Price-Earnings Ratio (P/E Ratio)

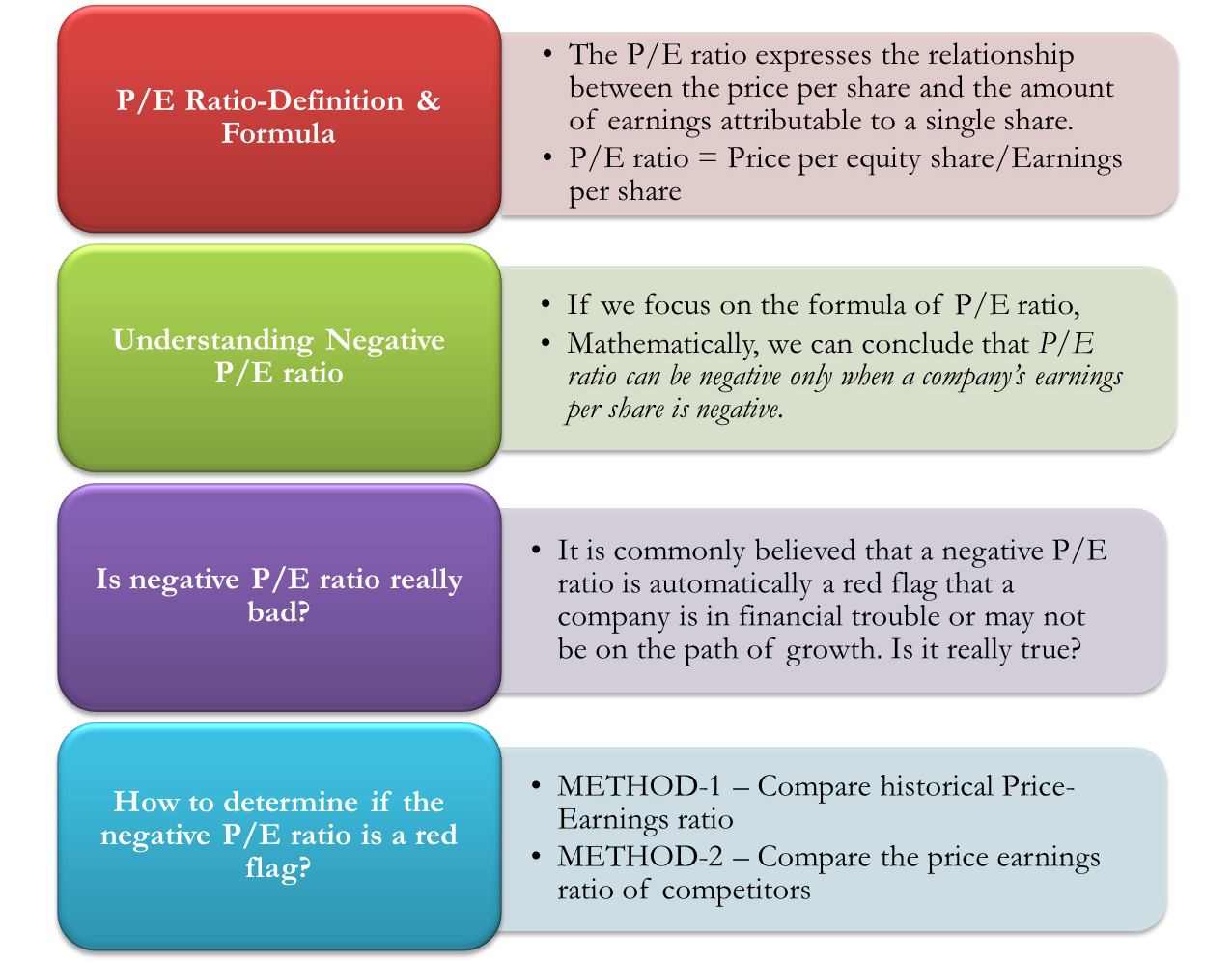

Before discussing the Negative P/E Ratio, let’s understand the concept of the Price-Earnings Ratio or P/E ratio. It expresses the relationship between the price per share and the amount of earnings attributable to a single share. In other words, the P/E ratio tells us how much an investor in common stock pays per dollar of earnings. For the purpose of understanding, sometimes the P/E ratio is expressed in years. Logically it means that the P/E ratio shows the number of years it will take for a particular company to earn its price per equity share. To understand the P/E ratio, let us start with an example.

P/E Ratio Example

Example 1 – Suppose XYZ Company’s share price in the open market is $100 & last year’s earnings were $10 per share

So P/E ratio = Price per Equity Share / Earnings per Share

Therefore P/E ratio of XYZ Company =$100 / $10 = 10

This simply means that the share of XYZ Company is selling for 10 times its earnings. In other words, it will take 10 years for XYZ Company to earn its equity share price. This gives us an idea of what the market is willing to pay for a company’s earnings.

