision making and control.

Cost Accounting

It measures the performance of the production resources of an entity in economic terms. Cost accounting considers direct and indirect costs incurred in the production and distribution of goods. Thereby, it helps to make decisions such as product pricing, production performance, and improvement.

Types of Accounts and Three Golden Rules

Real Accounts

All tangible and intangible assets of an entity come under the purview of real accounts. Physical assets are land, machinery, etc., whereas intangible assets are those that we cannot touch, like goodwill or patents.

The golden rule for creating real accounts is:

| Debit what comes in, Credit what goes out. |

For example, suppose an entity purchases a computer for US $800, paid in cash. Here, both assets are real accounts: computers and cash. Accounting entry for the same will be:

| Journal Entry | Amt. ($) | Rule |

|---|---|---|

| Computer A/c Dr. | 800 | Debit what comes in |

| To Cash A/c | 800 | Credit what goes out |

Personal Accounts

Accounts that relate to individuals or represent a group, entity, corporation, and bank comprise this category. Therefore, accounts like Sundry Creditors, Bank A/c, etc., fall under this category.

The golden rule for personal accounts is:

| Debit the receiver and Credit the giver. |

For example, an entity makes a payment of US $500 to one of its suppliers, XYZ, through the bank. Both the accounts are personal, and entry will be:

| Journal Entry | Amt. ($) | Rule |

|---|---|---|

| XYZ A/c Dr. | 500 | Debit the receiver |

| To Bank A/c | 500 | Credit the giver |

Nominal Accounts

These accounts are related to income, expenditure, gains, and losses and do not exist in physical form. Examples of such accounts are salary A/c, purchase A/c, rent A/c, etc.

The golden rule for treating nominal accounts is:

| Debit the expenditure and losses and Credit the income and gains. |

For example, suppose an entity sells a product for the US $200 in cash. Here, the entry for the same will be-

| Journal Entry | Amt. ($) | Rule |

|---|---|---|

| Cash A/c Dr. | 200 | Debit what comes in: Real Account |

| To Sales A/c | 200 | Credit the income: Nominal Account |

Extremely informative and helpful to me; very much appreciated and grateful for your help.

Thank you very much.