In a cycle of merger and acquisition, due diligence plays a very important role. Comprehensive due diligence helps to understand whether a prospective M&A deal will bring value in the future or wash out the value. The process of merger and acquisition consists of four phases as follows –

- 1st Phase – Merger and Acquisition Strategy

- 2nd Phase – Target Screening

- 3rd Phase – Due Diligence

- 4th Phase – Integration Planning and Execution

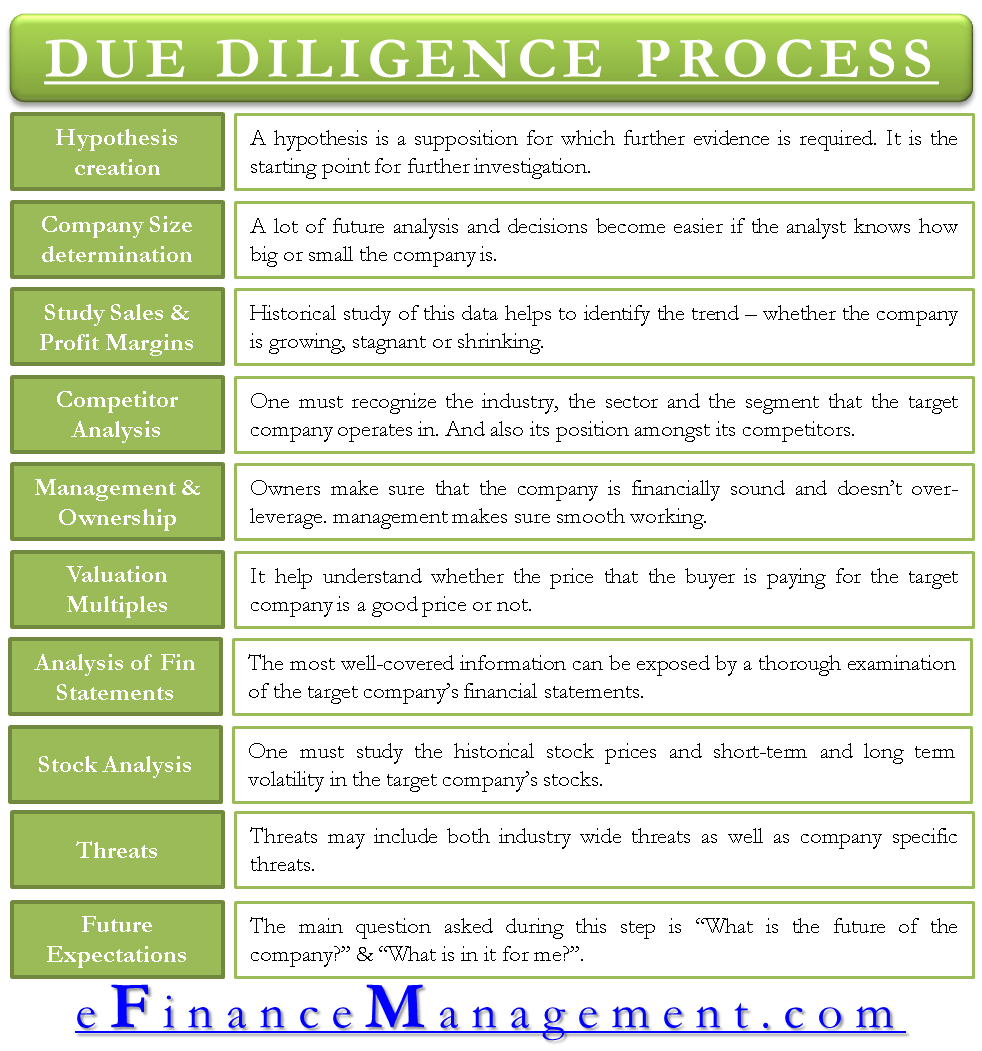

Today our agenda is to analyze the process of the due diligence phase in detail. The due diligence process can differ from organization to organization. However, the basic framework remains the same. Let’s understand the general step-by-step process.

- M&A Due Diligence Process

- Create a Hypothesis

- Determine Company Size

- Study Sales and Profit Margins

- Industry Trends and Competitor Analysis

- Management and Ownership

- Valuation Multiples

- Analysis of Financial Statements

- Company Stock Analysis – Stock Price History and Stock Options

- Industry-Wide and Company Specific Threats

- Future Expectations

- Test Hypothesis and Draw Conclusions

*For ease of understanding, we will assume that an analyst is conducting due diligence on behalf of the buyer/ investor*

M&A Due Diligence Process

Create a Hypothesis

The first step to starting a due diligence process is to create a hypothesis. A hypothesis is a supposition that requires further evidence. It is the starting point for further investigation. To start the process of due diligence, the hypothesis can be an assumption such as – “The valuation that the target company has submitted is correct.” Now the acquiring company has to conduct due diligence to conclude whether this assumption is true or false.

