Meaning of Due Diligence

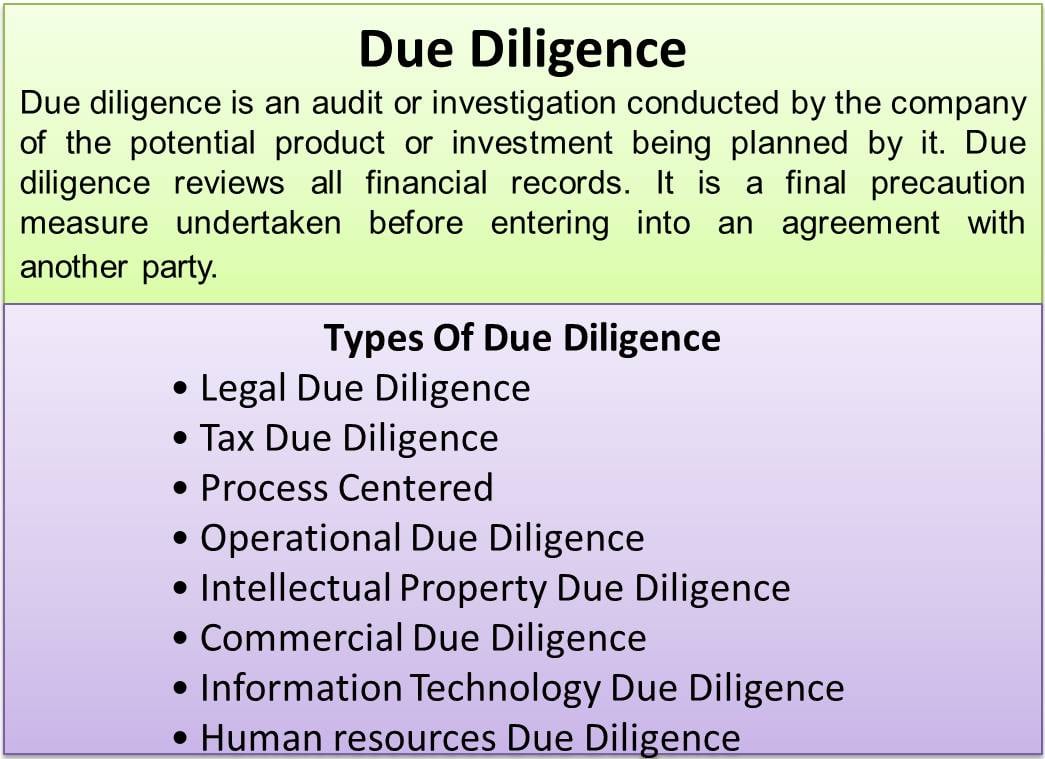

Due diligence is an audit or investigation that a company of the potential product or investment conducts. It reviews all financial records. It is a final precaution measure one undertakes before entering into an agreement with another party.

The company can conduct due diligence on various events. Like, for when the seller wants to investigate the authenticity of the buyer. Entities preparing for mergers and acquisitions also perform this activity. Brokers need to prepare it as a compulsion before selling the security.

After knowing the meaning, we will see the types of the same.

Types Of Due Diligence

Legal

Legal due diligence analyzes and understands the legal risk associated with the company and ensures that there is no involvement of legal issues in business investment or procurement. It analyzes the corporate structure, commercial contract, employee contract, environmental laws, etc.

Continue reading: Legal Due Diligence

Tax

Tax due diligence focuses on making sure that the seller’s firm does not hold any past tax liability that may be passed on to the acquiring firm.

Read more about it in its detailed article: Tax Due Diligence

Operational

It is necessary to know the operation of any business as it is the core of the business. It impacts the company significantly and helps in identifying the weaknesses and strengths to improve the profits. Operational due diligence assists the prospective purchaser in getting an analysis of the operational aspects of the target company.

See Operational Due Diligence for more details.

