Definition of Merger

A merger is an agreement undertaken to unite two prevailing organizations into one new entity. There are numerous reasons why a company chooses to unite with another company. The primary reasons for mergers include expanding the company’s reach, gaining market share, or expanding into new segments. The company conducts these activities to please the shareholders.

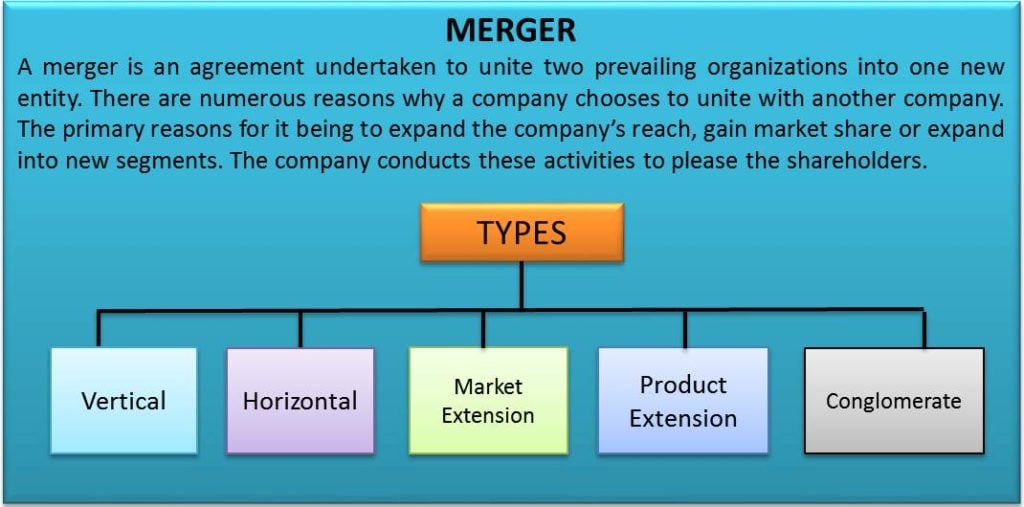

After gaining an insight into the meaning of mergers, let’s look at the types of mergers.

Types of Mergers

The five main types of mergers are as follows:

- Vertical Merger

- Horizontal Merger

- Market Extension Merger

- Product Extension Merger

- Conglomerate Merger

Read Classification / Types of Mergers for more details.

Let us see a few examples of mergers to understand the concept better.

Examples of Mergers

Disney and Pixar

The merger of the very famous Walt Disney and Pixar was much sought out for and a match made in cartoon heaven. Disney released almost all of Pixar’s movies; however, the contract was about to run out. Therefore the companies opted for the merger in 2006. The merger benefitted both companies by giving them some of the highest-grossing movies, such as Frozen and Tangled.

Exxon and Mobil

Exxon and Mobil signed an $81 billion agreement in 1999, giving birth to ExxonMobil. Post the merger, ExxonMobil became the largest company in the world, heading towards monopolization. ExxonMobil is the strongest leader in the oil market internationally and proudly boats dramatic earnings. ExxonMobil is soon heading for another merger in the coming years.

Sirius and XM Radio

Satellite Radio began in 1997 with only two licenses. The condition for the issue of two licenses is that either of the companies could not acquire the other. However, in July 2008, Sirius Satellite Radio and XM radio decided to join forces. Proper paperwork and investigations led to the approval of the merger. This eventually led to massive increases in the revenue of both the companies and thereby giving them a major hold on the market share.

Also Read: Mergers Vs Acquisitions

Continue reading – Amalgamation vs. Merger

Conclusion

A merger between two entities into a single new entity can have several benefits. The new entity holds an increased market share, leading to the firm gaining higher economies of scale and thus higher profits. More importantly, a merger reduces competition in the market and leads to higher prices from consumers.

Also, read Mergers And Acquisitions.

Thanks for your innovative idea. This Is really good for the people who has the passion to update themselves.