What is Working Capital Management?

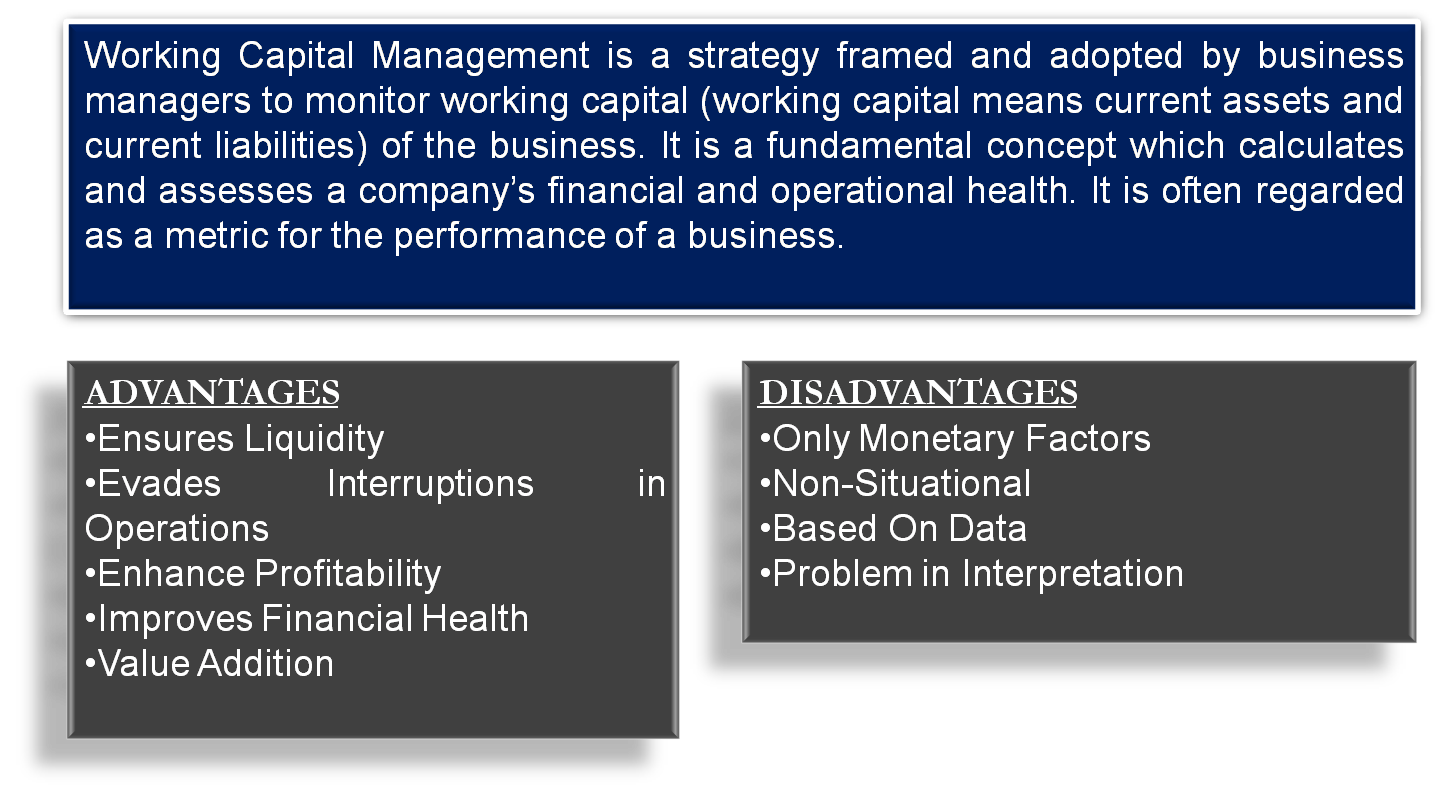

Working Capital Management is a strategy framed and adopted by business managers to monitor the working capital (working capital means current assets and current liabilities) of the business. It is a fundamental concept that calculates and assesses a company’s financial and operational health. It is often regarded as a metric for the performance of a business. Let’s see both the Advantages and Disadvantages of working capital management.

