A money market hedge is one of the methods to hedge risk when transacting in foreign currency. The money markets involve the lending and borrowing of money. So, a money market hedge involves lending or borrowing in the money market to hedge foreign currency risk. This method basically involves eliminating uncertainty in the future exchange rate by executing the exchange at the current rate. Parties execute the money market hedge by depositing/borrowing the foreign currency until the date of the actual cash flow. Though this method helps to reduce the risk, it is not without drawbacks. In this article, we will take a look at the advantages and disadvantages of a money market hedge.

Advantages of Money Market Hedge

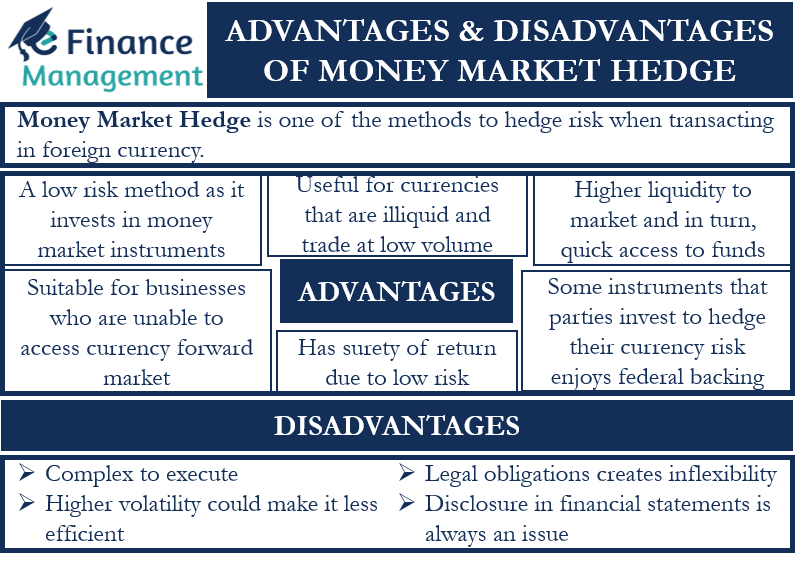

The following are the advantages of the money market hedge:

Safety

This method is considered to be low risk because it deals in short-term instruments, resulting in quick cash flows. Moreover, investors prefer using the money market to put their cash. This is because they not only get a better return than usual savings instruments but get more security, as well as easy access to funds.

Assured Return

When investing in a money market instrument, you are aware of the return you would get. So, by using the money market hedge, investors get assurance that at least some part of the transaction will bring the expected return. This assurance, however, could mean the return is less than what they would get by investing in stocks.

Liquidity

The money market is a big market where a large number of investors lend or borrow money. This gives higher liquidity to the market, and in turn, quick access to funds. Even if you withdraw the money early, you get access to the funds, but you may have to pay a little penalty. Nevertheless, it still means that the money market hedge gives parties assurance that they will have access to funds whenever they need it.

Also Read: Money Market Hedge – How to Implement?

Federal Backing

Some of the money market instruments that parties invest in to hedge their currency risk enjoy federal backing. This means even if the other party goes bankrupt, then the federal backing will help you recover some of your investment.

Suitable for Small Businesses

This hedge is suitable for small businesses that intend to make foreign currency transactions but are unable to access the currency forward market. Moreover, this hedge is well suited for smaller amounts of the capital where investors don’t want to enter futures or currency options.

Useful for Exotic Currencies

Exotic currencies are the ones that are illiquid and trade at low volumes. Due to their low volume, forward contracts may not be available for such currencies. Yet investors can hedge their risk with such currencies using the money market hedge.

Disadvantages of Money Market Hedge

A point to note is that most of the drawbacks of hedging will apply to the money market hedge. The following are the disadvantages of the money market hedge:

Also Read: International Money Market

Complex to Execute

A money market hedge could prove extremely complex to execute if investors don’t have much financial knowledge. Moreover, it is not easy to select the right money market instrument that could help you to hedge your risk. Also, financial institutions keep coming up with new products that make it more complex to select the right instrument.

Volatility

Though this hedge is related to the money market that is considered to be more stable, it does involve an element of volatility. Higher volatility in the exchange rate or interest rate could make the money market hedge less efficient. This volatility generally goes up as the contract approaches the maturity date.

Disclosure

With hedging instruments, disclosure in the financial statements is always an issue. Since you can’t ascertain the value of hedging instruments due to volatility, it becomes problematic for accountants. This is because if they show it at mark-to-market and it is a loss, it doesn’t speak well for the business, even if they have no intention to sell the agreement at a loss. Moreover, shareholders also need to have in-depth knowledge of accounting practices to identify the treatment of hedging transactions in the annual reports.

Inflexibility

A money market hedge, or any hedge in general, could get very rigid. This is because the contract carries a legal obligation to deliver the asset or make the payment at a set price and date. Though there is an option to settle prematurely, it may result in less payment or a fine. Also, since the money market hedge sets the future rate, investors lose the chance to gain from positive movements in the exchange rate.

Opportunity Costs

Once you enter a hedge contract, you may not be able to take part in any favorable development related to that asset. This is because the exchange rate has already been set. Thus, you lose the opportunity to make more profit.