Golden Parachute: Meaning

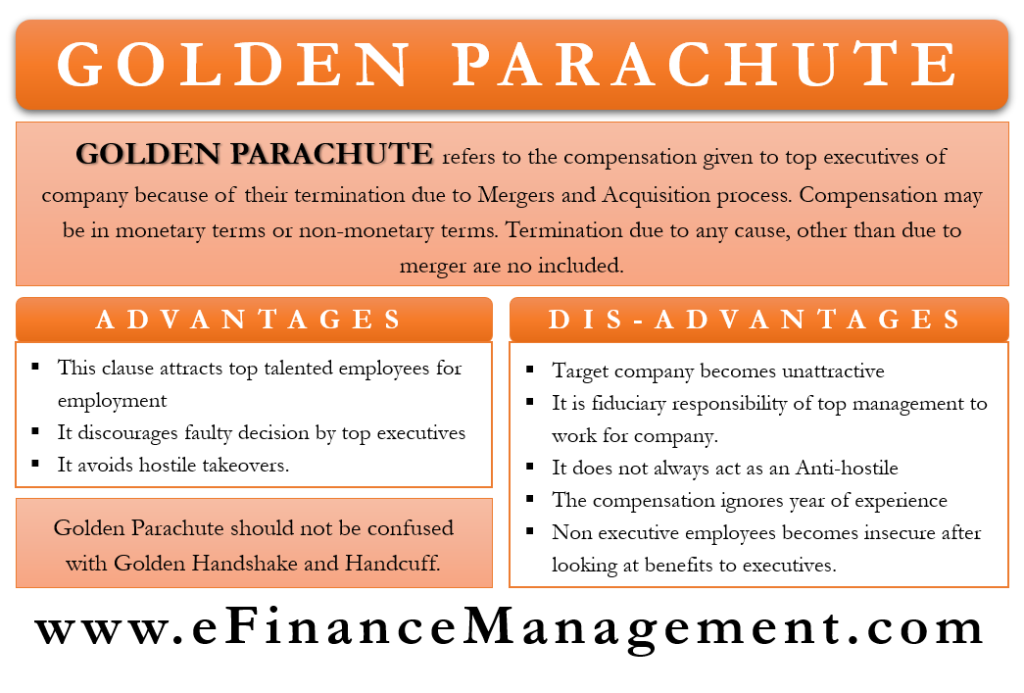

Golden Parachute is a term used to describe compensation given to the top executives of the company because of their termination due to the takeover process. At the time of the hostile takeover process, many top executives of the target company lose their jobs post-acquisition. In order to compensate for their loss, they are given substantial benefits, which are popularly known as the ‘Golden Parachute.’ Compensation can be in monetary or/and non-monetary terms. It can include cash bonuses or/and stock options or/and severance pay or/and insurance benefits or/and retirement benefits or/and paid health insurance or/and compensation for legal fees, etc. Depending on the company, the components of the compensation can vary. Generally, the compensation is two-three times the annual basic salary of the top executives.

The target company puts the clause of Golden Parachute into the employment contract of the top executives. It is a tool useful for the Target Company to avoid any hostile takeovers. This clause discourages the Acquiring Company to conduct a hostile takeover, as the acquisition becomes costly because of this clause. Activation of ‘Golden Parachute’ occurs only at the termination time due to hostile takeovers. Terminating top executives for some other reason does not activate this clause.

Understanding the Term: Golden Parachute

The term ‘Golden Parachute’ has its origin in the year 1961 by Trans World Airlines. The Airlines, in order to avoid the hostile takeover from Howard Hughes, gave its CEO and President, Compensation under the head Golden Parachute. This compensation provides a soft and safe landing to the top executives after their termination, and so the term Golden Parachute.

Advantages of Golden Parachute

Following are a few advantages of the clause.

Attracts Top Talent

Golden Parachute clause in the employment contract attracts a lot of talented top executives for employment. This clause acts as a safety net for the top executives at the time of the takeover. It encourages them to stay longer in the company and thereby boosts their morale.

