Working Capital Adjustment

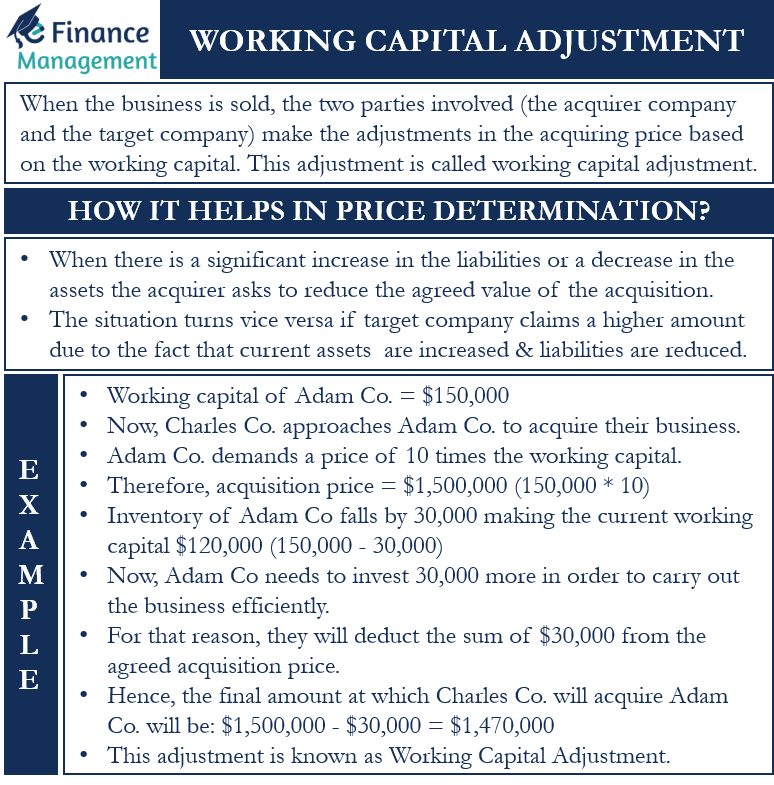

In every business, there is a minimum working capital requirement depending upon the current assets and current liabilities. However, when the business is sold, the two parties involved that is, the acquirer company and the target company make the adjustments in the acquiring price based on the working capital. This adjustment is called a working capital adjustment.

How it helps in Price Determination?

The working capital adjustments could help in determining the price in the following ways. This is mainly due to the increase or decrease in current assets and liabilities.

- When there is a significant increase in the liabilities such as bank overdrafts or accounts payable or a decrease in the assets such as inventory, cash, or accounts receivable, the acquirer asks to reduce the agreed value of the acquisition.

- When the target asks to increase the agreed value of acquisition – The situation turns vice versa here as the target company claims a higher amount due to the fact that they have increased the current assets and reduced the liabilities.

Example: Working Capital Adjustment

Lets us understand this better with an example:

Take the case of Adam Co., which is engaged in the business of sports equipment. The current assets and current liabilities held can be seen here:

| Current Liabilities | ($) | Current Assets | ($) |

|---|---|---|---|

| Accounts Payable | 60,000 | Accounts Receivable | 30,000 |

| Bank O/D | – | Cash | 40,000 |

| Inventory | 120,000 | ||

| Total | 60,000 | Total | 190,000 |

Working Capital = 190,000 – 60,000 = 130,000

This indicates that with the current operations, Adam Co. needs $130,000 to fund the day-to-day operations.

Now, a customer approaches Adam Co for the purchase of 100 cricket kits on credit. The cost price of 100 cricket kits is $130,000. And they are sold for $150,000. Since Adam Co. is falling short of inventory, therefore, the product manager of Adam Co. Will buy the additional stock of $20,000 from the manufacturer by paying him $10,000 in cash and keeping the balance on credit. Now, in this case, the new working capital would be:

| Particulars | Pre ($) | Adjustment | Post ($) |

|---|---|---|---|

| Current Liabilities | |||

| Accounts Payable |

60,000 | +10,000 | 70,000 |

| bank O/D | – | ||

| Total | 70,000 | ||

| Current Assets | |||

| Accounts Receivable | 30,000 | +150,000 | 180,000 |

| Inventory | 120,000 | +20,000 -130,000 |

10,000 |

| Cash | 40,000 | -10,000 | 30,000 |

| Total | 220,000 | ||

The above table shows the current assets and current liabilities of Adam Co (post receiving the order)

Working Capital = 220,000 – 70,000 = 150,000

Now, as shown above, the working capital has increased by $20,000. ($150,000-130,000)

Now, Charles Co. approaches Adam Co. to acquire their business. Adam Co. demands a price of 10 times the working capital. Charles Co. agrees to this and finalizes the purchase price at 10×150,000=1,500,000. In order to carry out the business operations rightly Charles Co. would be requiring a sum of $150,000 as working capital. We call this working capital of $150,000 the target working capital at the time the deal of acquisition was signed.

During Acquisition, the target company is given a certain period to wind up their business, say 60 days or 90 days. In this period, there are chances that the working capital can become more or become less depending upon the operations. Let’s assume that the inventory of the Adam Co falls by 30,000 making the current working capital $120,000 (150,000 – 30,000).

Now, Charles Co approaches Adam Co saying that they would be needing to invest 30,000 more in order to carry out the business efficiently. For that reason, they will deduct the sum of $30,000 from the agreed acquisition price.

Hence, the final amount at which Charles Co. will acquire Adam Co. will be:

$1,500,000 – $30,000 = $1,470,000

This adjustment is known as Working Capital Adjustment.

Issues in Working Capital Adjustment

The working capital adjustments are complex and it is important to realize that they can affect the acquisition price to a significant extent. This could create disputes between the two parties concerning the final acquisition amount.

To avoid such disputes and to clarify, a third party will be called upon. maybe the legal team or a CPA or an escrow expert to settle the adjustments. In order to resolve the differences and carry out the acquisition smoothly the expert follows relevant accounting standards and past audited reports to give a proper understanding of working capital to both the concerned parties.

Conclusion

It is important to realize that the working capital adjustments are indeed tough and need discussion and deliberations and make sure that the acquisition deal is fairly executed. Hence with these reasons in mind, It is important to have a proper understanding of the accounting standards to reach a final and fair conclusion.