What is a Subsidiary Merger?

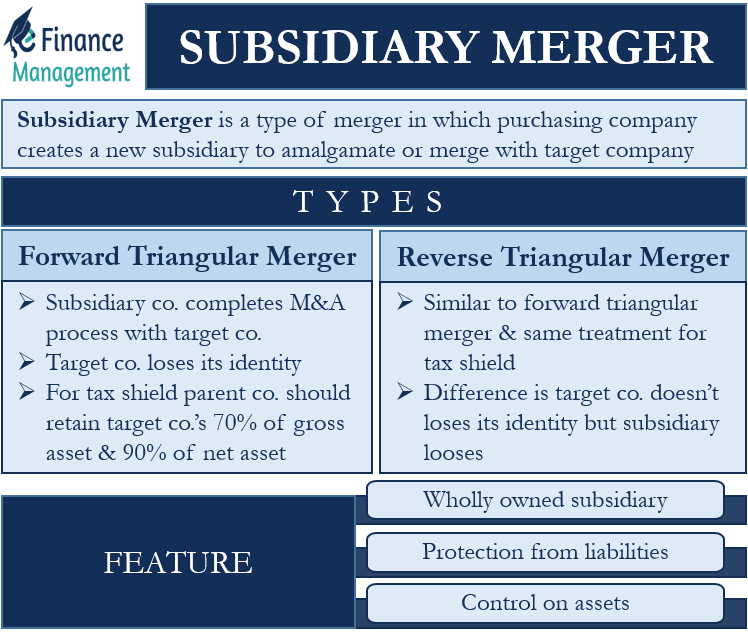

Merger and Amalgamation is one of the important restructuring methodologies practiced in the corporate world. A merger is an arrangement in which two or more companies decide to combine their operations. To achieve this objective they may retain one umbrella company and other companies get merged with that company. Or in the alternative, all companies merge and a new entity comes up. Further, the assets and liabilities of the target company (the company being purchased or merged) become the assets and liabilities of the purchasing company. The majority shareholder holding 90% or more of the shares of the target company automatically becomes the shareholder of the purchasing company. A subsidiary merger is a type of merger in which the purchasing company creates a new subsidiary to amalgamate or merge with the target company. It can also use its existing subsidiary for this purpose.

Features of Subsidiary Merger

Wholly-Owned Subsidiary

In case of a subsidiary merger, the company that is being acquired becomes a wholly-owned subsidiary of the company acquiring it. The buying company becomes the sole shareholder of the target company. Effectively the purchasing company purchases all the shares of the target company.

Protection from the Liabilities

The main purpose of taking the subsidiary route of merger by the acquiring company is to protect or shield itself from the liabilities of the purchasing company. In case of any mishap or claims arising from the stakeholders such as creditors of the target company at a later date for their past transactions, the acquiring company will not have any liability to settle or clear it. This is so because the liabilities are a part of a separate legal entity i.e. the subsidiary and not of the parent company.

Control on Assets

The company that purchases the target company through a subsidiary gets a controlling hand in it. It gets access to all its non-transferable assets as well as most of its existing contracts. However, in some cases, the right to use the patents or licenses may be lost by the parent company. This can be the case when the target company is dissolved and loses its identity.

Also Read: Classification / Types of Mergers

Types of Subsidiary Merger

The following are the two types of subsidiary mergers-

Forward Triangular Merger

A forward triangular merger occurs in a triangular pattern, and hence we call it so. Like a triangle, it involves three parties to the contract- the main buying company, its subsidiary, and the target company. As discussed above, the subsidiary company completes the merger and acquisition process with the target company. It takes over its assets and liabilities. The main difference from a regular merger is the fact that it eventually liquidates the target company. It loses its identity in the process.

The parent company or the buyer takes full control of the merged entity after liquidating the target company. It is the sole shareholder in it and hence, is answerable to no one. However, sometimes issues arise regarding the use of the licenses and contracts by the buying company. The parties dealing with the target company may not agree to continue their contract with the company acquiring it. The acquiring company will need to deal with such temporary hurdles resulting in a loss of money, time, and manpower.

The parent company should acquire and retain at least 70% of the gross assets and 90% of the target company’s net assets to achieve a tax-free merger status. Also, the acquirer stock should constitute at least 50% or more of the consideration amount for the purpose of the merger. In some cases, the target company tries to sell off the assets that are of no use to the buying company just before the merger. This may be detrimental to favorable tax treatment for the buyer.

Reverse Triangular Merger

A reverse triangular merger and a forward triangular merger actually are very similar to each other. The purchasing company uses its one of the subsidiary companies to take over the target company. However, the difference arises with the liquidation part. In this type of merger, the acquiring company liquidates its own subsidiary rather than the target company. This also results in total control of the assets as well as liabilities of the target company.

Also Read: Mergers Vs Acquisitions

The acquirer stock percentage requirements are stricter in a reverse triangular merger. It should be at least 80% or more by means of common or preferred stocks with voting rights of the total purchase price. Also, after the merger, the target company should retain at least 70% of the gross assets and 90% of the net assets to receive tax-free reorganization benefits. The merger should also satisfy a few requirements as the law prescribes. The merged entity needs to fulfill various requirements as prescribed as that of “business purpose”, “continuity of interest”, “plan of reorganization” and the “continuity of business”.

Advantages

This type of merger is usually more favorable than the forward triangular merger. The target company does not lose its identity and can continue to operate as before. The acquiring company will also benefit from the same. It does not have to renew the licenses or face cancellations of existing contracts. It may continue with its franchises and leases. The target company will continue to operate like before. There will be no change in its relationship with its stakeholders.

Disadvantage

The general requirement is that the acquiring company should obtain at least 80% control over the target company. It should get control over 80% of the combined voting power as well as 80% of the total nonvoting category of stock.