Meaning

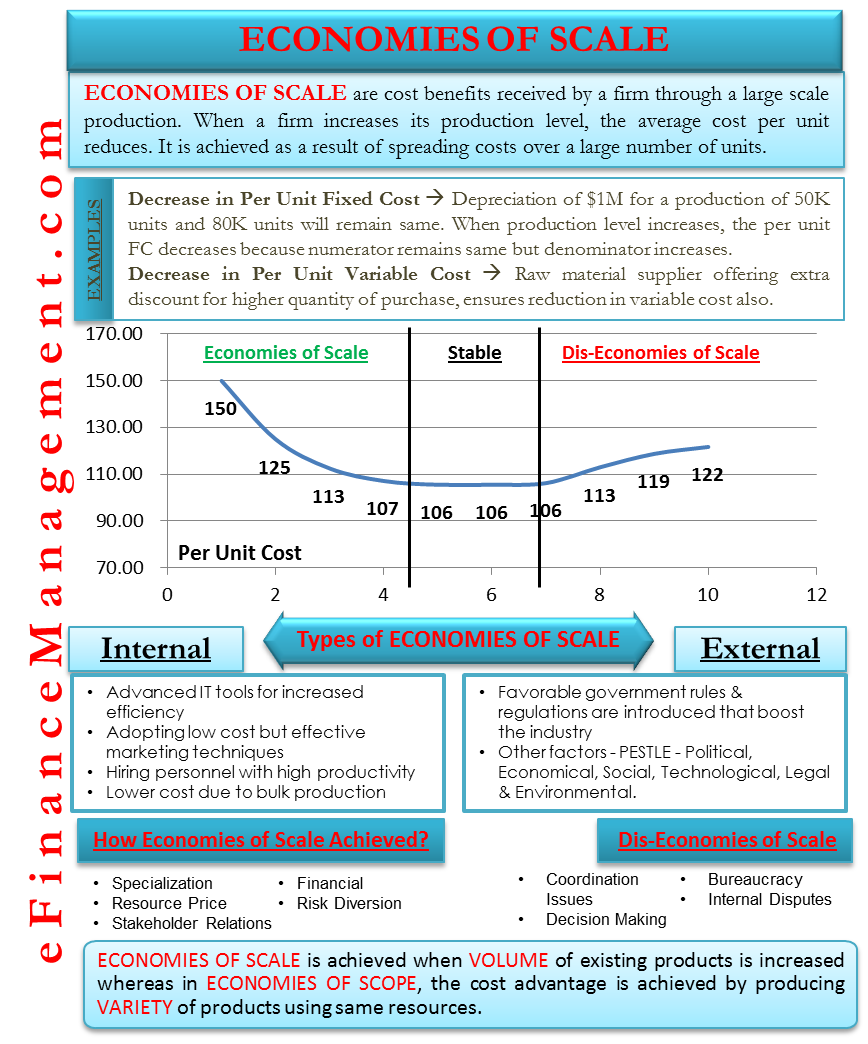

The economies of scale are cost benefits received by a firm through large-scale production. When a firm increases its production level, the average cost per unit reduces. Hence, the economy of scale is achieved as a result of spreading costs over a large number of units.

There is an inverse relationship between quantity produced & cost per unit. As a result, a firm enjoys economies of scale. Furthermore, it gives a competitive advantage to large firms over other smaller firms. Because taking benefits of economy of scale requires huge funds, which may seem difficult for smaller firms.

Say a firm produces 100 units from $ 1000. The cost per unit is $ 10. In contrast, another firm produces 200 units for $ 1800. The cost per unit is $ 9. If one of the firms increases production to 300 units for a total cost of $ 1500, the cost per unit will be lesser, i.e., $ 5 per unit.

Due to low costs, they have a lower market price. So, they enjoy a larger market reach. Further lower market price attracts more customers. Certainly, it increases the market share of the firm. This gives the firm an incentive to further produce more.

Also Read: Diseconomies of Scale

As shown in the graph in the infographic below, with an increase in production units, the costs show a decreasing trend.

Examples of Economies of Scale

Related to Fixed Cost

Fixed costs (FC) are one-time costs. For example, land building, machinery, etc. Total FC remains constant irrespective of change in production. Although FC per unit decrease with increasing production due to cost spreading over more units.

Market biggies such as Amul and Reliance produce on a large scale.

HUL company produces soap bars on a large scale as it owns lux, lifebuoy, liril, hamam, breeze, dove & pears.

Walmarts have large-scale buying & selling, so it has “everyday low prices” in retail for customers.

