What is Non-cash Working Capital?

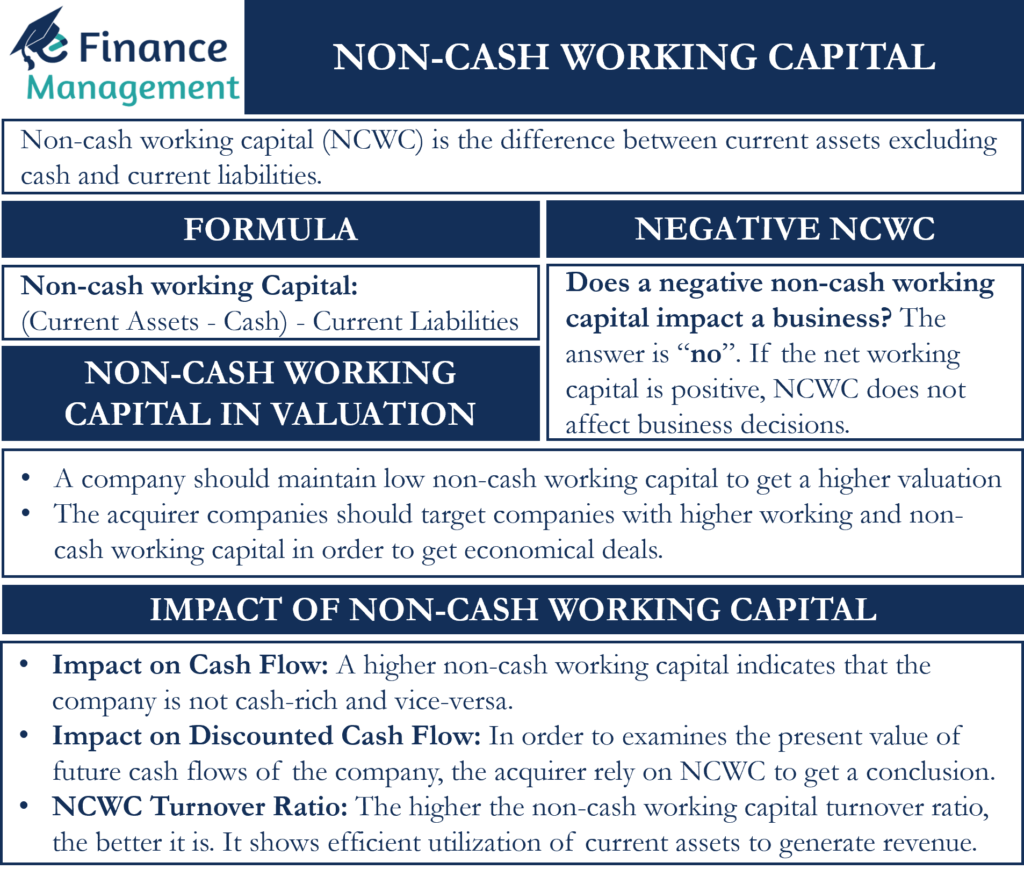

Non-cash working capital (NCWC) is the difference between current assets excluding cash and current liabilities. It plays a vital role in negotiating decisions regarding acquisitions for both the acquirer and the target.

Formula for Non-cash Working Capital

| Non-cash working Capital = (Current Assets – Cash) – Current Liabilities |

Let us understand this better with an example”.

Example

A company “Louis Co.” is involved in the shoe business. They are currently earning annual revenue of $40 million with an NCWC maintained at 15% of the annual earnings which is $6 million. The industry average of non-cash working capital is currently running at 10%. This means that the other companies in the shoe industry need only 10% of their yearly sales to maintain and run their business. Unlike, Louis Co., which needs 5% more than the industry in order to maintain and run its business.

Now Marten Co. approaches Louis Co. for acquisition and after analyzing the financial statements they witness that an extra 5% would be needed as working capital in order to maintain the business of Louis Co. efficiently.

For this reason, Martin Co. negotiated with Louis Co. to reduce the acquisition value.

Hence, based on this we can conclude that:

- The companies should maintain a low non-cash working capital in order to get a higher valuation.

- The acquirer companies should target companies with higher working and non-cash working capital in order to get economical deals.

Impact of Non-Cash Working Capital

Impact on Cash Flow

A higher non-cash working capital indicates that the company is not cash-rich. Therefore, this is a sign of companies have low cash transactions while a low non-cash working capital indicates that most of the transactions are cash-based. A low non-cash working capital is a primary signal of a good cash flow. But the condition applied here is that the net working capital should be high.

Also Read: Net Working Capital

Let’s take a look at the current assets and current liabilities of Louis Co.

| Liabilities | Amt ($) | Assets | Amt($) |

|---|---|---|---|

| Accounts Payable | 70,000 | Accounts Receivable | 65,000 |

| Accrued Expenses | 10,000 | Inventory | 40,000 |

| Outstanding Wages | 15,000 | Cash | 60,000 |

| Bank O/D | 5,000 | ||

| Total | 100,000 | Total | 165,000 |

The NCWC sums up to be: (65,000 + 40,000) – 100,000 = $5,000

A low NCWC shows that the business has good cash to recover the debts.

Impact on Discounted Cash Flow

When acquiring a company, the acquirer examines the present value of the company by following the discounted cash flow method. For this purpose, the valuers rely more on non-cash working capital in order to get a conclusion.

Non-Cash Working Capital Turnover Ratio

The non-cash working capital turnover ratio tells us how many current assets (except cash) and liabilities are replaced concerning its annual revenue.

The formula of NCWC Turnover Ratio = Net Sales/NCWC

Thus, the higher the NCWC turnover ratio the better it is. This indicates that the company is utilizing its current assets efficiently to generate revenue.

Impact on Decision Making

- A lower working capital portrays a good financial position for the company as most of the transactions are cash-based and hence less working capital would be needed to run the business efficiently.

- It puts a significant impact on the acquirer’s decision as it helps to analyze how many liquid assets the company owns apart from cash.

Negative Non-Cash Working Capital

Quite often a question arises does a negative non-cash working capital impact a business? So, the answer is “no”. As long as the net working capital is positive, it does not affect business decisions. Let’s take an example to understand this better.

| Current Liabilities | ($) | Current Assets | ($) |

|---|---|---|---|

| Accounts Payable | 70,000 | Accounts Receivable | 55,000 |

| Accrued Expenses | 10,000 | Inventory | 40,000 |

| Outstanding Wages | 15,000 | Cash | 60,000 |

| Bank O/D | 5,000 | ||

| Total | 100,000 | Total | 155,000 |

NCWC = 95,000 – 100,000 = -5,000

Net Working Capital = 155,000 – 100,000 = 55,000

Here, the NCWC is negative but the working capital is positive. This is a sign that the company has enough cash to pay off the debts. Hence, it would not affect the business to that extent.

Also Read: Working Capital

Conclusion

NCWC plays a quite crucial role in making good investment decisions. Generally, during corporate deals, the investors are using working capital as a term but actually, they mean non-cash working capital.