Inventory turnover ratio, a measure of financial ratio analysis, helps to understand how the company carries out effective inventory management. Generally, companies prefer a higher inventory turnover ratio as compared to industry standards. The article highlights the interpretation of the ratio apart from discussing the need and ways to improve this ratio.

Definition of Inventory Turnover Ratio

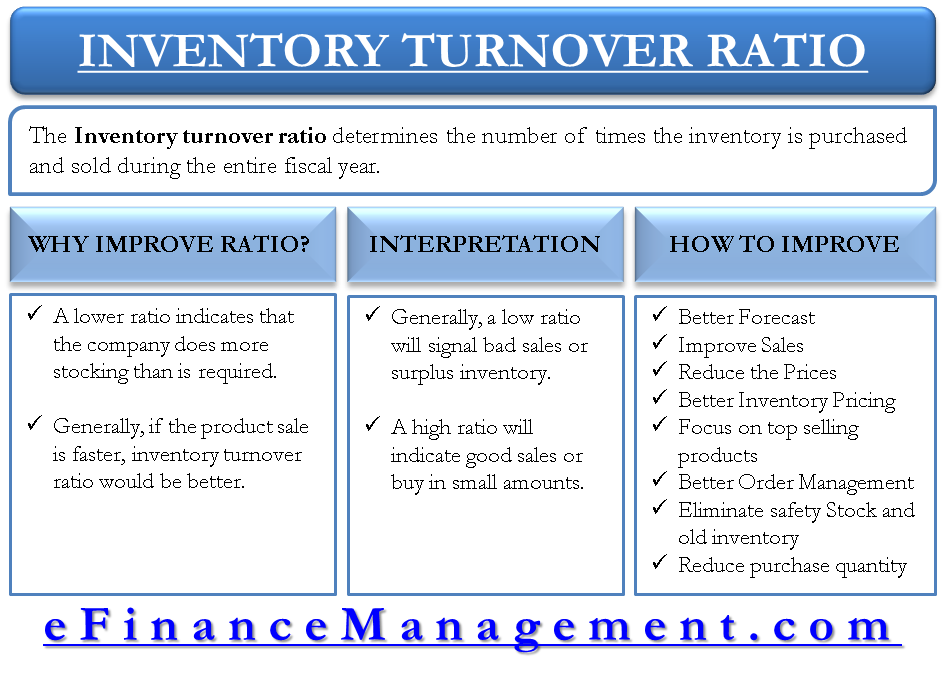

The inventory turnover ratio determines the number of times the inventory is purchased and sold during the entire fiscal year. This ratio is important to both the company and the investors as it clearly reflects the company’s effectiveness in converting the inventory purchases to final sales.

There are two variations to the formula to calculate the inventory turnover ratio. The most commonly used formula is dividing the sales by inventory. The other formula divides the Cost of Goods Sold (COGS) by average inventory. The latter takes into account the fluctuations in inventory levels throughout the year. The second variation is better as both COGS and inventory are recorded at a cost, whereas sale in the first formula is recorded at market value.

Why Is It Necessary to Improve Inventory Turnover Ratio?

Generally, companies prefer higher inventory turnover ratios. The need for improving the ratio arises when a stock turnover ratio is lower than industry standards. A lower ratio indicates that the company does more stocking than is required. Generally, inventory operation is more efficient if the product sale is faster. This is because the inventory churning would be faster, and thereby the inventory turnover ratio would be better. This means the business needs less blockage of funds/investment in inventory for ongoing business operations. So, it is best to have a proper plan for improving the inventory turnover ratio by concentrating on better sales or lowering the blockage of funds on a stock.

Also Read: What is a Good Inventory Turnover Ratio?

How to Interpret Inventory Turnover Ratio?

The inventory turnover ratio is very easy to calculate but tricky to interpret. Firstly, we should analyze the ratio for any company by keeping the industry standards in mind. Secondly, different cost flow assumptions like FIFO and LIFO result in different inventory turnover ratios in varying scenarios. Even inventory methods like just-in-time influence the ratio in different ways. Generally, a low inventory turnover ratio will signal bad sales or surplus inventory, which can be interpreted as poor liquidity, overstocking, and even obsolescence. A high inventory turnover ratio, on the other hand, will indicate good sales or buying in small amounts. It also implies better liquidity but can also signal inadequate inventory at times.