Related to Variable Costs

Variable costs (VC) are costs that change with a change in production. For example, raw materials, fuel, oil, etc. Variable costs per unit decrease when a company adopts large-scale production. As a result, the subsequent units have significantly low total variable costs (TVC).

For example, the firm gets the benefit from the learning curve or experience curve with an increase in production. Also, due to optimum utilization of resources, wastages are minimized & hence raw material cost per unit decreases.

Relationship between Fixed Costs and Economies of Scale

The advantage of economies of sales is connected more with the dilution of fixed costs and not with the reduction of variable costs. The reason for this is variable cost remains constant per unit while fixed cost keeps decreasing with the increase in the number of production units. This eventually leads to a reduction in total cost per unit.

Also Read: Cost Structure

Types of Economies of Scale

Internal Economies of Scale

These are related to inner management matters. They are controllable & predictable. For example, using advanced IT tools for increased efficiency, adopting low cost but effective marketing techniques, hiring personnel with high productivity, etc., reduce costs per unit.

External Economies of Scale

They are affected by various outer factors such as PESTEL – Political, Economic, Social, Technological, Environmental & Legal. They are not controllable & not predictable. For example, suppose the government has introduced favorable rules & regulations that boost the industry. In that case, it increases the cost of the firm, and political stability gives a firm base to plan for the future, assuming no changes in rules in the near future.

How Economies of Scale is Achieved?

Specialization

A company focuses on specialization along with an increase in production. As a result, they will be more efficient. Technology, Method of production, Labor, or any other factor of production moves higher in the learning curve.

Resource Price

For a high volume of production, the firm buys material on a large scale. So, it gets bulk discounts—for example, Walmart.

Stakeholder Relations

Firstly, a firm maintains good relations with a supplier because it buys repetitively from them. Secondly, they maintain good relations with media & other marketing partners by giving additional services. For example, sending gift hampers on festivals or birthdays. Small firms cannot afford this.

Financial

Big firms can easily take loans of the bigger amount by presenting their financial statements as having higher turnovers. They can easily raise capital. Stakeholders have trust in them.

Risk Diversification

Risk is spread over various activities. As a result, there is less deviation from expected costs.

Specialization & lowered resource prices are often considered as operational efficiencies.

Economies of Scale vs Economies of Scope

Economies of Scale

When a company achieves cost advantage by increasing the level of production and diluting fixed costs, we call it economies of scale. In other words, it is achieved with VOLUMES.

Economies of Scope

When a company produces more and more related products, they share raw materials, production processes, distribution channels, and customer services. It includes a product mix with various product lines. Here, the economies are achieved with VARIETY.

For example, ITC produces cigarettes & tobacco. Pepsi owns Aquafina & Fretole. They are complementary products. P & G produces tissues & diapers, so the common raw material becomes cotton. Johnson & Johnson has three segments in products: Firstly, a customer segment includes baby care, skincare, nutritional products, etc. Secondly, a pharmaceutical segment that includes anti-infective antiseptic products. Lastly, medical devices such as wound care and blood glucose monitoring.

Diseconomies of Scale

They refer to the long run, where increasing production after a certain limit causes more harm than benefit. The disadvantage is that the average cost per unit increases. (Read more about it in its detailed article – Diseconomies of Scale).

What causes Average Cost rise during the Dis-economy of Scale?

Coordination Issues

A larger firm has a number of employees and departments. Due to this, there exists a communication gap in the employees. This causes a decrease in productivity. This can be reduced by opening communication channels & using the latest technologies such as e-mails, internal chat groups, etc.

Decision Making

Large firms cannot make decisions overnight. They have procedures & formalities. One has to take various permissions. In case of emergencies, there are possibilities of making wrong decisions. Delegation of authority solves this problem.

Bureaucracy

A large firm has more levels in the chain of command. This increases the paperwork. Subsequently, an employee’s time is wasted & the efficiency of an employee is reduced.

Internal Disputes

Acquisitions and mergers or diversification cause an increase in the stakeholders. They have their own motives. For example, as we saw above, HUL owns various brands of soaps. It may happen that one unit eats up the sales of another unit. This is referred to as Cannibalization.

RELATED POSTS

- Factors of Production – Meaning, Types, and Features

- Marginal Cost – How to Calculate, Relationship with Fixed & Variable Cost

- Cost Behavior – Meaning, Importance, Types and More

- Variable and Fixed Costs

- Types of Costs and Relationship of Direct & Indirect Costs with Fixed & Variable Costs

- Types of Utility – Form, Time, Place, Possession, and Other Utilities