What do we Mean by Short-Term and Long-Term Investments?

Short-term investments are the investments that investors intend to hold for a short duration of time, generally less than a year or so. On the other hand, Long-term investments are investments that a company, individual, or investor intends to hold for more than a year. Actually, long-term investments are held for several years, maybe for 3-5-7 years or even beyond that. So what is not a short-term investment is a long-term investment. Both short-term and long-term investments have their own advantages and disadvantages. Investors should assess their investment goals, need for liquidity, and risk appetite before choosing between any of these two investment options or sticking to an investment decision.

Investment Objective

Investors invest in short-term investments to make quick profits from volatility in their prices. Prices of such assets change quickly, usually in small proportions. And provide opportunities for investors to sell their investments and book immediate profits. Moreover, liquidity is one of the key features and requirements for an asset to qualify as a short-term investment. Investors can sell or liquidate their investment in a very short span of time in times of need. Common examples of short-term investments are short-term fixed deposits, short-term bonds, time deposits, recurring deposits, debt mutual funds, etc.

Investors who invest in long-term investments usually have a strategy according to which they build their portfolio. Such investments usually fulfill a long-term need or goal such as providing for retirement income, or for future education expenditure or accumulation to purchase an asset, etc. The assets and instruments for long-term investments do not offer windfall profits in the short run. But they grow slowly and steadily over a few years and provide capital appreciation opportunities. Moreover, the average return on such investments over the longer term usually remains quite attractive. Many of such investments are not liquid in nature at times. And such investments take time to convert into cash. Some assets may have a withdrawal clause and restrict withdrawal or redemption for the initial few years. Common examples of long-term investments include real estate, stocks, bonds, mutual funds, etc.

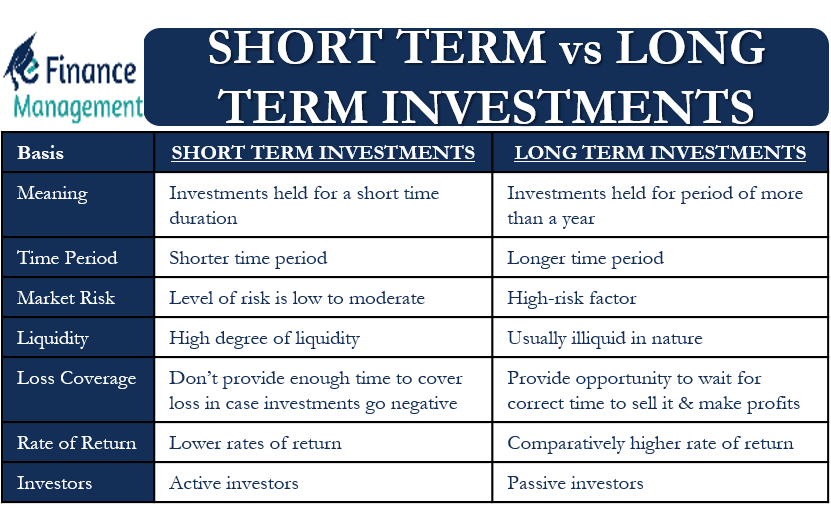

Key Differences between Short-Term and Long-Term Investments

In the above discussions, we could understand the basic nature and objective of these investments. Now let us attempt to discuss the key differences between these two types of investments.

Also Read: Long-Term Investment Examples

Time Period

As the name suggests, short-term investments are held for a short duration of time, generally less than a year. Investors may sell/exit or liquidate their investment in such assets even in a few hours, such as in the case of intra-day trades. In other instances, they may hold their investments for a few days, weeks, or months and then sell them.

On the other hand, long-term investments are held for a longer duration of time, always more than a year. Investors may hold such investments for time periods as long as 20 years or even more in some cases, such as government bonds. Investors hold assets such as real estate and stocks too for many years before actually selling them.

Market Risk

The level of risk is low to moderate in the case of short-term investments. This is so because the time span is quite less for factors such as changes in interest rates to affect the prices of such investments. Or, for that matter, any major political or economic event can affect the value of such investments. The short time frame urges the investors to invest in relatively safer options that will give them moderate returns along with the safety of their investments. However, there are exceptions to this rule, like intra-day traders who indulge in high-risk-taking activities regularly.