Working capital management deals with controlling the free credit period offered to the accounts receivables monitor the effective implementation of credit policy to keep the optimum stocks and cash levels. It speeds up the working capital cycle of a company and eases the liquidity position. The managers also try to extend the credit available from the accounts payables and thereby avail trade credit, which is normally considered a free working capital up to a certain period.

Working Capital Management is an easily understandable concept that can be linked to an individual’s household. It’s like how an individual collects cash from his income and how he plans to expend it on his needs.

Advantages of Working Capital Management

Ensures Liquidity

Businesses often get in trouble due to the lack of cash needed for operations and to repay short-term debts. It happens because of an ineffective or no working capital management policy in the enterprise. Working capital management ensures liquidity by monitoring account receivables, account payable, stock management, and debt management. It assists in keeping sufficient liquid cash in the business at any point in time to pay operational costs and short-term debts. Thus, it helps in allocating the resources in an optimum manner.

Also Read: Working Capital Management

Evades Interruptions in Operations

Working capital management involves the use of ratio analysis. Ratios like working capital ratio, quick ratio, accounts receivables turnover ratio, etc., are calculated and interpreted to provide information to management. Such information helps managers plan and execute business operations in the most efficient way. Optimum use of working capital management evades any future hindrances in business operations. Instances like delay in paying accounts payable and lack of production would minimize by a substantial amount. This would give the business a competitive edge over its competitors.

Enhance Profitability

Proper application of working capital management strategy would enhance the company’s profitability in the long run. The policy properly manages inventory to avoid any operational failures. Collection from trade receivables would be on time as receivables management is a key part of working capital management. There would be no cases of default in paying the trade payable on the due date because of proper management and allocation of cash.

Improves Financial Health

Working capital management basically deals with the management of cash in an enterprise. It assesses the sources of cash inflows and determines cash outflow in the best possible manner. Proper cash allocation makes a scope for the investment of remaining cash or in repaying short-term debts. It allows the business to be financially solvent most of the time and thus evading any legal troubles that could have arisen due to a lack of working capital. Higher profitability would imply a higher return on capital employed. This, in turn, would attract more capital from prospective investors leading to the unlocking of further capacities.

Value Addition

As explained earlier, working capital enhances a company’s financial health and operational success. It makes the company stand out amongst its peers. A sense of respect emerges in the market for the business. This all, in turn, leads to value addition for the entity.

Also Read: Importance of Working Capital Management

Disadvantages of Working Capital Management

Only Monetary Factors

This strategy takes only monetary factors into account. Monetary items like the value of debts receivables, the value of finished goods, etc., are the basic determinants while implementing the strategy. Non-monetary factors like recession, unsatisfied workers, changes in government policy towards the industry, etc., are not considered or hold no relevance in this policy.

Non-Situational

Another disadvantage of working capital management policy is that it’s not situational in nature. The strategy does not acknowledge sudden changes in the market conditions as it is based on past events and figures. The time taken to respond to certain recent events is significant in impacting business operations and profitability.

Based On Data

Working capital management operates around data. It is the key soul of any working capital management strategy. Data would include every minute detail about the components of working capital. For example, in trade receivables, it would require the date of sale, the period of credit, the number of grace days allowed, a penalty in case of non-fulfillment of payment, etc. Without data, this strategy holds no relevance in the practical world.

Problem in Interpretation

Working capital management involves techniques of ratio analysis. Ratios are just a number that allows a user to interpret the result. In most cases, it is unclear to a user whether a particular ratio is favorable to the company or not. For example, in the case of the current assets ratio, it is advisable that a ratio that is higher than 1:1 is favorable. But on the other hand, it is also advisable that ratios bigger than 2:1 are unfavorable, keeping the business conditions and trade cycle in mind. Now, if a business has a bigger trade receivables cycle than the industry’s average, the business would not be able to interpret the ratio accurately.

Conclusion

Thus, we can conclude that working capital management is a very efficient tool at the hands of the management to allocate its current assets towards its current liabilities properly. It offers many pros to the entity, but it comes with slight disadvantages too. But to conclude, its merits outweigh its merits by a huge margin. Thus, business managers must use it, keeping in mind the situational needs of the business.

Quiz on Advantages and Disadvantages of Working Capital Management

Let’s take a quick test on the topic you have read here.

Excellent notes has been presented and can be understood by all kind of users