What are Long-Term Investments?

Long-term investments are those investments that a company or individual makes to hold for a longer period, usually 3-5-7 years, etc. In accounting terminology and the financial world, we refer to it for a period beyond 12 months. Such investments help in wealth creation since they are meant to be held for several years, which will result in value appreciation in real terms. Investments in real estate, stocks, bonds, mutual funds, exchange-traded funds (ETFs), bullion, etc., are all examples of long-term investments. For that matter, any investment in any asset or financial instrument kept for the long term is a Long Term Investment.

Higher Holding Period Leads to Higher Profits

Investors tend to create a balance between the safety of their investments along with growth and good profits. And this is usually possible only with investments that the investors hold for the long term. These investments have the potential to provide a stable and good income for the later years in one’s life and hence are a must-have in everyone’s portfolio.

Long-term investments such as shares and real estate come with some amount of risk, too, as no investments can be devoid of any risk element. However, since the goal is to grow our funds over the long term, some sort of risk is inevitable. As per the past performance, the chance of appreciation of capital is high, resulting in real wealth creation and accumulation. Investors can book profits in the short term by investing in the market and then exiting their position in less than a year. But the investments which they hold for several years often provide returns in double-digits. Thus, a high return along with capital appreciation multiplies the value of their investment portfolio several times in the long run. This is, however, not possible if the investments are not kept for a longer period.

Investors who look to make quick money by selling their investments in the short term often end up losing more. Long-term investments generally keep our principal amount secure while providing opportunities for its growth too. Also, they are a relatively safe avenue to park our excess funds for the long term with good returns if we do not have any alternate use for them in the near future.

Also Read: Short-Term vs Long-Term Investments

Examples of Long-Term Investment

Let us now look at the key long-term investment examples in detail.

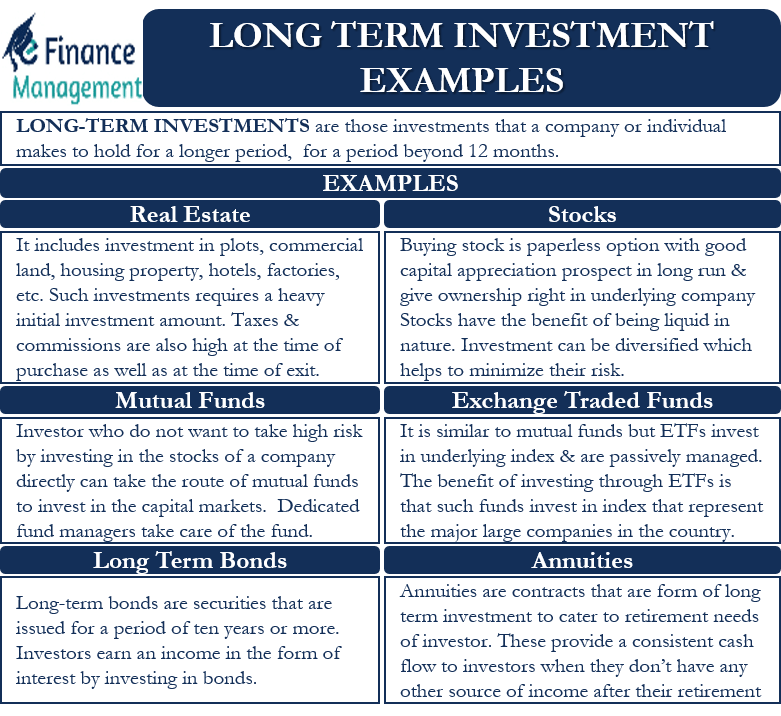

Real Estate

Real estate is one of the best forms of long-term investment, especially when the investor intends to hold his investment for at least five to seven years. It includes investment in plots, commercial land, housing property, hotels, factories, etc. If an investor intends to dilute his investment in real estate in just a couple of years, the capital appreciation may be quite limited, or sometimes he may have to exit as par.

Such investments require a heavy initial investment amount. Taxes and commissions are also high at the time of purchase as well as at the time of exit. The good part is that the chance of considerable capital appreciation and profits from such investments is quite high. Also, in some cases, it is possible to cover most of the purchase price of such assets with a loan from a bank or a financial institution at pretty low-interest rates. This makes investing in real estate very lucrative.

REIT – Real Estate Investment Trusts

The hassle of directly purchasing and maintaining real estate can now be avoided. An investor can now also invest in real estate indirectly through the mode of Real Estate Investment Trusts. It is similar to investing in a share or bonds, or ETFs. Investors get ownership rights in the underlying real estate property. They can benefit from the increase in prices of such property. Also, we have an option of real estate crowdfunding in which we can invest in small amounts rather than a lump sum payment in one go. Investors enjoy a decent rate of return on their investments too. Furthermore, investors can invest in rental real estate where they can earn rentals every month, acting as a regular income source. As usual, the investor can also count on the capital appreciation benefit of such properties.

