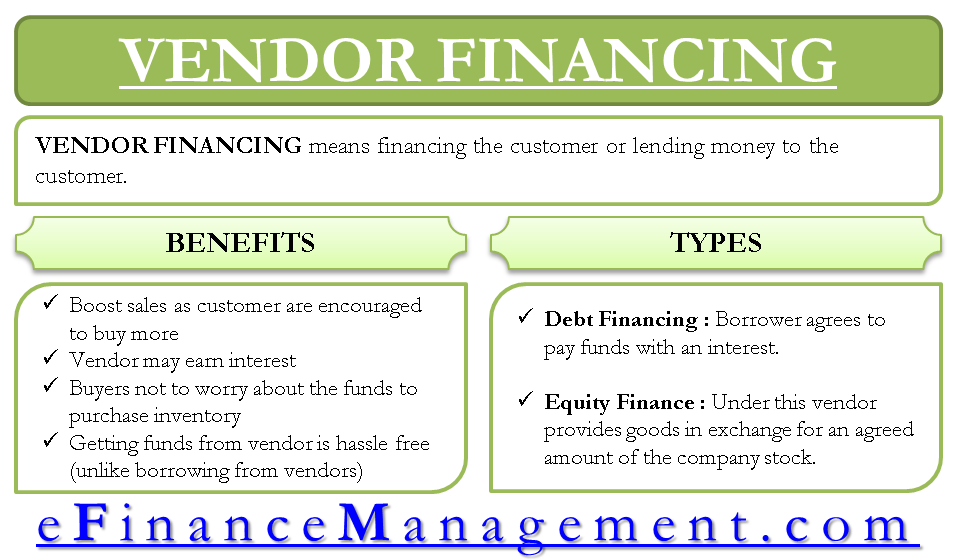

As the name suggests, vendor financing means financing the customer or lending money to a customer. Under this vendor lends money to a customer to buy the product or services from the said vendor. We can say it is a type of credit sale where the customer pays from the loan given by the vendor.

For instance, suppose you plan to buy raw materials worth $10 million from a company ABC. However, you only have $5 million in cash with you and want ABC to give you the balance amount. ABC agrees to your request and offers you $5 million at 5% interest.

In some cases, the financing may be without interest, while in some cases, the vendor may even ask you to provide collateral before financing you. The terms and conditions that a vendor lays depend primarily on your terms with the vendor.

History

Vendor financing stems from its use in private equity. It gained popularity after the Great Recession when there was less cash in the market. Several private equity firms started financing the buyers of their assets to address such an issue.

Also Read: Sources of Debt Financing

It was a much-needed step for the private equity firms for their survival. For the private equity firms to operate, they need buyers for the asset they are offering. If private equity firms don’t have buyers, they won’t be able to return money back to their investors.

If there are no buyers, financial pressure from investors will rise, eventually leading to investors pulling their money out. Thus, vendor financing was a smart move from private equity firms to save their business and reputation.

Benefits of Vendor Financing

- It helps the vendor boost sales as customers are encouraged to buy more.

- Along with sales, vendors may also earn interest.

- It is a crucial sales strategy for high-price items, such as cars.

- Buyers don’t have to worry about the funds to purchase inventory.

- For new buyers or those with poor credit history, vendor financing is better for acquiring inventory.

- Getting funds from a vendor is hassle-free, unlike getting a loan from a bank or any other financial institution.

- Some vendor financing loans are also in the form of deferred payments, meaning the borrower does not have to pay any interest. This transforms into saving for the customer as they would not have to pay interest on a loan taken from elsewhere, such as a bank.

Types of Vendor Financing

There are basically two types of vendor financing:

Debt Financing

Under this, the borrower agrees to pay funds with interest. The borrower either pays back the amount, or the lender writes it off as a bad debt.

Equity Financing

Under this vendor provides goods in exchange for an agreed amount of the company stock. Such type of financing is more common with startups. In this case, the vendor doesn’t get cash; instead, shares of the company buy goods from the vendor.

Also Read: Project Finance

How Does it Work?

After a vendor and customer enter into a financing agreement, the borrower needs to make an initial deposit. Rest comes from the vendor. The borrower then needs to pay the balance of the loan and the interest at an agreed date. The interest rate will depend on the terms between the parties.

Another Vendor Financing

There is another type of vendor financing where banks offer finance to a company for their smooth running. Such type of financing could be in the form of a working capital loan. It helps businesses overcome the shortage of funds and carry forward with the business operations as usual. Such financing is for a short period, usually less than a year.

Continue reading about other sources of working capital.