Fixed working capital is the minimum investment required in working capital irrespective of any fluctuation in business activity. Also known as Permanent working capital, it is that level of net working capital below which it has never gone on any day in the financial year. Net working capital (NWC) means current assets less current liabilities. This term is important to be calculated for decisions relating to financing mix of working capital and saving the interest cost of the firm.

Effectively,

NWC = Current Assets – Current Liabilities

NWC = Inventories + Account Receivables + Bank Balance + Cash Balance – Accounts Payables.

For smoothly running the business operating cycle, it is necessary to pay our obligations when due, satisfy the customer as and when a need arises, and improve and promote revenues of the business. We need cash and bank balances as and when required to honor the obligation.

To satisfy customer needs, we need to maintain a minimum inventory level, and to generate revenue and improve customer relations, we have to extend credit and thereby maintain accounts receivables.

Therefore, it is clear from the above explanation that irrespective of the activity levels of the business, there is always a requirement for a minimum investment in the current asset. This investment requirement is called permanent working capital.

How to Calculate Permanent Working Capital?

There is no formula for calculating the exact permanent working capital. It is an estimation based on the experience of the entrepreneur. Statistical data on the balance of all current assets and liabilities can help decide that level. We can plot the net working capital amount of each day in a table and find the lowest amount. In the example below, 2500 is the permanent working capital.

Following are the various types of working capital:

- Net Working Capital

- Permanent/Fixed Working Capital

- Temporary/Variable Working Capital

- Positive Working Capital

- Negative Working Capital

| Types of Working Capital | ||

| Net Working Capital | Permanent / Fixed Working Capital | Temporary / Variable Working Capital Requirement |

| 3000 | 2500 | 500 |

| 2500 | 2500 | 0 |

| 2800 | 2500 | 300 |

| 3200 | 2500 | 700 |

Permanent Working Capital is also not Permanent.

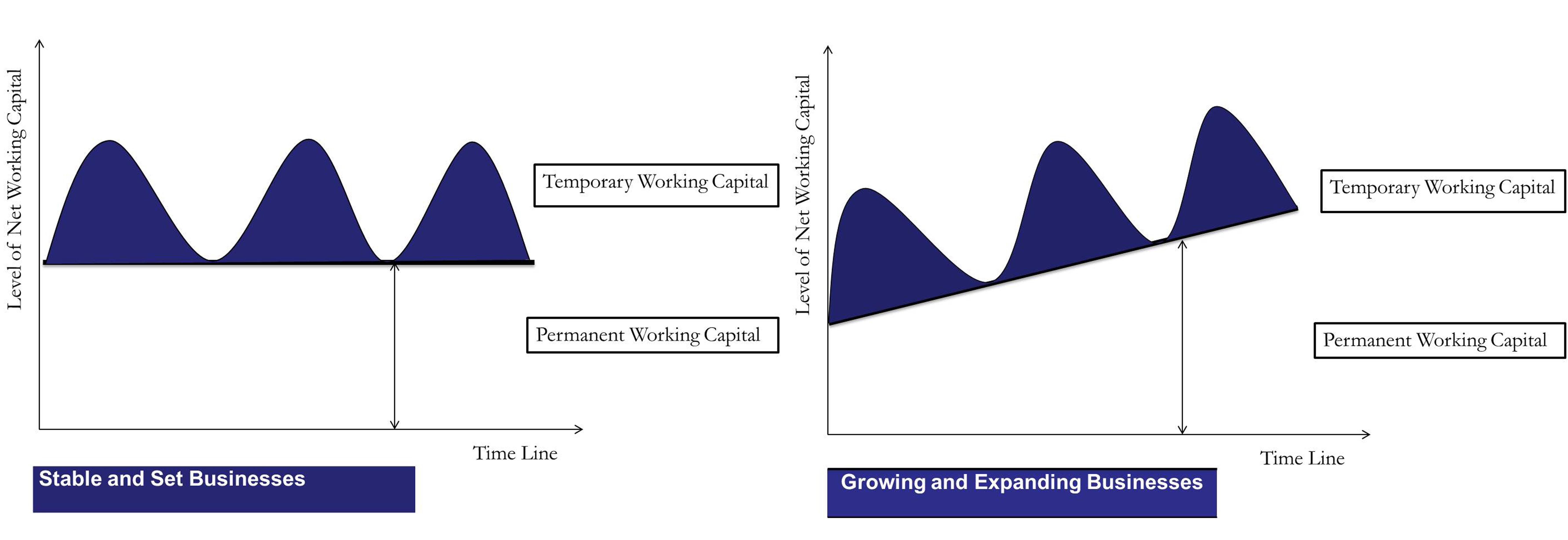

Permanent or fixed working capital is also not fixed in the long term. As the business grows, it will also grow. We have shown two graphs, one for set and stable businesses, and there is not much change in sales, margin, and other workings. Such businesses are rare. Another graph shows that businesses are constantly growing and expanding.

Types of Permanent Working Capital

Since we know that it is impossible to determine the exact amount of permanent working capital can also be further divided into the following two:

Regular Working Capital

Permanent working capital is normally required in the normal course of business for the working capital cycle to flow smoothly.

Reserve Working Capital

The working capital cushion needs to be maintained over and above regular working capital for contingencies that may arise due to unexpected situations.

Why is Classifying Working Capital as Permanent Working Capital Important?

The prime reason behind differentiating permanent working capital and temporary working capital is the decision relating to the financing mix of financing the working capital gap. After classifying it as permanent working capital, we can finance the permanent part of working capital with long-term sources of finance such as equity, debenture, long-term loans, etc. Long-term sources are cheaper than short-term sources of finance. This strategy of financing will save the cost of interest for the company.

Quiz on Permanent or Fixed Working Capital

This quiz will help you to take a quick test of what you have read here.

I do not even know the way I stopped up here, however, I believed this post was once good. I do not recognize who you are however certainly you’re going to a famous blogger in case you are not already 😉 Cheers!