Stocks

Investors can opt for stocks as a good long-term investment option if they do not want to physically purchase a property or an asset and take care of it. Buying a stock is a paperless option, with good capital appreciation prospects in the long run. It gives ownership rights to the underlying company. Many companies declare periodic dividends, too, which can act as an additional regular source of income for the investor.

Also Read: Long Term Finance

Stocks have the benefit of being liquid in nature, unlike real estate. Investors can liquidate their investment within a few hours in case of urgent need of money. Also, they can diversify their investment into different companies, industries, and sectors which helps to minimize their risk. Investors can also invest in cross-border stocks and go international with their investments. Another most important part of stock investment is that it does not require a large amount of initial outlay/capital as is needed for Real Estate investments.

Mutual Funds

Investors who do not want to take high risks by investing in the stocks of a company directly can take the route of mutual funds to invest in the capital markets. Mutual funds have a diverse portfolio across the stocks, bonds, and other money market instruments of multiple companies and industries. Investors can thus enjoy the benefits of diversification of their investment and balancing of their risk as per their comfort and liking.

Also, they do not have to manage the fund themselves. Dedicated fund managers take care of the fund. Thus, they can enjoy the services of professionals through the mutual fund route. Investors can invest in mutual funds with small amounts periodically, which gives them the freedom from investing large sums of money in one go. The returns, too, are usually good in the long term.

Exchange-Traded Funds (ETFs)

This long-term investment option is similar to mutual funds. These funds also invest in a portfolio of shares, bonds, and other instruments. But exchange-traded funds invest in an underlying index and are passively managed. The benefit of investing through ETFs is that such funds invest in an index that represents the major large companies in the country. Hence they will automatically cover the big companies and the major economic sectors. And the investors can ride the growth and appreciation of those companies indirectly.

Even if the index represents small and mid-cap companies, the investment will be relatively safe than directly investing in penny stocks. Also, ETFs generally replicate the investment allocations of the underlying index. They are less costly than mutual funds too. The investment amount is also not a concern since investors can invest in them with small sums of money. The only limitation with ETFs is that they may just match the returns of an index while never trying to exceed them.

Long-Term Bonds

Long-term bonds are securities issued for a period of ten years or more. Investors earn an income in the form of interest by investing in bonds. The investors in long-term bonds earn interest at a higher rate than that from short and mid-term bonds. Also, the value of a bond appreciates when the rates of interest in an economy are falling. Thus, investors can also enjoy capital appreciation and regular interest income.

The downside of investing in bonds is that their value decreases with rising interest rates in the economy. Also, they are less flexible than bonds of smaller durations. A long time period to maturity blocks the money of the investor. The longer the term of the bond, the higher is the chance of interest rates affecting its prices. Longer tenure also sometimes do pose the risk of default in repayment at the expiry of the term.

Annuities

Annuities are contracts that are a form of long-term investment to cater to the retirement needs of investors. Investors make a lump sum payment or periodic smaller payments over a period of time to a financial institution. Then these institutions pay back a fixed amount of money regularly in the later years, as stated in the contract. This helps the investors to earn a regular stream of payments after their retirement. Or after the deferment period of the annuity is over.

Thus annuities act as a means of providing a consistent cash flow to investors when they do not have any other source of income after their retirement. Also, they can be used as a scheme to invest the surplus money with investors in one go or parts and enjoy its benefits later on. The only problem with annuities is liquidity. Investors cannot withdraw money from such schemes for a certain number of years, or they may have to pay penalties for the same. And sometimes, only part of the corpus could be withdrawn, and the rest needs to come as a regular income over the years. Thus, it is not suitable for investors who want to encash their investment in the near future.

Summary

Picking the right long-term investment avenue is both an art and science. Long-term investments have wealth creation and capital appreciation power. The world’s wonder, compounding effect is fully reflected in such investments. They help the investors to earn good profits and grow their money over a period of several years. Investors should go for a diverse portfolio and invest in a few or all of the above long-term investment examples to balance their risk and returns.

As with any investments, Long-term investments also do carry some amount of risks. No investment avenue can be thought of as risk-free or that every investment will appreciate. Secondly, the quantum of appreciation also is not certain. Investors may invest for several years and may still lose some portion of their money. However, because such investments are held for the long term, there is always a chance for recovery if the investor does not get scared of short-term dips and remains invested. So on average, all long-term investments tend to give a positive rate of return.

Refer to Short-Term vs. Long-Term Investments for more.