Once the hypothesis is decided, an investigation is started in every area of the company. Let’s look into it.

Determine Company Size

In the second step, the analyst needs a rough idea about the size of the company. A lot of future analysis and decisions become easier if the analyst knows how big or small the company is. If it is a public company, its size can be determined by its market capitalization. It may fall under either one of the three – large-cap, medium-cap, or small-cap. If it is a private company, equity capital is a good indicator of its size. It is also a good time to determine the potential size of the company, i.e., in the future, say in 5, 10, or 20 years how big the company will be?

Also Read: Due Diligence Report-Meaning and Areas

This will give the analyst a rough map of what he is dealing with.

Study Sales and Profit Margins

It is very important to study the revenue and profit margins of the company. A historical study of this data helps identify the trend – whether the company is growing, stagnant, or shrinking. After that, the analyst finds answers to questions such as – If the company is growing, what are its growth drivers? Are these sustainable? Can the merger bring any value addition to the target company’s revenue and profit margins? This will give insights to test the hypothesis.

Industry Trends and Competitor Analysis

Once the analyst understands the company, its size, and its profit model, it is time to understand where the target company stands in the market. One must recognize the industry, the sector, and the segment that the target company operates in. Also, the analyst must compare the target company’s data with its peer/ competitor data to understand if it is doing better or worse than its competitors.

Management and Ownership

The previous three steps show how the target company is from the outside. Now it’s time to take a look inside. The most important part of any company is its ownership and management. The ownership or the owners make sure that the company is financially sound and doesn’t over-leverage. On the other side, the management makes sure that the company is working smoothly and efficiently and its internal culture is that of harmony. A company that doesn’t have good owners and management staff eventually makes mistakes and fails.

Valuation Multiples

Valuation multiples help understand whether the price that the buyer is paying for the target company is a good price or not. It shows whether the M&A deal or investment is value for money. Valuation multiples include equity multiples such as – P/E Ratio, P/B Ratio, Dividend Yield, and Price/Sales. Another subcategory of valuation multiples is enterprise value multiples. Together both the multiples show us the real value of the company and if the price demanded by the target company is the right price.

Analysis of Financial Statements

One cannot stress enough about the importance of analyzing the company’s financial statements. A thorough examination of the target company’s financial statements can expose so many important information. One can find fairly simple facts such as the company’s cash flow and cash conversion cycle, how leveraged the company is, how efficient it is, etc. However, the analyst also finds eye-opening information such as – has the company set us sister concerns to deleverage itself? Is the majority sale of the company from one customer or multiple customers? Etc.

These answers can reveal a lot about the company and can raise questions for further investigation.

Company Stock Analysis – Stock Price History and Stock Options

When an entity targets a public company for an M&A deal, it has to pay a price that is partly determined on the basis of the market price of its stock. One must study the historical stock prices and short-term and long-term volatility in the target company’s stocks. Furthermore, one must also look into the future planning of stocks which includes factors such as future stock splits, dilutions, buy-backs, etc.

Industry-Wide and Company Specific Threats

When investing in a company, an investor must understand the threats that he will have to deal with after the acquisition of or investment in the target company. These threats can be industry-wide such as slow economy, shortage of raw material, etc., or they can be company-specific such as a very strong competitor, high debt expense, technology obsolescence, and its replacement expense, etc. A SWOT analysis is useful in this step of the due diligence process. Further precautions can be taken during the deal to reduce the effect of threats.

Future Expectations

By this time, the analyst has a rough estimate about everything from future revenue, profit, etc., to future investments in assets, future exit strategies, etc. The main question asked during this step of the due diligence process is, “What is the future of the company?” & “What is in it for me?”. Now the investor has a rough idea of where the company is standing today and what can be expected in the future. Further, the investor asks.

Test Hypothesis and Draw Conclusions

Finally, after the step-by-step due diligence process is conducted, the final report is made. This final report concludes and draws assumptions about the current and future valuation of the target company, the fair price that can be paid for the company, and how the target company will add value after the merger/ acquisition. These conclusions are tested for the hypothesis established in the first step of the due diligence process. If the hypothesis is true, the investor will move further. Otherwise, there are chances of the deal falling apart.