The turnover ratios are used to check the company’s efficiency and how it uses its assets to earn revenue. The sales figure is compared with the assets (different assets). This measures how much of the assets are used to generate the number of sales.

In a business, there are requirements for different types of assets, and these are used to generate the business’s revenue so that the business can run. The turnover ratios are categorized under efficiency ratios as these ratios measure how a company or business utilizes its different assets to achieve its revenue. Here the ‘revenue’ is construed differently for each type of turnover ratio. For example, in the receivable’s turnover ratio, only the amount of credit sales are used, not the total sales figure, but for the inventory turnover ratio, the total sales or the COGS is used. These ratios are more specific to the asset, and revenue (denominator) is defined depending on the relationship between the asset and the revenue.

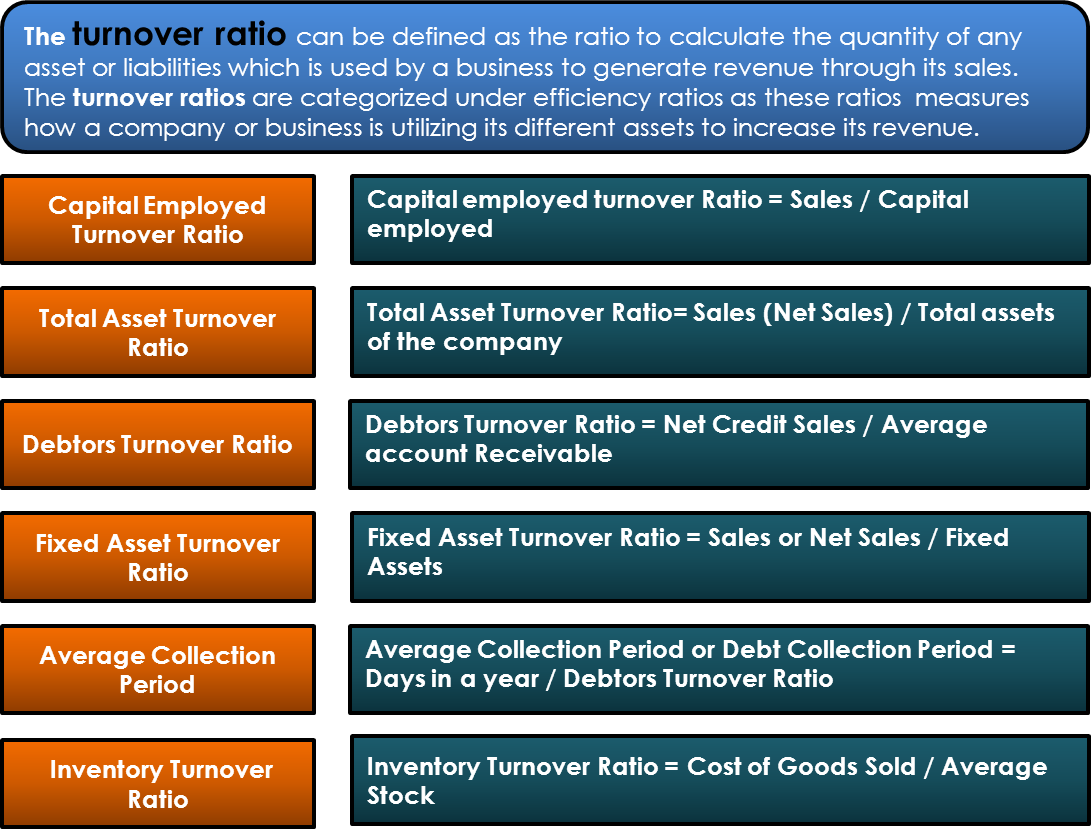

What is the Turnover Ratio?

The turnover ratio can be defined as the ratio to calculate the quantity of any asset which is used by a business to generate revenue through its sales. It is the relation between the amount of a company’s assets and the revenue generated from them. To be more precise, it is an efficiency ratio to check how efficiently the company uses different assets to extract earnings from them (individually and as a whole). A higher ratio is considered to be better as it would indicate that the company is optimally using the resources to earn revenue. It would imply a higher ROI, and the funds invested are used the least.

Types of Turnover Ratios with Formula

Capital Employed Turnover Ratio

It indicates the relation between the capital employed in a business and the sales or revenue the business generates out of it. The capital, whether used in a proper direction to generate revenue or not, and how efficiently it has been employed is measured with this ratio. The formulae for

Also Read: Types of Activity / Turnover Ratios

Formula

Capital employed turnover Ratio = Sales / Capital Employed

Total Asset Turnover Ratio

It is a ratio that determines the connection between the sales and the total asset of a company. It checks for the efficiency with which the company’s all assets are utilized to earn revenue. The formula for

Formula

Total Asset Turnover Ratio = Sales (Net Sales) / Total Assets of the Company

Debtors Turnover Ratio

It is the ratio that calculates the quickness of the conversion of the debtors or credit sales amount to cash. It is also known as the receivables turnover ratio as it measures the credit sales against the average debtors for a year. The formula for

Formula

Debtors Turnover Ratio = Net Credit Sales / Average Account Receivables

Fixed Asset Turnover Ratio

This is the ratio that measures how much sale is generated from churning the company’s fixed assets and how efficiently it is done. The fixed assets of a company are very crucial in revenue generation. Thus the optimization of the fixed asset use increases the sales if done properly. The formula for

Formula

Fixed Asset Turnover Ratio = Sales or Net Sales / Fixed Assets

Average Collection Period

It shows the amount of time required to convert the credit sales into cash. It states the average time period given to the debtors to make their payments. The formula for

Also Read: Asset Turnover Ratio (ATR)

Formula

Average Collection Period or Debt Collection Period = Days in a year / Debtors Turnover Ratio

Inventory Turnover Ratio

It is also referred to as the stock turnover ratio, which measures the number of sales generated from its inventory and how efficiently the inventories in a company are used. The formula for

Formula

Inventory Turnover Ratio = Cost of Goods Sold / Average Stock

or

Inventory Turnover Ratio= Sales / Closing Inventory.

Uses of Turnover Ratios

The turnover ratios analysis is important to the internal and external parties of the company. To the internal members like the managing body and the board of directors, they check this ratio to evaluate their efficiency in managing the different assets and liabilities and where to make the correction and increase their efficiency or not. For the external parties like the investors, and creditors, check these ratios to find out the capabilities of the company’s management and evaluate whether their investment will reap profit or go in vain. The Turnover Ratios uses by the debtors are to find how many days of credit they will receive.

Quiz on Turnover Ratios

Let’s take a quick test on the topic you have read here.

Hello sir I have a doubt regarding inventory turnover ratio , I have taken online course on finance in which they are describing formula as follow inventory turnover ratio = net sales / average inventory

it is correct ?

Hi Pritesh,

Thanks for writing in. Please refer our article on Inventory Turnover Ratio. I hope that will clear your doubt about the two formula. Both the formula are in use.