Analysts across the globe use ratios such as Return on Equity (ROE) and Return on Investment (ROI) to identify the investment potential. Although both metrics define the health of investment, the result of both might not always go in the same direction. A company might have higher ROE but a poor ROI, or vice versa. Thus, to understand which metric to use when, it is crucial to understand the difference between ROI vs ROE.

Return on Equity (ROE)

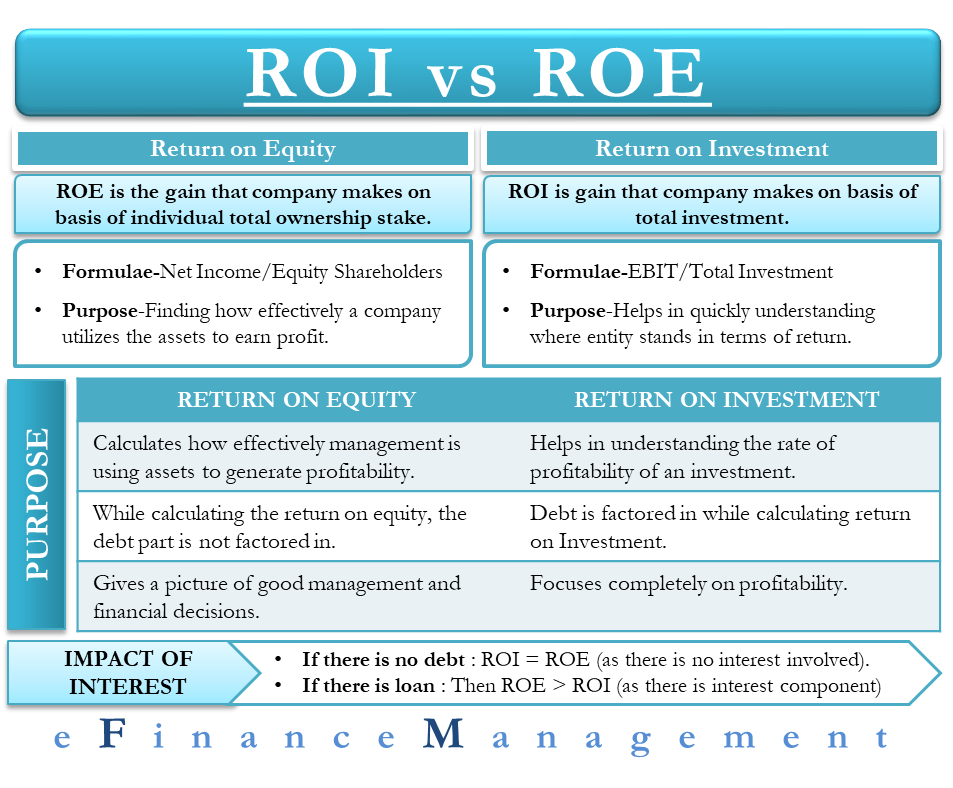

ROE represents the company’s financial performance or the money that the company makes based on the individual’s total ownership stake. The formula to calculate ROE is net income divided by shareholder’s equity. The formula for calculating shareholders’ equity is Asset of the company – Debt.

The purpose of calculating ROE is to determine how effectively the company utilizes the assets to earn profits. Net income, in this case, is the total income, net of expenses, and taxes for a given period.

ROE could be positive or negative, but it being good or bad depends on the industry standards. If a company is outperforming its peers, we can say that it is performing better than others. However, investors mostly take S&P500 as a benchmark and compare the return of their investment against the same.

Also Read: Return on Equity (ROE)

Read more about RETURN ON EQUITY

Return on Investment (ROI)

ROI is another financial ratio that calculates the return on investment. The formula for calculating the ROI is Net income/ Cost of investment Or Investment Gain/ Investment Base. The first formula is most commonly in use for the calculation of ROI.

We can also calculate ROI for the company by dividing EBIT (Earnings Before Interest and Tax) by Total Investments.

ROI is a straightforward financial ratio. It helps to get a quick understanding of where the entity stands from the return point of view. Moreover, this ratio is universally understood and gives a decent picture of the investment, along with helping investors to understand and decide the next course of action.

Read more about RETURN ON INVESTMENT

ROI vs ROE – Purpose

| Return on Equity (ROE) | Return on Investment (ROI) |

| Calculates how effectively management is using assets to generate profitability. | It helps in understanding the rate of profitability of an investment. |

| While calculating the return on equity, the debt part is not factored in. | Debt is factored in a while calculating return on Investment. |

| Gives a picture of good management and financial decisions. | Focuses entirely on profitability. |

Impact of Interest Expense

If an investment involves only equity and no debt or equity and the total investment amount is the same, then in such a case, ROE and ROI will also be the same. When there is a loan or debt, then ROE will be higher than when there is no loan if the profit possibly due to the loan exceeds the loan’s interest expenses.

For example, you can invest $50000 to open a small restaurant that could give a return of $10000. Or, you can invest $10000 more by borrowing to add a takeaway as well, which will increase the profit by $2000 more. In this case, you should borrow the money only when the interest expense on loan is less than the additional profit of $2000. If the additional profit is more, the ROE will grow.

Also Read: Return on Investment

ROI vs ROE – Which to Use?

Both ROE and ROI are profitability ratios and are a quick way to assess a company’s financial health or an investment. However, both are used for different purposes and cannot be used interchangeably. Also, both have their advantages and disadvantages. For instance, in ROE, the equity contains both borrowed funds and invested funds both, so it may happen that a company is running high on debt to remain profitable in the longer run. According to Dun and Bradstreet, a company should have twice as much income as its debt to service. If that is not the case, then the company might be in trouble.

On the other hand, ROI gives a clear picture of the profit that the company makes before it takes on debt. A positive ROI will indicate that the company is financially sound and is using borrowings to expand rather than servicing debt.

ROI, however, also has its flaws. For instance, it sometimes gets difficult to tie the revenue with any specific investment when using ROI. Suppose a company that hires a third-party marketing manager would not be able to know the amount of revenue it gets from its efforts.

Since both ROI vs ROE is not perfect, a company or an investor, or an analyst should use both to make a wise decision. If you use one of them, you may forgo some vital information. Together, they can prove strong indicators of investment profitability.