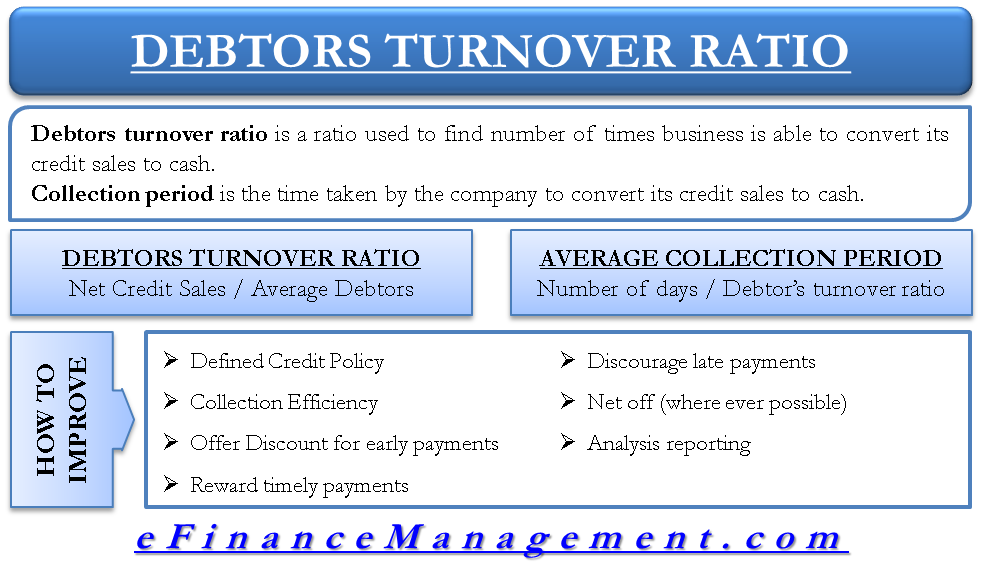

The debtors turnover ratio, also called the accounts receivable turnover ratio, is a ratio that is used to gauge the number of times a business is able to convert its credit sales to cash during a financial year. The collection period is when the company takes to convert its credit sales to cash. Both these ratios indicate the efficiency factor of the company in collecting receivables from its debtors and the speed at which they are able to do it. These two ratios are largely used to indicate the company’s liquidity position and the efficiency with which it operates. It also reflects the power the company has to dictate credit terms. Let us see how you can analyze and improve the receivable turnover ratio.

Formula for Calculating (Debtor’s) Receivable Turnover Ratio

Debtor’s Turnover Ratio = Net Credit Sales / Average Debtors

Here, we consider ‘net credit sales’ because cash sales generate immediate cash. Also, net credit sales mean total credit sales less sales returns, if any.

Average Debtors is the average of opening debtors and closing debtors. However, in certain cases, it may be required to consider only the current year as the company may have gone for a new product, geographical expansion, etc., which may cause debtors to deflate if an average is taken. (Note: bills receivables will also form part of debtors for the said calculation)

Formula for Calculating Average Collection Period

Average Collection Period = Number of days / Debtor’s turnover ratio

Usually, We take 360 days into the calculation to calculate the number of days. This ratio is expressed in terms of the number of days and represents the length of time taken to convert debtors to cash.

Let us analyze the ratios with an example so as to provide a key understanding of the topic.

Analysis with an Example

Credit sales = $ 5,000,000

Sales returns = $ 1,400,000

Opening Debtors = $ 400,000

Closing Debtors = $ 500,000

Opening bills receivables = $ 100,000

Closing bills receivable = $ 200,000

Average Debtors = ($ 400,000 +$ 500,000) / 2

= $ 450,000

Average Bills = ($ 100,000 +$ 200,000) / 2

= $ 150,000

Debtor’s Turnover Ratio = Net Credit Sales / Average of Debtors and bills

= ($ 5,000,000 – $1,400,000) / ($ 450,000 + $ 150,000)

= 6 times

Average Collection period = Number of days/ Debtor’s turnover ratio

= 360 / 6 = 60 days

Read more about Debtors / Receivable Turnover Ratio

Interpretation

A debtor’s turnover ratio of 6 times means that, on average, the debtors buy and pay back 6 times in a year. So we can assume that 6 times a year means once every two months, which is nothing but the average collection period of 60 days. The credit sales get converted to cash 60 days from the date of sale on an average basis.