Whereas, except in cases of Government Bonds, long-term investments always carry an element of high risk. Their prices and returns can be volatile, and in some cases, they may provide negative returns even after holding them for several years. The time span is very long, which gives ample time for any adverse changes in the market factors such as interest rates, rules, and regulations of the government, company performance, financial strength of the company, economic scenarios, project and product viability, competition, etc. to affect the prices of such investments.

Also Read: Long Term Finance

Liquidity

Short-term investments have a high degree of liquidity. Investors can convert them into cash or equivalent at very short notice. For example, we can easily sell short-term investments like shares and convert them into cash within a day.

Long-term investments are usually illiquid in nature. It is usually not possible to convert them into cash or equivalent at very short notice. Investors will take a considerable number of days to sell long-term investments like real estate and get money in return.

Covering of Losses in case of Short-Term and Long-Term Investments

Short-term investments do not provide enough time for investors to cover their losses in case their investments turn negative. Therefore, short-term investors have to suffer a loss whenever these investments see a decrease in value. And in case the investor has to liquidate their position and exit.

Long-term investments provide opportunities for investors to wait for the correct time to sell their investments and make profits. Even if an investment offers negative returns over a small period of time, the investor can wait and keep holding it. The temporary low may be due to business cycles, recessionary phase, or simply due to temporary poor performance of a company or sector. Investors can sell their investments whenever the investment rebounds and prices go up.

Rate of Return

Short-term investments usually provide lower rates of return than long-term investments. For example, short-term bonds offer a lower rate of interest than long-term bonds. Also, it is a proven fact that long-term investments provide ample opportunities for true capital appreciation, unlike short-term investments. As these are for short maturities and carry a lesser risk, the returns are also low on these investments.

Some long-term investment assets like real estate and shares grow in value manifold when held for several years. Also, the element of long-term provides an investor with an opportunity to perfectly time his exit from the investment and make maximum profits out of it.

Accounting Treatment

Short-term investments are meant to be liquidated within a period of one year from the date of purchase and are recorded under the category of “current investments.” Initially, we record them at their cost price at the time of purchase. However, these investments need to be adjusted to their fair market price at the end of the financial reporting period. Further, any increase or decrease in value of such investments vis-a-vis the purchase price flows to the income statement for that period. Hence, they affect the net income figure of an organization.

Long-term investments can be classified as “held-to-maturity” investments as there is no known date of their sale. We write down the value of such investments in case of permanent impairment in their value. However, we do not adjust any changes in their value, which are due to temporary fluctuations in the market. Until the actual exit or sale, we do not include such unrealized gains and losses in the income statement till the actual exit or sale.

Active and Passive Investors

Active investors usually invest in short-term investments since they are dedicated and can give sufficient time to take care of their investments.

Passive investors usually prefer to invest in long-term investment avenues and hold them for a long duration of time. It is difficult for them to track their investments daily or very frequently, and hence, they prefer the passive approach.

Uses

The common uses of short-term investments can be to arrange funds for a vacation, wedding, home renovation, and improvement, making a purchase for a home or office, or just for saving purposes.

Investors use long-term investment options to prepare a corpus for their retirement, the future education of their children, or other such major future expenditures, or simply build wealth when they have surplus funds with them.

Summary: Short-Term and Long-Term Investments

We should understand that there are many investment options that can be both short-term as well as long-term. The time duration for which an investor will hold an investment will decide the category to which it belongs. Accordingly, an investor should be clear about his investment goals and the time period for which he wants to invest because both options have their own pros and cons.

An important key factor that influences such a decision is the Risk Tolerance Level of the investor. This, together with the quantum of funds and need thereof, will guide the investor either to go for short-term or long-term investments. The current stage of the life cycle will also decide which of the two options is better for an individual. A person with around 15-20 years from retirement can opt for a long-term investment plan. But a person who has already retired will prefer a short-term investment plan.

Investors should create the right balance between both types of investments in line with their investment strategy and goals. One should diversify his investments between both options to create a good combination of stability, safety, returns, and liquidity.

Frequently Asked Questions (FAQs)

The investment objective behind investing for the short term is to make quick profits from volatility in price. At the same time, long-term investments are made for future savings.

a) Short term

b) Long term

b) Short term

Short-term investments get liquidated within a period of one year from the date of purchase and are, therefore, recorded under the category of “current investments.”