Temporary or variable working capital (TWC) is the temporary fluctuation of net working capital over and above the permanent working capital. It is the additional working capital requirement arising out of the product’s seasonal demand or any special event that otherwise is not predictable. In other words, it is the difference between networking capital and permanent working capital.

Business earnings are not like the salary earnings of an employee. An employee earns an equal amount of money every month throughout the year. But, businesses are rarely of such nature. In business, business people get an opportunity to earn good money at a particular time, and all businessmen try to grab such opportunities. This requires additional working capital for him to take that advantage. Such a requirement of working capital is temporary working capital.

How to Calculate Temporary Working Capital?

There is no academic formula for calculating temporary working capital. If permanent working capital is estimated, TWC can be calculated as below:

Temporary Working Capital = Net Working Capital – Permanent Working Capital.

Data on the balance net working capital can help us calculate temporary working capital. NWC should be plotted for each day, and the lowest amount in it is the permanent working capital. In the example below, 2500 is the permanent working capital, and besides, it indicates the temporary working capital. It is a fluctuating figure.

| Types of Working Capital | ||

| Net Working Capital | Permanent/Fixed Working Capital | Temporary/Variable Working Capital |

| 3000 | 2500 | 500 |

| 2500 | 2500 | 0 |

| 2800 | 2500 | 300 |

| 3200 | 2500 | 700 |

Temporary Working Capital is also called Fluctuating Working Capital.

Types of Temporary Working Capital

Based on the reasons for the fluctuation of the net working capital, the TWC is further classified into the following two types.

Seasonal Working Capital

It is that fluctuation of NWC which is caused due to the effect of season. For example, the seasons may be mangoes, school uniforms, audit deadlines, crackers, particular festivals, etc.

Also Read: Permanent or Fixed Working Capital

Special Working Capital

It is the fluctuation in NWC due to some special event that otherwise would not occur—for example, acute summer or winter, floods, famine, sudden government policy changes, etc.

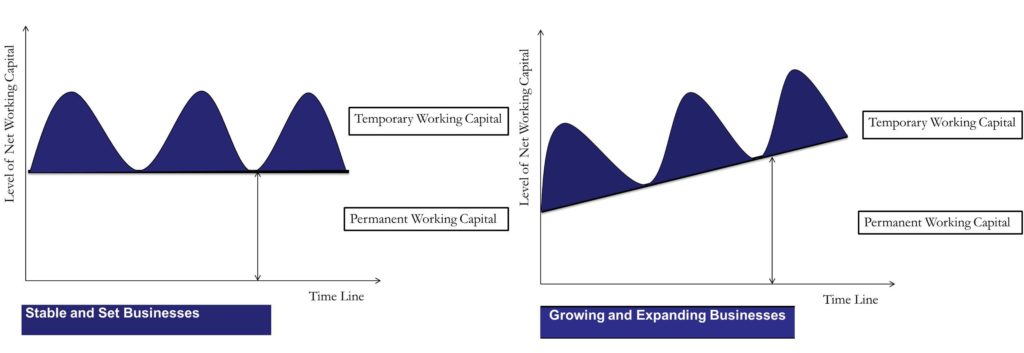

In the above diagram, we can make out that the temporary working capital fluctuates with the season and with the occurrence of a special event. A stable business should have more minor fluctuations, and a bigger and growing business would have more significant fluctuations. This is why TWC is also called fluctuating working capital.

Why is Classifying Working Capital as Temporary Working Capital Important?

The prime reason behind differentiating permanent working capital and temporary working capital is the decision relating to the financing mix of financing the working capital gap. Short-term financing sources preferably finance temporary working capital. Even after admitting the fact that long-term sources of finance are cheaper than short-term finances, it is beneficial to adopt the latter because long-term finances cannot be redeemed easily. Short-term finances have time flexibility. We can use them and repay them when our purpose is served. A cash credit limit extended by banks is a common way of addressing the TWC. You pay interest on the amount used and for the period of use only. Therefore, there is the utilization of idle cash to pay off the outstanding short-term finances and save on interest costs in such a situation.