Discourages Faulty Decisions

At the time of the takeover process, the top executives often become insecure about their job. In order to save their job, they avoid any such deal, even if it is good for the company. Golden Parachute clause ensures the top executives get enough rewards after their termination and helps them make flawless decisions for the organization. It overcomes the personal bias of the top executives.

Avoid Hostile Takeovers

In the takeover process, the Acquiring Company is responsible for paying off the terminating employees and replace them with new employees. The Golden Parachute clause in the employment contract of the top executives makes a costly affair for the Acquiring Company. And so, it discourages any hostile takeovers.

The above advantages are non-exhaustive in nature.

Criticism of Golden Parachute

There are many experts who have claimed a few disadvantages or criticisms regarding the Golden Parachute clause; they are as follows:-

Target Company becomes Unattractive

According to the experts, sometimes the Golden Parachute cost is way too higher for the Acquiring Company. And so, at the time of screening targets, the Acquiring Company avoids such kinds of companies.

Fiduciary Responsibilities and Over-payment

According to a few experts, it is a fiduciary and moral responsibility of the top executives to work for the betterment of the company and the shareholders. And so, there is no requirement to pay additional remuneration to the top executives. The top executives are not underpaid, and so paying additional at the time of termination to perform fiduciary responsibilities is not a viable and ethical option.

Not always acts as an Anti-hostile

Sometimes, the compensation component of the Golden Parachute is very less in the total acquisition cost. In such a situation, it does not act as an Anti-hostile takeover tool. The main purpose of the clause stands still even in such a situation.

Ignores Years of Service

This clause completely ignores the total years of service of the top executive before the termination. And as a result, there are high chances of over-payment to the top executives. A top executive, who has served only for a short duration, may end up getting high rewards.

Non-Executive Employees

Sometimes, Non-Executive Employees at the managerial level become insecure after looking at the benefits given to the top executives. In such a situation, the culture of the company takes a hit.

In conclusion, above were a few criticisms and controversies of the clause.

Real-life examples of Golden Parachute

There are many real-life examples of Golden Parachute, which are as follows:-

- In 1983, William Agee, the CEO of Bendix Corporation has, received $4 million after its takeover.

- Henry McKinnel, CEO of Pfizer, in 2005 was given an $83 million pension along with other compensation at the time of termination.

- Tony Hayward, CEO of British Petroleum in 2009, was fired over his reaction to the oil spills. Irrespective of this, he was given a severance packet of $1.6 million and a $6000000 yearly pension.

There are also many other real-life examples apart from this.

Golden Parachute Vs Golden Handshake

Both the terms almost serve the same purpose, but the only difference is their extent of coverage and applicable situations. Handshake, apart from all components of Parachute, also includes retirement benefits. Handshakes are more generous in nature because Retirement benefits come into the picture at the time of retirement and not termination. And so, Handshake is more popular than Parachute as well.

Another minor variation is that while Golden Parachute is applicable in times of corporate restructuring, however, Golden Handshake is available to high-ranking senior executives of the company. And it remains available even during the course of dismissal, and routine retirement, apart from during the corporate restructuring.

Golden Parachute Vs Golden Handcuffs

Parachute and Handcuffs perform different roles altogether. The target of the Parachute is to compensate at the time of leaving, and the target of the Handcuffs is to stop from leaving. In Golden Handcuffs, the employee gets extra benefits for staying and if the employee leaves the organization within a particular time, then charging of a certain cost takes place. And, so in Parachute, the reaping of benefits takes place at the time of leaving, and in Handcuffs, the reaping of benefits takes place for staying.

Conclusion

The Golden Parachute clause has both supporters and opponents. There are a few criticisms of this clause justified by the opponents. Irrespective of all this, companies and top executives prefer Golden Parachute, and it generally forms an important part of their employment contract. The Industry in which there are high chances of takeovers makes sure to put this clause to avoid such hostile deals. And so, this clause becomes beneficial for the company, shareholders, and top executives in hostile takeovers.

Please send me regular updates