Differential Cost or Incremental Cost is the difference in total relevant cost between two alternatives. These alternatives are ‘make or buy,’ ‘two different levels of activity, etc.

Incremental Cost

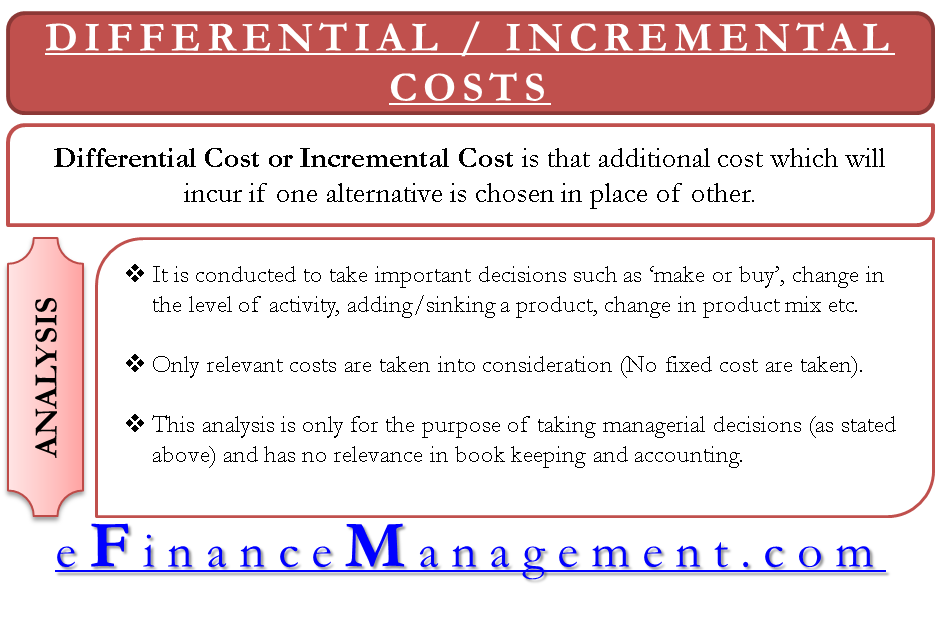

Differential cost is known as incremental cost. It is that additional cost that will incur if one alternative is chosen in place of another. In short, two options are compared in terms of their total costs, and the difference between their total costs is termed an incremental cost. The change in the revenues of two alternatives is termed incremental revenue.

Differential Cost Analysis

Differential Cost Analysis is conducted to take important decisions such as ‘make or buy,’ change in activity level, adding/sinking a product, change in product mix, export orders, goods marketed in a new market, etc. In differential / incremental cost analysis, only the relevant costs are taken into consideration. Fixed costs or costs already been incurred in the past are not relevant. Future costs that are mainly variable costs are taken into consideration. The use of differential cost analysis only takes management decisions and has no relevance to accounting or book-keeping. There is no journal entry suggested by any accounting standard for a differential cost.

Also, read about other Types of Costs and their Basis for Classification.

Differential Cost Example

Differential Cost Example of ‘make or buy’ decision and ‘different level of activity’ is explained to understand the concept better. Please refer to the table below. Make or buy situation appears when the management has an option to either manufacture a particular product or buy from the market. If we see, the per-unit cost of buying from the market is less than the manufacturing cost. Here, we will have to think twice because the $15 includes $5 of fixed manufacturing costs. The $50,000 is already spent and will become idle capacity if the product is bought from the market. Therefore, the comparison should be made between $10 for manufacturing and $13 for buying, and the decision is quite clear. ‘MAKE’ is a better option here.

Also Read: Types of Costing

| Particulars | Total No. of Units | 10,000.00 |

| Total Costs ($) | Per Unit Costs ($) | |

| Variable Costs | 1,00,000.00 | 10.00 |

| Fixed Costs | 50,000.00 | 5.00 |

| Total Manufacturing Costs | 1,50,000.00 | 15.00 |

| Price of Product in Open Market | 1,30,000.00 | 13.00 |

| Output Levels | Output Unit | Differential Unit | Total Cost ($) | Differential Cost ($) | Differential Cost Per Unit ($) |

| 1 | 1,00,000 | 30,00,000 | – | 30 | |

| 2 | 1,20,000 | 20,000 | 35,00,000 | 5,00,000 | 27.5 |

The long-run incremental cost is another important concept, especially when the forecasting exercise is done. Long-run incremental costs are those costs that a company can forecast. Examples are fuel price increases, repairs and maintenance costs, rent expenses, etc.

RELATED POSTS

- Price Variance – Meaning, Calculation, Importance and More

- Absorption vs Variable Costing

- Variable and Fixed Costs

- Types of Costs and Relationship of Direct & Indirect Costs with Fixed & Variable Costs

- Marginal Cost – How to Calculate, Relationship with Fixed & Variable Cost

- Types of Cost Accounting