An inventory turnover ratio is an important ratio that helps in analyzing the frequency of sales and inventory replacement taking place within a specific time period and, accordingly, helps in making decisions. However, determining what constitutes a good inventory turnover ratio is not a one-size-fits-all answer. Various factors, such as industry type, business size, profitability goals, and stock characteristics, must be considered. For example, a ratio of 5 for A Ltd means the inventory of A Ltd is converted to sales 5 times a year on average. So, today, we will deal with a very common question associated with inventory turnover, i.e., What is a Good Inventory Turnover Ratio? This question scratches the minds of a retailer or traders, manufacturers, financial analysts, students of the commerce and finance streams, etc. In this article, we will delve into the complexities of determining the optimal ratio.

Ideal Inventory Turnover Ratio

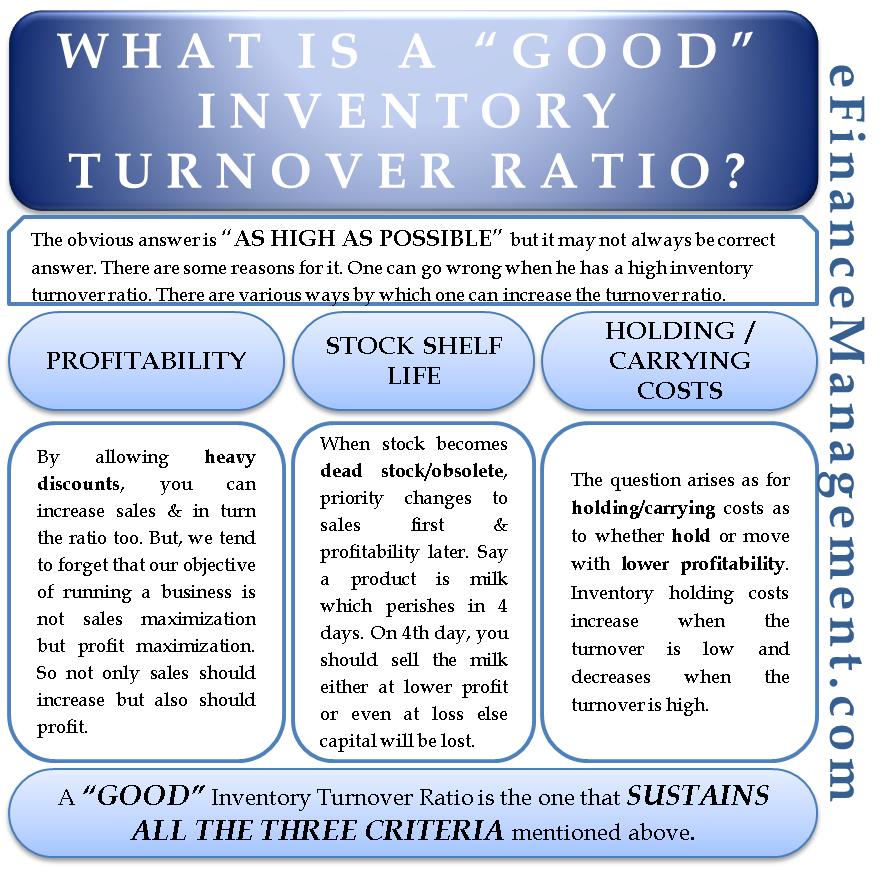

Generally, it is difficult to be precise in giving an exact ratio because the industries differ from each other in terms of size, product, etc. Moreover, it is believed that the inventory turnover ratio is good when it is as high as possible. It is pretty simple to understand. We have invested, say ‘x’ amount of working capital in inventory. Interest cost on ‘x’ would remain fixed for the whole year irrespective of how many times that money is used to purchase inventory. So, it is obviously desirable to have higher ratios. A higher frequency of turnover would mean effective utilization of working capital funds.

But, the obvious answer, i.e., as high as possible, may not always be the correct answer. Like everything else in life, a balance is also required here. Too high or too low of such a ratio is not a good sign. Let’s see how.

Very High Inventory Turnover Ratio

Usually, one recommends a higher ratio as that would mean effective rolling up of working capital. At the same time, a very high of such ratio would have a different meaning also. That may signal a very low level of inventory one maintains. Too low inventory means too frequent orders. The manager should ensure that the additional ordering cost incurred should not outperform the savings of interest on working capital.

Very Low Inventory Turnover Ratio

Lower ratios signify a lack of sufficient sales or higher levels of stock. Needless to explain, a very low ratio will not utilize the fixed interest cost incurred on investment in inventory, as described in the above example.

Significance of a Good Inventory Turnover Ratio

Efficient inventory management is vital for the success of any business. A good inventory turnover ratio is crucial as it signifies effective inventory management, improved cash flow, and optimize profitability.

Efficient Working Capital Management

A high inventory turnover ratio indicates that a company can quickly convert its inventory into sales. This translates to a reduced amount of money tied up in inventory, allowing for better utilization of working capital. By minimizing the capital invested in inventory, a business can allocate resources more effectively to other areas, such as marketing, research, and development.

Improved Cash Flow

A good inventory turnover ratio ensures a steady flow of cash. When inventory moves quickly, sales are made, and cash is collected. This enables a business to meet its financial obligations promptly, such as paying suppliers, managing overhead costs, and investing in growth opportunities. Adequate cash flow is vital for the smooth operation and growth of any business.

Also Read: Inventory / Stock Turnover Ratio

Minimized Holding Costs

Holding costs refer to expenses associated with storing and maintaining inventory, such as warehousing, insurance, and obsolescence costs. A higher ratio indicates that inventory is not sitting idle for extended periods, resulting in lower holding costs. By reducing holding costs, businesses can improve their overall profitability.

Effective Inventory Management

A good inventory turnover ratio is a reflection of effective inventory management. It indicates that a company has a clear understanding of customer demand, avoids overstocking or understocking, and maintains an optimal level of inventory. By effectively managing inventory, businesses can prevent stockouts, minimize wastage, and ensure timely fulfillment of customer orders.

Enhanced Profitability

A high inventory turnover ratio is often associated with increased profitability. When inventory moves quickly, sales revenue is generated, and the cost of goods sold is minimized. This results in higher gross profit margins and improved overall profitability. Furthermore, a good inventory turnover ratio allows businesses to identify slow-moving or obsolete inventory, enabling them to take timely action to reduce losses and focus on high-demand products.

Competitive Advantage

Maintaining a good inventory turnover ratio can provide a competitive edge in the market. It allows businesses to respond quickly to changing customer preferences and market trends. By having the right products available at the right time, companies can attract and retain customers, thereby gaining a competitive advantage over their competitors. Additionally, a good inventory turnover ratio enables businesses to be agile and adaptable, meeting customer demands efficiently.

Conclusion

In essence, the question “What is a good inventory turnover?” can be best answered as below:

A good inventory turnover ratio is one that sustains

- Profitability

- Saves stock from becoming a deadstock

- Optimizes holding costs/carrying costs