Acquiring Company: Meaning

An acquiring company is a company that purchases the other company through the Mergers and Acquisition process. And Target Company is the name for the other company which is to be acquired or merged. The Acquiring Company mostly acquires 50% or more than 50% of the ownership stake, which is a majority stake. And settles the deal either by issuing securities or cash. As a result, the Acquiring Company mostly has full control and decision-making power over the Target Company and the newly formed entity post-acquisition process. Here the Acquiring Company is a buyer, and the Target Company is a seller.

On the basis of the valuation of the Target Company, the Acquiring Company decides on the terms of the settlement. Valuation plays a vital role in this process. The Acquiring Company has to consider all Assets (including non-tangible assets) and liabilities at a fair market value to come up with an offer price of the deal.

Once the acquisition takes place, the acquiring company now becomes the parent company or holding company. Suppose the acquired company is not merged and decided to be kept as a separate company. And the Target Company becomes the subsidiary company. However, suppose there is a plan to merge the acquired entity with the acquiring company. In that case, the acquired company loses its existence and becomes part and parcel of the acquiring company. There are times when the acquisition takes place without the approval of the Target Company. And this type of acquisition is known as a hostile takeover.

The other name of Acquiring Company is a Purchasing Company or a Surviving Company.

Purpose of Acquisition By Acquiring Company

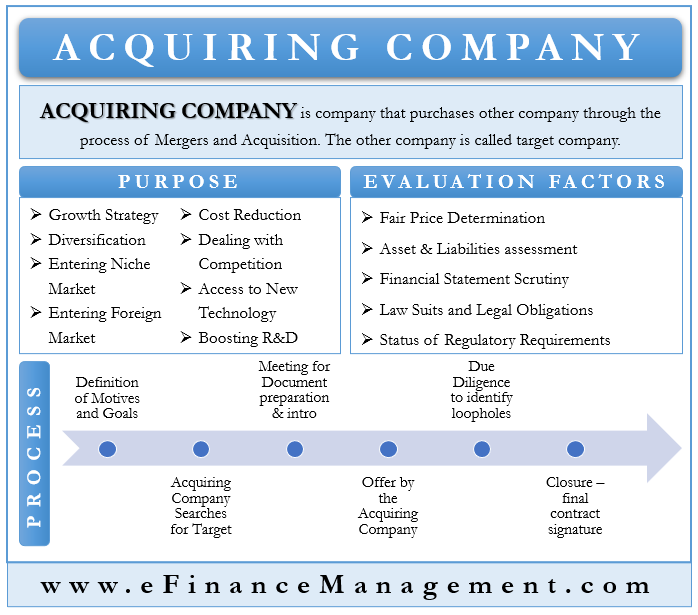

The Acquiring Company can have a variety of purposes for performing the acquisition process. The purchasing/parent company always expects an added advantage or a synergy post-deal. Although the Target Company is not always in a better position post-settlement. The Purchasing Company performs the acquisition or merger process for the following reasons/purposes:-

Also Read: Process of Acquisition

Growth Strategy

Most of the Purchasing Company has a goal or motive for Growth. With the added synergy and economies of scale, it helps the merged entity cater to a larger audience and expand its roots. Thus this is a basic purpose of the Surviving Company.

Diversification

Sometimes Companies want to enter into some new market and expand their product line. In this situation, rather than starting from scratch, the Acquiring Company acquires an existing company and later expands its reach.

For Cost Reduction

Post-acquisition, the combined entity gets the advantage of ‘Economies of Scale‘; as a result, there is a reduction in cost. Many times, Companies have this goal for conducting the acquisition.

Entering Niche Market

It is very difficult to cater to a Niche Market, and as a result, it becomes less risky by acquiring some companies already catering to this market. In such a situation, the Surviving Company acquires the company already catering to this market. Sometimes rather than a single entity, the combined entity would be in a better position to cater to a niche market. Moreover, the acquiring company thus gets both the niche and the non-niche market in its portfolio.

Also Read: Mergers Vs Acquisitions

Entering Foreign Market

Multinational Companies prefer acquiring the local company while entering into the foreign market. And so, many companies, while going global, acquire the Target Company.

Dealing with the Competition

The Economies of Scale, added Synergy, bigger combined market share, larger product portfolio, and geographical reach, post-acquisition helps in a big way for the Surviving Company to deal and handle the competitors. The combined entity gives the advantage of various aspects. And though some of these factors, the surviving company gets a firm footing in giving tough competition to the existing players.

To get Access to New Technology

Technology is the heart of almost every industry these days. The Surviving Company, in order to get the advantage of the technology of the Target Company, acquires it.

