Mergers and acquisitions (M&A) are complex transactions that involve the consolidation of companies through various strategic agreements. These deals can be transformative for organizations, enabling them to expand their operations, enter new markets, gain access to new technologies, or achieve synergies and cost savings. M&A transactions come in different forms, including mergers, acquisitions, joint ventures, and strategic partnerships. While each deal is unique, there are several common characteristics of a mergers and acquisitions transaction that define its nature.

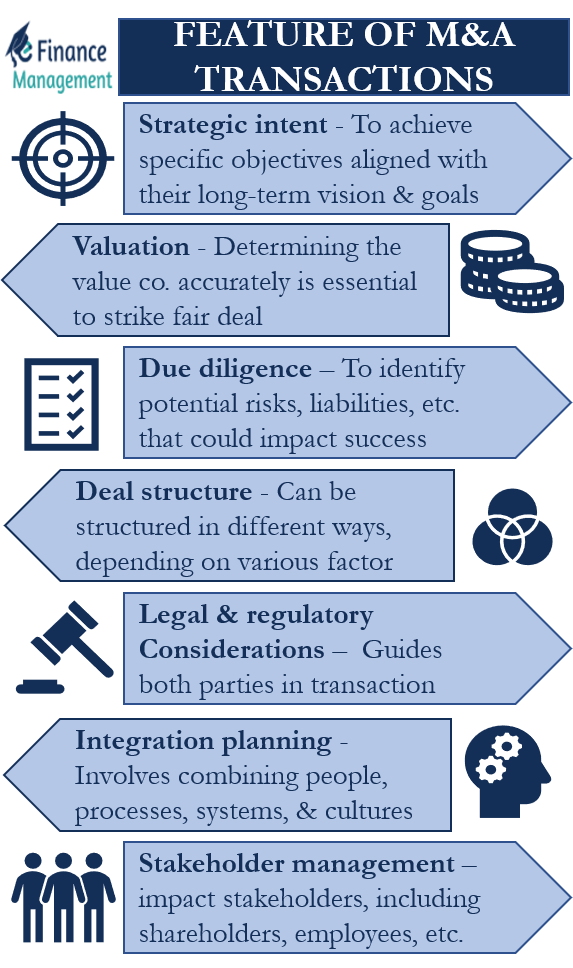

Features of Merger & Acquisition

The characteristics of a mergers and acquisitions transaction are important. They will decide how the entire transaction is concluded, how the valuation will be performed, and what all tax and regulatory rules will apply. The following are the characteristics of a merger and acquisition:

Strategic Intent

M&A transactions are driven by strategic intent. Companies engage in these deals to achieve specific objectives aligned with their long-term vision and goals. These objectives may include enhancing market share, diversifying product portfolios, acquiring key talent or intellectual property, entering new markets, or gaining a competitive advantage. The strategic intent forms the foundation for evaluating potential targets and structuring the transaction.

Valuation

Valuation plays a crucial role in M&A transactions. Determining the value of the target company accurately is essential to strike a fair deal for both parties involved. Valuation methods can vary depending on the industry, but common approaches include analyzing financial statements, assessing market comparables, conducting discounted cash flow analyses, and considering intangible assets. Valuation also takes into account synergies realizing through the combination of the merging entities.

Also Read: Mergers Vs Acquisitions

Due Diligence

Thorough due diligence is a critical step in the M&A process. It involves the comprehensive assessment of the target company’s financial, legal, operational, and commercial aspects. Due diligence aims to identify potential risks, liabilities, or hidden issues that could impact the deal’s success or valuation. It covers areas such as financial statements, contracts, intellectual property, customer relationships, regulatory compliance, and employee matters. The level of due diligence depends on the transaction’s size, complexity, and the industry involved.

Deal Structure

M&A transactions can be structured in different ways, depending on the specific circumstances and objectives. Common deal structures include stock acquisitions, asset acquisitions, mergers, and joint ventures. In stock acquisitions, the acquiring company purchases the target company’s shares, while asset acquisitions involve buying specific assets or business divisions. Mergers result in the combination of two companies into a single entity, and joint ventures involve the creation of a new entity jointly owned by the partnering companies. The choice of deal structure impacts legal, financial, and tax implications.

Legal and Regulatory Considerations

M&A transactions are subject to legal and regulatory requirements that vary across jurisdictions. These considerations include antitrust laws, securities regulations, competition laws, and corporate governance guidelines. Companies must navigate these legal complexities to ensure compliance and obtain necessary approvals from relevant authorities. Legal advisors play a crucial role in guiding the parties through the transaction and addressing any potential legal challenges.

Integration Planning

After the deal is closed, the merging companies must undertake integration planning and execution to realize the intended synergies and operational efficiencies. Integration involves combining the people, processes, systems, and cultures of the merged entities. It requires careful planning, effective communication, and change management strategies. Integration challenges can arise from cultural differences, overlapping operations, technology integration, and employee retention. Successful integration is vital to achieve the strategic objectives of the deal.

Also Read: Process of Acquisition

Stakeholder Management

M&A transactions impact various stakeholders, including shareholders, employees, customers, suppliers, and the broader community. Effective stakeholder management is crucial to ensure support and minimize disruptions. Companies must communicate transparently with stakeholders, address concerns, and provide a clear vision of the expected benefits of the transaction. Managing stakeholder expectations is essential to maintain trust and mitigate potential resistance or negative impacts.