Business managers often face scenarios when they have to choose between projects. Such business decisions are very crucial as resources are limited. Thus, managers need to choose the best project that could maximize their return on investment. One capital management or capital budgeting method that managers often refer to when facing such dilemmas is the Payback Method. There are various advantages and disadvantages of the payback period, which we will discuss and critically evaluate the technique.

What is the Payback Period?

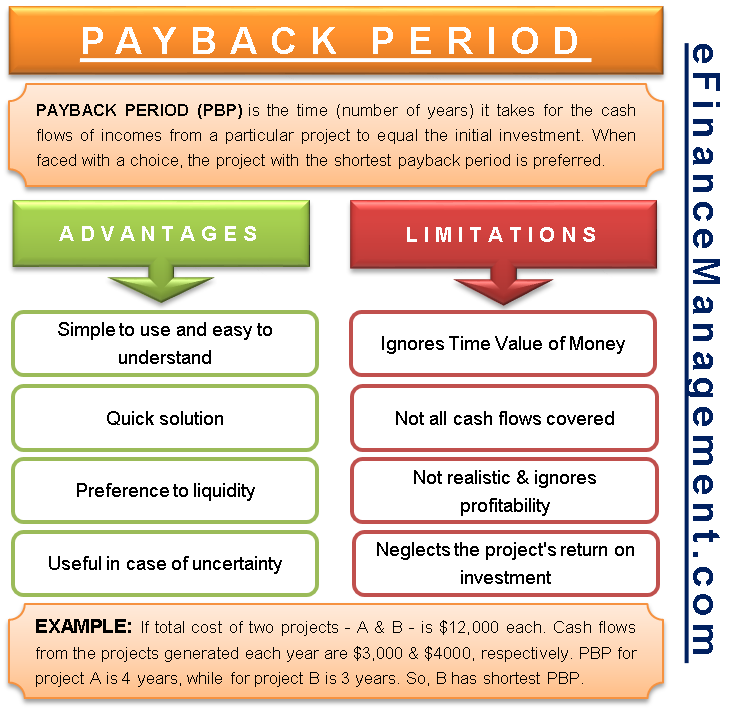

The payback method helps in revealing the payback period of an investment. The payback period (PBP) is the time (number of years) it takes for the cash flows of incomes from a particular project to cover the initial investment. When a CFO faces a choice, he will prefer the project with the shortest payback period.

For instance, if the total cost of two projects – A and B – is $12,000 each. But, the cash flows of income of both the projects generate each year are $3,000 and $4000, respectively. The payback period for project A is four years, while for project B is three years. In this case, project B has the shortest payback period.

The advantages of the payback period make it a popular choice among the managers. But like any other method, the disadvantages of the payback period prevent managers from basing their decision solely on this method. In this article, we will discuss the advantages and disadvantages of the payback period to help you make an informed decision on this capital budgeting method/technique.

Also Read: Investment Appraisal Techniques

Advantages of Payback Period

Simple to Use and Easy to Understand

This is among the most significant advantages of the payback period. The method needs very few inputs and is relatively easier to calculate than other capital budgeting methods. All that you need to calculate the payback period is the project’s initial cost and annual cash flows. Though other methods also use the same inputs, they also need more assumptions. For instance, the cost of capital, which other methods use, requires managers to make several assumptions.

Quick Solution

Since the payback period is easy to calculate and needs fewer inputs, managers are quickly able to calculate the payback period of the projects. This helps the managers make quick decisions, which is very important for companies with limited resources.

Preference for Liquidity

The payback period is crucial information that no other capital budgeting method reveals. Usually, a project with a shorter payback period also has a lower risk. Such information is extremely crucial for small businesses with limited resources. Small businesses need to quickly recover their cost to reinvest them in other opportunities.

Useful in Case of Uncertainty

The payback method is very useful in industries that are uncertain or witness rapid technological changes. Such uncertainty makes it difficult to project the future annual cash inflows. Thus, using and undertaking projects with short PBP helps reduce the chances of a loss through obsolescence.

Also Read: Importance of Capital Budgeting

Disadvantages of Payback Period

Ignores Time Value of Money

This is among the major disadvantages of the payback period that it ignores the time value of money, which is a very important business concept. As per the concept of the time value of money, the money received sooner is worth more than the one coming later because of its potential to earn an additional return if it is reinvested. The PBP method doesn’t consider such a thing, thus distorting the true value of the cash flows. Here, there is a workaround. One can use the Discounted Payback Period to do away with this disadvantage.

Not All Cash Flows Covered

The payback method considers the cash flows only until the initial investment is recovered. It fails to consider the cash flows that come in subsequent years. Such a limited view of the cash flows might force you to overlook a project that could generate lucrative cash flows in its later years.

Not Realistic

The payback method is so simple that it does not consider normal business scenarios. Usually, capital investments are not just one-time investments. Instead, such projects need further investments in the following years as well. Also, projects usually have irregular cash inflows.

Ignores Profitability

A project with a shorter payback period is no guarantee that it will be profitable. What if the cash flows from the project stop at the payback period or reduces after the payback period. In both cases, the project would become unviable after the payback period ends.

Neglects project’s return on investment – some companies require their capital investments to earn them a return that is well over a certain rate of return. If not, the project is scrapped. However, the payback method ignores the project’s rate of return.

Conclusion

Despite the disadvantages, the payback method is still used widely by businesses. The method works well when evaluating small projects and projects that have reasonably consistent cash flows. Also, it is a go-to tool for small businesses, for whom liquidity is more important than profitability.

Even big enterprises use this method. But, due to its limitation in giving a complete analysis, the businesses often use the payback method as a preliminary screening tool to scrap the projects that do not meet their payback criteria, and then, use more detailed analysis or other capital budgeting methods such as net present value (NPV) analysis or the internal rate of return (IRR) on the remaining projects.

Frequently Asked Questions(FAQs)

A. It ignores the time value of money.

B. It ignores the project’s return on investment.

C. It is easy to calculate and provides a quick solution for managers.

C. It is easy to calculate and provides a quick solution for managers.

Initial investment/Cash inflows.

a) It ignores the time value of money.

b) It only considers cash flows till the initial investment is recovered.

c) It doesn’t consider the profitability of the project.

d) It neglects the project’s return on investment.

I Really enjoyed your blog. I just bookmarked it. I am a regular visitor of your website I will share It with my friends .Thanks.

Your blog was helpful. Thank you so much.

Quite helpful too

I have learnt alot on your blog about Payback. The information was very useful

…payback method is explained very well.

Thanks very much.

Thank you for the valuable information provided. I learned a lot.