Boosting Research and Development

The Target Company may have extra resources and skills. As a result, the Surviving Company, in order to boost its Research and Development, acquires the Target Company.

Evaluation Factors for Acquiring Company

There are various factors to be analyzed before acquiring the Target Company; a few important and key factors that need detailed scrutiny are as follows:-

Determine a Fair Price

The Acquiring Company has to perform the valuation process with the utmost diligence. The price to be paid for the acquisition should be a fair market value and should be in sync with the percentage of stake in the Target Company. If the undervaluation of Target Company takes place, then the Target Company can express its disapproval for the deal. If the overvaluation of price takes place, then the merged entity might have issues with its shareholders and lenders, which may also affect its fund flow. As a result, the Surviving Company has to come up with a fair and reasonable price. (Read working capital adjustment and non-cash working capital to know more on how buyers and sellers arrive at the acquiring price)

Examine the Assets and Liabilities

At the time of valuation, consideration of all debt obligations and total assets occurs. The Acquiring Company should avoid acquiring companies having higher levels of debt unless the future returns are comfortable, keeping in view the higher quantum of debt obligations. The Target Company’s financial stability is of immense importance.

The company also needs to evaluate and inspect the condition of the property and facilities, the status of machines, etc., to judge whether major repair or replacement is needed in the short term.

Scrutiny of Financial Statements

The Financial Statements of the Target Company should be transparent and flawless. The Purchasing Company has to scrutinize the financial statements of the Target Company in minute detail. If the financial stability is very bad or there are some hidden worrisome elements, then the Acquiring Company should either drop the acquisition or decide the price accordingly.

Law Suits or Legal Obligations

If the Target Company has any Lawsuit or some legal obligation, the Purchasing Company has to study it thoroughly. Irrespective of getting synergy, the Purchasing Company should avoid acquiring companies with lots of lawsuits and legal obligations. It is possible that the ‘Return on Investment’ turns into zero, and the purchasing company may not fulfill the objective due to the various legal hurdles.

Status of Regulatory Requirements

The Purchasing Company also needs to have a thorough and detailed look into the various regulatory aspects of the Target Company. That may include the various agreements, like lease or land agreements with renewal clauses, various manufacturing licenses, and their validity or renewal period, technology, patent, trademark, and copyright-related agreements and their validity, and any major pendency with regard to tax and regulatory dues, etc.

Steps used by Acquiring Company

The acquisition is a step-by-step process undertaken by the Acquiring Company. Following are detailed steps undertaken by the Purchasing Company.

Acquiring Company defines Motive or Goals

The first step the Purchasing Company should initiate is to determine the acquisition goal or motive. The Acquiring Company should be very clear with its ultimate target or motive. The acquisition without any specific reason is baseless. And so, the Surviving Company should be clear and apt when it comes to defining goals. If the goal is ambiguous, there are high chances of acquisition failure.

Acquiring Company Searches for Target

The second step in the process is to identify a perfect match. The Acquiring Company uses an existing database for the search. The requirements of both parties should match for the success of the deal. A detailed study of the Target Company takes place here.

Documentation and Introductory Meetings

Once the identification of Target Company takes place, the next step is to prepare enough documentation for the process and initiate introductory meetings. The Surviving Company has to prepare documents like Non-Disclosure Agreement, Letter of Intent, Confidential Information Memorandum, Indication of Interest, Purchase Agreement, etc.

Once documentation is cleared, the Purchasing Company conducts an introductory meeting with the Target Company. These kinds of meetings help to understand the Target Company’s culture and its requirements. It is an opportunity for the Target Company to put forward their side.

Offer by the Acquiring Company

After considering all aspects and valuation, the Purchasing Company makes an offer. This offer is actually a fair price to be paid for buying a stake in Target Company. A lot of negotiations take place at this stage. Sometimes, cancellation of the deal takes place at this stage due to a lack of common interest.

Due Diligence

Once both the parties come to a common consensus, a final Due Diligence takes place. This is the last option for the Surviving Company to identify loopholes in the company.

Closure

This is the last step where both parties sign the final contract. After all negotiation and due diligence, this is the final stage of the process where actually the acquisition takes place. The Acquiring Company and the Target Company come up with a legal binding at this stage and completely locks the deal. Both parties have to abide by the legal contract.

Conclusion of Acquiring Company

The acquisition is a process that takes place at both the Large and Small-Medium levels. The Acquiring Company has to perform the process with the utmost diligence, as a lot of time, money, and energy investment takes place in Target Company. If the Acquiring Company ignores the loopholes or bad signs in the Target Company, then this will lead to Acquisition failure. As a result, to avoid such failure, it is of vital importance to conduct this process with due diligence to get the advantage of synergy and economies of scale.