Intellectual Property

IP due diligence form studies the various intellectual properties that the company may own. The Intellectual properties include all intangible assets like patents, copywrites, etc. As we know nowadays, technology has become an important factor investors look for, so this can help those investors in better analysis.

Read more at IP Due Diligence.

Commercial

Commercial due diligence form aims at gaining an understanding of the market in which the target company operates. It helps to know the viability of the business in the current market scenario. Commercial due diligence is done along with financial and legal due diligence.

Visit Commercial Due Diligence for more details.

Information Technology

As every company deals with some sensitive data and had to protect this data from others, it is important to know the technology structure of such companies. IT due diligence form assists in identifying if there are any information technology concerns in the target entity.

Also Read: Due Diligence Report-Meaning and Areas

Keep reading more at IT Due Diligence.

Human resources

Human resource is a crucial asset of every business, as we know that although a company is an artificial person, but a company is always run by people. So, the human resources due diligence understands the impact of human capital on the planned deal.

Learn more at HR Due Diligence.

Financial

Finance is the blood of a business, and it is very important to know the financial health of a business before making an investment. The financial due diligence analyzes these by conducting financial due diligence, where they look at the historical earnings, quality of assets, the requirement of capital expenditure, etc.

Read more about Financial Due Diligence here.

On gaining insight on types, let’s understand the steps involved in preparing the same.

Steps of Due Diligence

The following is the step-by-step due diligence process:

Understand Compliance Concerns

In the ever-growing corporate world, the number of regulations imposed on the entity keeps increasing. The firm must gain an understanding of the compliance they need to match.

Define Corporate Objectives

The due diligence process needs to align with the regulatory, strategic, reputational, and financial risks that the entity may face.

Gather Key Information

Information about the entity needs to be gathered on a number of bases, such as political connections, board members, incorporation documents, key shareholders, etc.

Screen Prospective Third Parties against Watchlists

Watchlist screenings can determine if the particular party poses any form of significant risk. The entity should be checked against points of law enforcement lists, global sanctions lists, published lists of debarred companies, etc.

Conduct a Risk Assessment

There has to be the preparation of the risk assessment. The assessment must consider points such as high level of government involvement, country risk, and financial risks arising due to deficiencies in internal factors.

Validate the Information Collected

After completing the risk assessment step, the next step in the due diligence process is to verify and validate all the information that has been procured.

Record the Process

One should maintain a record through the due diligence process. The record should include all relevant assessments and documents. This record will later enable an entity to calculate the return on investments.

Establish an On-Going Monitoring Plan

There has to be proper scrutiny throughout the to avoid any form of unanticipated problems.

Review Your Process Regularly

A business should keep adapting to changes. Periodic reviews should be conducted, and required amendments should be incorporated into the process.

Due Diligence Checklist

Different organizations have different methods of conducting the due diligence process. And therefore, each organization maintains its own due diligence checklist. It helps in conducting the process smoothly. A few examples of contents of a checklist are sales, customers and revenue streams, material contracts, insurance coverage, licenses, permits, etc.

Due Diligence Report

A Due diligence report can be defined as the final product of a due diligence process. It is the summary of analyzes that gives an overview of the due diligence.

Conclusion

Suppose any modification or addition in the entity is being considered, such as a contract with a new supplier or takeover of another entity. In that case, a due diligence report will give the knowledge and confidence required to achieve the desired goal from the deal. This report detects issues that one can tackle early in the process. The findings can provide factual information, thereby assisting an entity in determining the true value or cost of business. Due diligence also contributes towards the drafting of the agreement and enables the entity to negotiate the best terms.

RELATED POSTS

- Financial Due Diligence – Importance, Scope and Requirements

- Legal Due Diligence – Meaning, Scope & Advantages

- IP Due Diligence – Meaning, Importance & Process

- Operational Due Diligence – A Framework

- Commercial Due Diligence – An Overview

- Due Diligence Process for Mergers and Acquisitions – A Step-by-Step Approach

Interested to read more articles that comply with the fashion and textile industry and retail