So ideally, a higher debtor’s turnover ratio and lower collection period are what a company would want. A lower collection period would mean a faster conversion of credit sales to cash. One can say that the lower the average collection period higher the efficiency of the company in managing its credit sales and vice versa. A Higher debtor’s turnover ratio indicates a faster turnaround and reflects positively on the company’s liquidity. The faster collection would keep the company having the cash to pay off its creditors, thereby reducing the working capital cycle for better working capital management.

A higher debtor’s turnover ratio is one of the key considerations among others when companies look to avail working capital loans from banks. A faster cash conversion will facilitate banks with comfort while lending to companies with a lower collection period.

For now, we know that a higher debtor’s turnover ratio and a lower collection period are beneficial to a company. Let us see how a company can improve the said ratios.

Also Read: A High Accounts Receivable Turnover Ratio

How to Improve (Debtor’s) Receivable Turnover Ratio / Average Collection Period?

Defined Credit Policies

Design and document clear credit policies and encourage adherence to the same to reduce instances of delays in collection. A frequent revisit and modification of the policies will help adjust to the new environment.

Collection Efficiency

Increase the efficiency of the collections from debtors; a dedicated team force can do some of it. Insisting on a post-dated cheque, timely reminders, etc., can help in aiding faster collection.

Offer Discounts For Early Payments

Designing a discount structure for debtors who pay earlier than the credit period sanctioned will motivate some debtors’ payments to clear faster. The discounts can be designed keeping in mind the business’ return on investment or the cost of short-term liability.

Reward Timely Payments

rewarding debtors who have a history of timely payments will ensure timely or earlier payments by those debtors going forward.

Discourage Late Payments

Charging interest to debtors who make payments beyond the sanctioned credit period can limit the number of debtors paying late. A stricter action could be to reduce/prohibit further sales to debtors who have a history of delays in payments.

Net off Wherever Possible

If there are credit purchases and credit sales with the same company, advising a net off payment at a defined interval can help reduce the debtors’ amount.

Analysis Report

Generate a report on the aging profile of the debtors, which will highlight weekly collection due. Such analysis can help focus on the weeks where higher payments are due and aid in better working capital management.

Conclusion

Debtor’s turnover ratio and average collection period are important aspects of working capital management. This ratio, along with the inventory turnover ratio and creditor’s turnover ratio, can help a firm design an efficient working capital cycle. These ratios, along with the liquidity ratios like current and the quick ratio, can help banks analyze the liquidity situation of the company and the efficiency with which it manages its receivables. All companies should work towards increasing their debtor’s turnover ratio and reducing the average collection period to the minimum, which eventually will lead to all sales converting to cash sales and negligible or very little credit sales. This will also help in bringing down the bad debts for the company.

Frequently Asked Questions (FAQs)

1. Ensure clear credit policies

2. Increase efficiency in collecting cash

3. Allow discount for quick payments

4. Can charge interest on late payments

A higher debtors turnover ratio is ideal for a company. A higher debtor’s turnover ratio indicates a faster turnaround and reflects positively on the company’s liquidity.

The reason is that cash sales generate immediate cash. And hence, these are not linked with the debtor’s turnover ratio.

very nice

I totally agree with what you said. I believe that all companies should work towards increasing its debtor’s turnover ratio. I think that by doing this we can grow our business well. Thanks for sharing this article. This is very easy to understand.

As a rule of thumb, what is the ideal receivables turnover ratio?