Let us look in detail at how to interpret the inventory turnover ratio:

Industry-Specific Analysis

To determine a good inventory turnover ratio, it is essential to consider industry-specific benchmarks. Different industries have varying sales cycles, product characteristics, and supply chain dynamics that influence their ideal turnover ratios. For instance, industries with perishable goods, such as food and beverages, may require higher turnover ratios to prevent stock from becoming obsolete or expired. On the other hand, industries with longer product lifecycles, such as automobiles or heavy machinery, may have lower turnover ratios due to lower demand frequency.

Balancing Turnover and Profitability

While a high turnover ratio is generally desirable, it should not come at the expense of profitability. Merely focusing on increasing sales volume through heavy discounts or aggressive pricing strategies can lead to diminished profit margins. Therefore, businesses must strike a delicate balance between inventory turnover and profitability. By analyzing sales data, pricing strategies, and cost structures, companies can identify an optimal level of turnover that maximizes both sales and profitability.

Analyzing Holding and Carrying Costs

Holding and carrying costs are significant considerations in inventory management. Holding costs include expenses such as storage, warehousing, insurance, and depreciation. Carrying costs, on the other hand, encompass expenses related to transportation, handling, and obsolescence. These costs can significantly impact a company’s bottom line. Interestingly, the inventory turnover ratio has an inverse relationship with holding costs: a higher turnover ratio reduces holding costs, while a lower ratio increases them.

Also Read: Inventory / Stock Turnover Ratio

Stock Shelf Life and Risk Mitigation

Another crucial factor in determining the optimal inventory turnover ratio is the consideration of stock shelf life. Certain products, particularly perishable goods or items with short lifecycles, have limited timeframes in which they can be sold before becoming obsolete or incurring losses. In such cases, the priority shifts from maximizing profitability to minimizing the risk of stock becoming deadstock.

How to Improve Inventory Turnover Ratio?

Once you have analyzed the inventory turnover ratio, keeping in mind all the necessary facts, and have come to a conclusion that the ratio is low, it is time to work on improving the turnover ratio.

There are several ways in which we can improve the inventory turnover ratio :

Better Forecasting

The company needs to pay more attention to forecasting techniques. If you can forecast the customer’s demands correctly, you need to stock only those items. This will reduce your inventory levels, which in turn will increase the inventory turnover ratio.

Improve Sales

Another way to improve your inventory turnover ratio is to increase sales. The company needs to formulate better marketing strategies to create more demand in the industry and thus push its sales. These could focus on advertisements or have promotional events and offers.

Reduce the Price

If you cannot increase the demand/sales by marketing, apply the discount strategy or reduce the price to an attractive level so as to increase the sales. You can cut short on margin with a permanently low price for items having a lower sale to clear the inventory faster.

Better Inventory Price

Contact your vendors to reduce the price they quote you for the inventory items. This way, you can reduce the inventory cost.

Focus on Top Selling Products

Apply the Pareto’s ’80:20′ principle and invest only in the products that get you the maximum profit. Eliminate products that are creating losses for you and reducing the bottom line. Effectively, eliminating the specific inventories having a lower turnover ratio will improve the overall inventory turnover for the company as a whole.

Better Order Management

Focus more on obtaining advance orders. This will help to eliminate unnecessary inventory and improve your inventory turnover ratio.

Eliminate Safety Stock and Old Inventory

Generally, companies keep the excess product to meet unseen demands. This leads to excess inventory. If you focus on better forecasting techniques, there is no need to invest in safety stock. Further, cut your losses and dispose of the old inventory. Invest the same money in faster-moving products.

Reduce Purchase Quantity

It is best to devise a strategy of optimum purchase. Instead of ordering a higher quantity, it is better to buy a lower quantity and replenish the stock once the product’s major quantity is sold. Purchase needs to be in line with demand.

Conclusion

It is evident that companies cannot afford to ignore the inventory turnover ratio. While analyzing this ratio, it is imperative that you keep a lot of factors in mind. We should undoubtedly improve a lower inventory turnover ratio. However, an excessively high turnover ratio is also not a sign of a healthy company.

Thank you for every other informative web site. Where else may just I get

that kind of information written in such an ideal method?

I have a project that I am simply now operating on, and I’ve

been at the glance out for such information.

magnificent issues altogether, you simply received a new reader.

I conceive this web site holds some real superb information for everyone.

I want to improve Inventory Turnover Ratio. I think that this article will definitely help me to do this. This article is really helpful. Thanks for sharing this article.

Hi, thanks for the article. I have got clear my concepts about the inventory turnover ratio. Let me check other topics to prepare for my exams. Once again thanks. It helps me a lot.