Definition Of Hostile Takeover

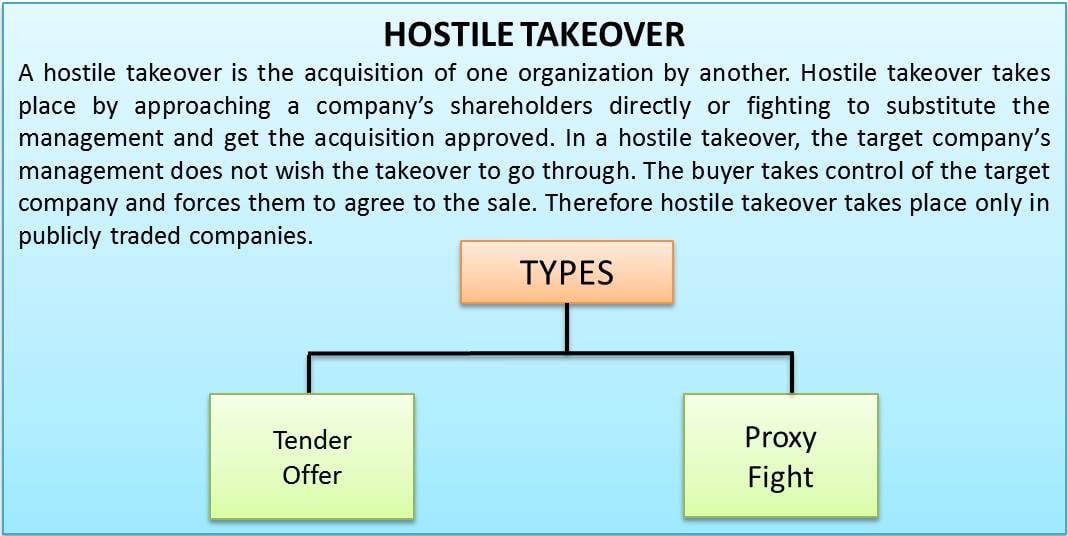

A hostile takeover is the acquisition of one organization by another. A hostile takeover occurs by approaching a company’s shareholders directly or fighting to substitute the management and get the acquisition approved. In a hostile takeover, the target company’s management does not wish the takeover to go through. The acquiring company takes control of the target company and forces them to agree to the sale. Therefore hostile takeover takes place only in publicly traded companies.

Further on, we will see the methods enabling hostile takeovers.

Methods of Hostile Takeover

The two primary methods in which a hostile takeover takes place are:

Tender Offer

The tender offer is a public bid made by the acquiring company for a large segment of the target company’s stocks at a fixed price. The price quoted is usually higher than the market value of the stock. They offer a premium price to convince the shareholders to sell their shares. The bid holds a specific time limit and may have conditions that the target company must follow if the offer gets approval. The acquiring company must file required documents with the regulatory body and should disclose its plans for the acquired company. Sun Pharma’s attempt to acquire Israel Company Taro is an example of a tender offer method.

Proxy Fight

In the proxy fight method, the buyer tries to influence the shareholders to vote out the current management in favor of the team that will support the takeover. Proxy is the term that defines the ability to let someone else vote on behalf of the shareholders. Thus the buyer uses the proxy method to vote for the new board. Usually, managers and displeased shareholders within the company attempt to change ownership by getting the confidence of the remaining shareholders. The defense strategies that may be applied to prevent the takeover may not be strong enough for the proxy fight method of a takeover. Hewlett-Packard’s hostile takeover of Compaq was conducted by the proxy fight method.

Bear Hug

A bear hug is a type of takeover in which the buying company offers a price higher than the target company’s market price. This higher price is for the target company’s unwillingness to get acquired.

After understanding the methods of a hostile takeover, let’s look into the reasons for the same.

Reasons For Hostile Takeover

There can be numerous reasons why a company may desire to take over another company, such as to gain a majority market share, cheap valuations with low promoter stake, etc. The company may want to take over and use the acquired firm as cash flow for the benefit of the primary company.

Reasons For Opposing Hostile Takeover

Not all target companies agree with such takeovers. This may lead to a hostile takeover instead of the approach of friendly acquisition. The other primary reasons for the reluctance of the target company are:

- It may be that a company wants to stay independent and have complete control over its operations.

- The members of the management are trying to protect their jobs. They realize that the acquiring company will replace them soon after completing the buyout.

- The shareholders and board of directors might fear the reduction in the company’s value as an aftermath of the buyout. This will also put the company in the danger of running out of business.

These are a few of the reasons why a target company opposes the takeover. These reasons induce the acquiring company to commence a hostile takeover.

Now let’s look at the defense mechanisms that the target company can use in case of hostile takeovers.

Defensive Measures

The target company can put defensive measures into action either before or after the hostile offer. The uses of defensive measures are:

- Delaying the transaction.

- Negotiating a better deal.

- Keeping the target company independent.

Defensive measures can be of two types:

- Pre-offer Takeover Defence Mechanism

- Post-offer Takeover Defence Mechanism

Generally, the experts recommend setting up pre-offer defensive measures as they are less scrutinized in the court than the post-offer defense measures.

Pre-offer Takeover Defense Mechanism

Following are some of the pre-offer defense strategies that a company opts for before an attempt of a hostile takeover.

- Poison pill

- Poison put

- Restrictive takeover laws

- Staggered board

- Restricted voting rights

- Supermajority voting provisions

- Fair price amendments

- Golden parachutes

- Scorched earth policy

Post-offer Takeover Defense Mechanism

Following are some of the post-offer defense strategies that a company opts for after a hostile takeover attempt is made.

- ‘Just Say No’ defense

- Litigation

- Greenmail

- Share repurchase

- Leveraged Recapitalization

- ‘Crown Jewel’ defense

- ‘Pac-man’ defense

- White knight defense

- White squire defense

Example Of Hostile Takeover

After gaining an insight into the concept of hostile takeovers, let’s look at an example to have a clearer view of the same.

AOL and Time Warner, $164billion – One of the classic examples of a hostile takeover is the takeover of Time Warner by AOL in the year 2000. AOL announced its plan to take over the much larger and more successful firm, Time Warner. However, Time Warner was resistant to the takeover and wanted to commence functioning as an independent entity. This pushed AOL to opt for the hostile method of the takeover. This deal was termed the deal of the millennium.

Also Read: Takeovers

Conclusion

The term ‘hostile takeover’ turns the boardroom into a battlefield – a takeover results in volatile stock prices and lost jobs in the corporate world. The hostile takeovers damage a firm’s reputation and affect the lives of all those associated in the years to come. There are various defensive measures available to the managers to avoid getting acquired involuntarily. They can use these before or after making the offer. It is important that managers know these measures in detail and make provisions. A target company needs to have its defenses strong if they do not want to be acquired forcefully.