It is easy to calculate the P/E ratio; the more complicated part is its interpretation. This ratio is unique in the sense that either a high or a low P/E ratio can be positive and negative. There can be many possibilities, some as follows:

- A low P/E ratio of, say, 6 can be good because it means the stock is selling for “cheap” & is good value for investors.

- A low P/E ratio can also be bad because-“Why is the equity share selling so cheap?”

- A high P/E ratio of, say, 20 can be good because-“Why are people willing to buy equity shares of this company at such expensive rates?”

- A high P/E ratio can be bad because it’s “expensive” and not good value for investors.

Generally, the P/E ratio of any company is positive, but in some unusual cases, the P/E ratio is negative. In today’s discussion, we will talk about these unusual negative P/E ratios.

Also Read: P/E Ratio

Visit P/E Ratio

Negative P/E Ratio

Suppose we focus on the formula of the P/E ratio. In that case, we can conclude mathematically that the P/E ratio can be negative either because the price per share is negative (i.e., numerator) or earnings per share are negative (i.e., denominator). As we know, the price per share can never be negative, so we can conclude that the P/E ratio can be negative only when a company’s earnings per share are negative.

Negative P/E Ratio Interpretation & Analysis

As discussed, a negative P/E ratio results from negative earnings per share. A negative P/E ratio means the company is losing money, i.e., the company is reporting losses. To understand, suppose a company has a P/E ratio of (-5). This means that if the company consistently keeps reporting losses at this rate, it will take 5 years for the company to lose its floating equity capital.

Negative P/E Ratio-Debunking the Myth

It is commonly believed that a negative P/E ratio is automatically a red flag that a company is in financial trouble or may not be on the path to growth. This is not necessarily true; a company can have a negative P/E ratio and still be doing very well. There can be various reasons for the P/E ratio to be negative; some of them are as follows:

- A company can have negative P/E ratios because of a change in its accounting policy

- Negative P/E ratio may be a one-off thing. This may be due to incidents such as a company writing off higher depreciation or amortization for a particular year or a market trend wherein an entire industry may generate a negative P/E ratio due to cyclical causes.

Such occurrences are very normal in a company’s lifecycle, and a negative P/E ratio due to these may not be a cause for concern. In such a scenario, the company may report a negative P/E ratio and still be on the path of growth.

Also Read: Why is EPS Important to Investors?

An investor or an analyst should be concerned about the negative P/E ratio when a company consistently reports a negative P/E ratio for longer periods of time for say, 5 years in a row. This indicates that the company is not in good financial health.

How To Determine If the Negative P/E Ratio is a Red Flag?

There are many methods to determine if a negative P/E ratio of a particular company is a negative sign. Some of the methods are as follows:

- COMPARE THE HISTORICAL PRICE-EARNINGS RATIO OF THE COMPANY

Say a company was established in 1990, and from 1990 to 2015, the company has consistently reported a P/E ratio between 8 and 10; now, from 2015 to 2018, the company has been reporting a negative P/E ratio. Does that mean the company is having a downfall? To answer this question, we need to look closer; we need to determine the reason for this negative P/E ratio. We may find that this may be due to structural management changes within the company, or it is an aggressive marketing strategy. In India, Flipkart is a classic example of a high-valued company with a consistently negative P/E Ratio. This is because Flipkart is pouring cash to grow its market share.

- COMPARE THE PRICE-EARNINGS RATIO OF THE COMPANY WITH OTHER COMPANIES IN THE SAME SECTOR

A method to determine if a company’s negative P/E ratio points to its gloomy future are to compare the company’s P/E ratio with that of its competitors. Suppose Company A is a beverage manufacturer, and it reported a P/E ratio of (-2) for the financial year 2017-18. For the same period, Coca-Cola Company reported a P/E ratio of 23.30 & Pepsico Inc reported 32.72. Now, this is a big concern while analyzing Company A, and analysts should dive deeper to find the cause of this abnormality.

Bottomline

It is always easy to come to a negative conclusion when we see a negative P/E ratio. What is important to understand is that ratios must not be taken as answers but must be used as questions. An analyst should try to find answers to the questions that are indicated by irregularities in the ratios. Furthermore, it is not a wise decision to rely on only one ratio to conclude the financial health of any company. Each financial ratio only gives one side of the story. To form a complete picture of a potential investment, one needs to consider other metrics as well. While Price-Earnings Ratio can be a solid indicator of value if seen in isolation, it has the potential to mislead or misinform.

Would love to hear your assessment of APT which has a high negative PE

Thanks for sharing this article. This article is very helpful for my accounting. This will surely help me to do my accounting. I will definitely calculate P/E RATIO properly with the help of this article.